HSN Code Wise Purchasetax Report

User Access

HSN Code Wise Purchase Tax Report, the general approach involves analyzing and categorizing your purchases based on the Harmonized System of Nomenclature (HSN) codes, and then calculating the corresponding taxes applicable on each item. This is typically done for businesses that need to comply with Goods and Services Tax (GST) regulations, particularly in India, where the GST system requires detailed reporting by HSN code.

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- HSN Code Wise Purchasetax Report.

Pre-Requisite Activities

- From Date

- To Date

Business Rules

Key Information to Include in the Report:

HSN Wise Tax Calculation – For each HSN code, the tax amounts should be summarized.

HSN Code – The unique code for each product or service.

Product/Service Description – A brief description of the product or service corresponding to the HSN code.

Purchase Date – Date of purchase or invoice date.

Supplier Name – The name of the vendor or supplier.

Purchase Value – The total cost of the purchase (excluding taxes).

GST Rate – The applicable GST rate (5%, 12%, 18%, 28%, etc.).

CGST & SGST/IGST – The amount of Central GST (CGST) and State GST (SGST) or Integrated GST (IGST) applied.

Total Purchase Value – The total value after adding taxes.

Taxable Amount – The base value before applying GST.

GST Amount – The actual tax (CGST/SGST/IGST) amount.

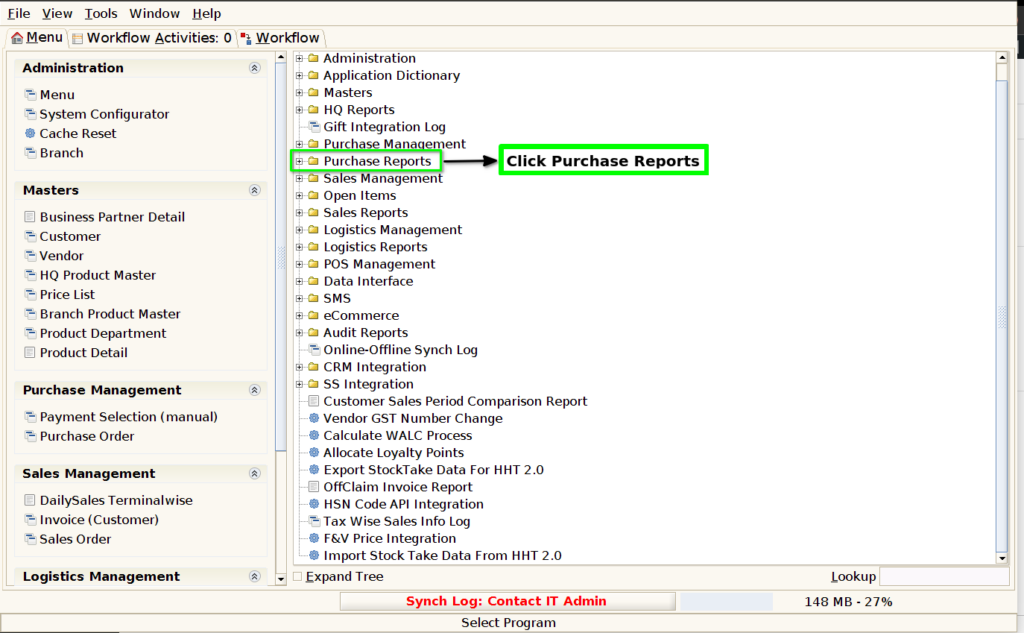

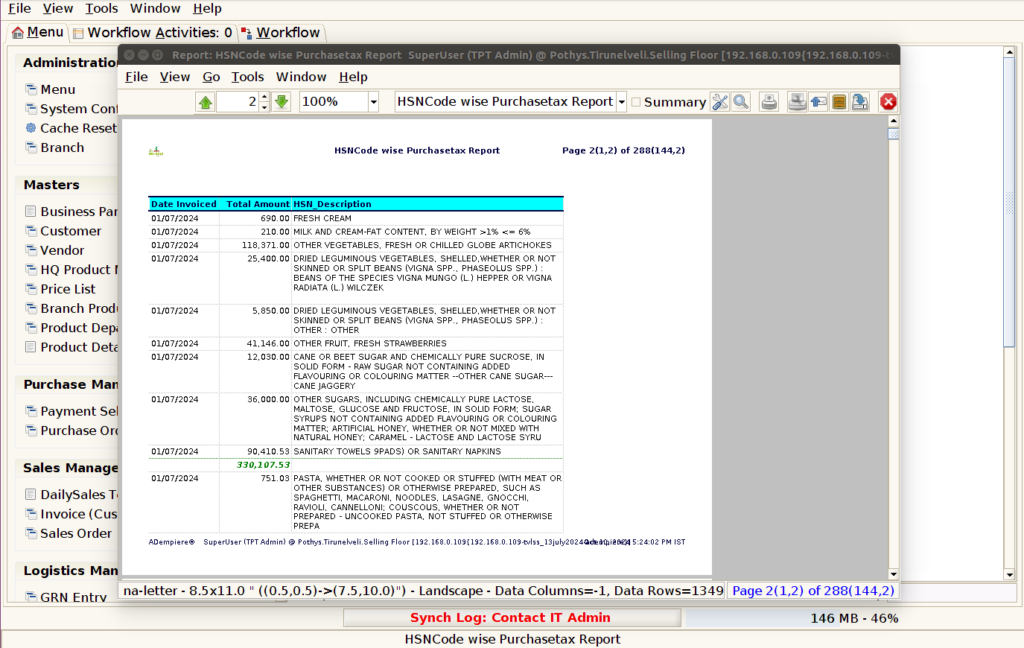

STEP1: Click Purchase Reports Folder.

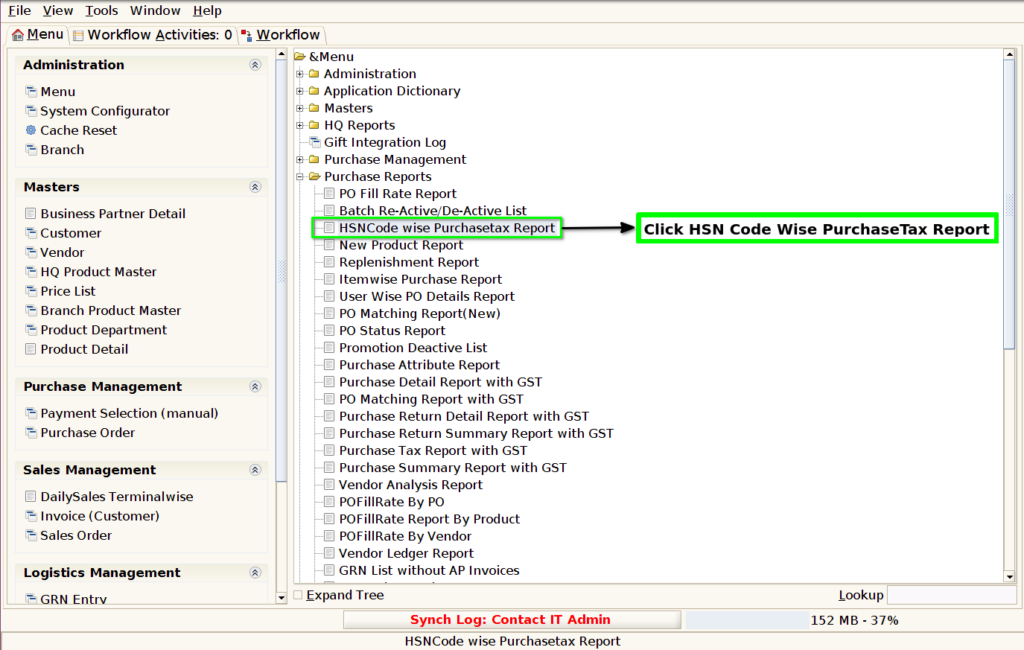

STEP2: Click HSN Code Wise PurchaseTax Report.

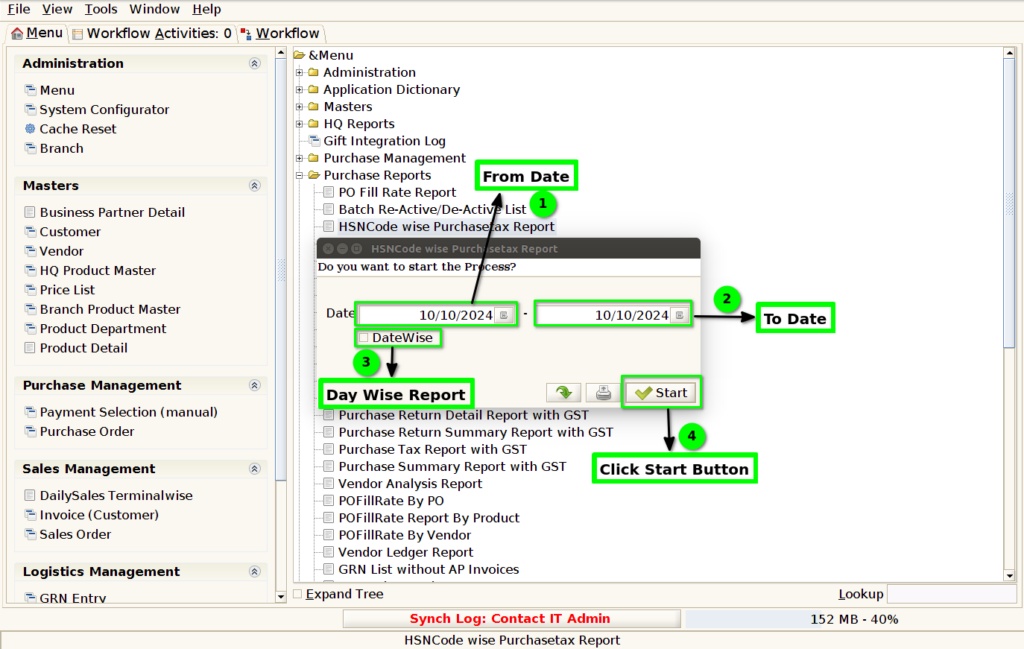

STEP3: Choose Parameter From Date, To Date and Day Wise.

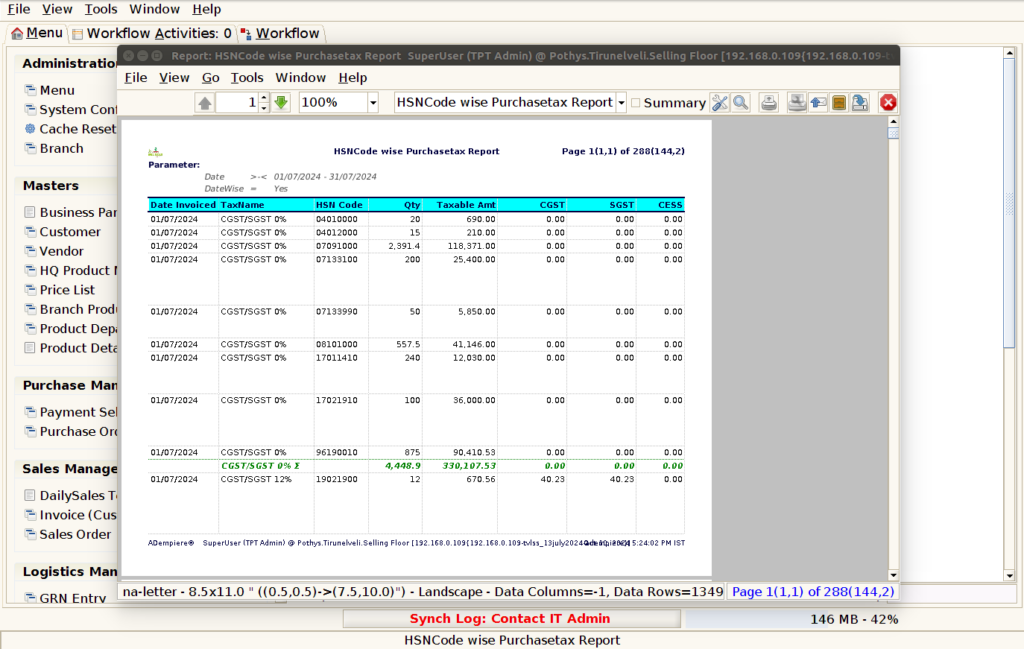

STEP4: Show Columns Details.

1.Date Invoiced.

2.Tax Name.

3.HSN Code.

4.Purchase Quantity.

5.Taxable Amt.

7.CGST

8.SGST

9.CESS

STEP5: Click Page Down Button Show Columns Details.

10.Total Amount.

11.HSN Description.

1.Date Invoiced.

The “Date Invoiced” refers to the specific date when an invoice is issued or generated. This date typically marks the point at which a business formally requests payment for goods or services provided. It is an important element for tracking payment terms, due dates, and the overall financial management of a business.

2.Tax Name.

The tax name should accurately reflect the tax regulation or law of the jurisdiction where the transaction occurs. This ensures compliance with local tax laws and helps both businesses and consumers understand the specific taxes being applied.

3.HSN Code.

The HSN code (Harmonized System of Nomenclature) is a standardized international system of names and numbers to classify traded products. The system was developed and is maintained by the World Customs Organization (WCO). It’s used by customs authorities around the world to assess tariffs, taxes, and other regulations related to imported and exported goods.

4.Purchase Quantity.

The purchase order quantity (PO quantity) refers to the amount of a product or material specified in a purchase order (PO) that a buyer requests from a supplier. It represents the number of units of goods or services that the buyer intends to acquire.

5.Taxable Amt.

The term taxable amount refers to the portion of an income or transaction that is subject to taxation by the relevant authorities, after accounting for exemptions, deductions, and other allowances.

7.CGST.

The rate of CGST depends on the GST slabs for different goods and services. The rates are categorized into 0%, 5%, 12%, 18%, and 28%.

8.SGST.

SGST is levied by the state government on the intra-state supply of goods and services (i.e., transactions that occur within the same state).

9.CESS.

The CESS tax refers to an additional levy or surcharge imposed on a specific tax, usually in the form of an additional percentage added to the base tax rate. It is most commonly seen in countries like India, where cess taxes are introduced to fund specific purposes such as education, health, or infrastructure.

10.Total Amount.

To calculate the total amount including tax, you’ll typically follow this formula:

Total Amount = LC Amount + (LC Amount × Tax Rate)

11.HSN Description.

An HSN (Harmonized System of Nomenclature) description refers to the standardized system used internationally to classify products in trade. It’s a coding system developed by the World Customs Organization (WCO) and is widely used by customs authorities and businesses to identify products for import/export purposes.

Training Videos

FAQ

SOP