Item Wise Purchase Report

User Access

An Item Wise Purchase Report typically provides a detailed summary of purchases made for each item in a business or inventory system. The report is useful for tracking the quantity, cost, and frequency of purchases of individual items. It helps in making informed decisions regarding stock replenishment, budget allocation, and identifying trends in the buying patterns.

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Item Wise Purchase Report .

Pre-Requisite Activities

- From Date

- To Date

Business Rules

Inventory Management: Helps keep track of stock levels and plan for reorder.

Cost Analysis: Enables businesses to monitor and control procurement costs.

Supplier Evaluation: Provides insight into supplier reliability and pricing.

Budget Planning: Assists in forecasting future purchasing expenses based on past data.

Auditing: Serves as a tool for auditing purchases, ensuring accuracy in financial reporting and compliance.

Key Components of the Report:

- Item ID or SKU (Stock Keeping Unit): A unique identifier for each item.

- Item Description: The name or detailed description of the item being purchased.

- Purchase Date: The date on which the purchase was made.

- Purchase Quantity: The number of units of the item purchased.

- Unit Price: The cost per unit of the item purchased.

- Total Purchase Cost: The total cost of the purchase, calculated by multiplying quantity by unit price.

- Supplier Name: The name of the vendor or supplier from whom the item was purchased.

- Purchase Order Number (Optional): If applicable, the specific order number associated with the purchase.

- Payment Terms (Optional): The agreed-upon payment terms for the purchase (e.g., net 30 days).

- Delivery Date: The expected or actual date of delivery for the purchased item.

- Purchase Location (Optional): The warehouse or location where the item was received.

- Tax: Any applicable sales tax or VAT associated with the purchase.

User Interface

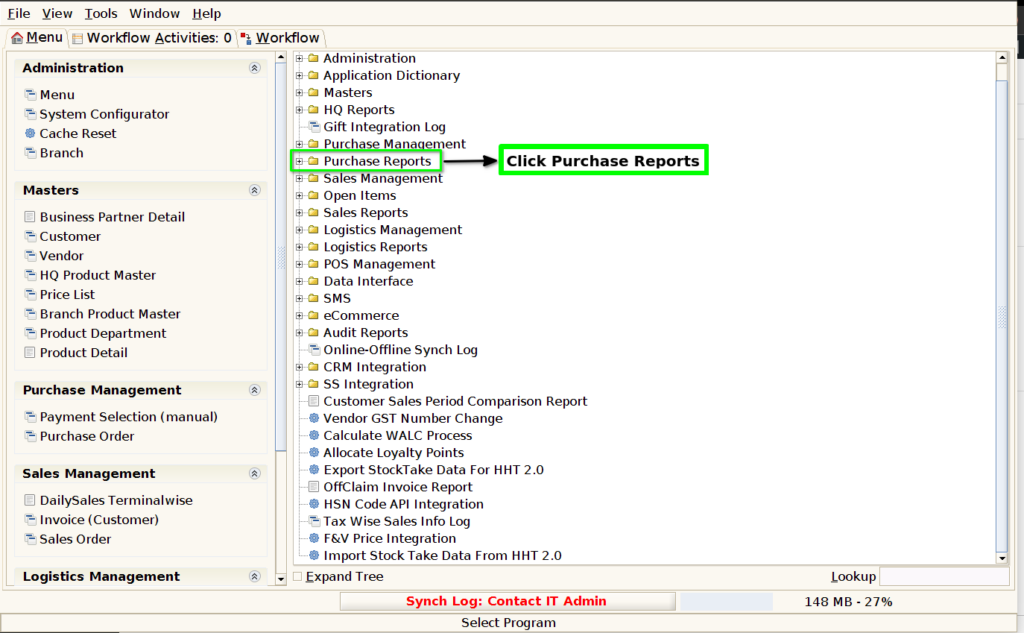

STEP1: Click Purchase Reports Folder.

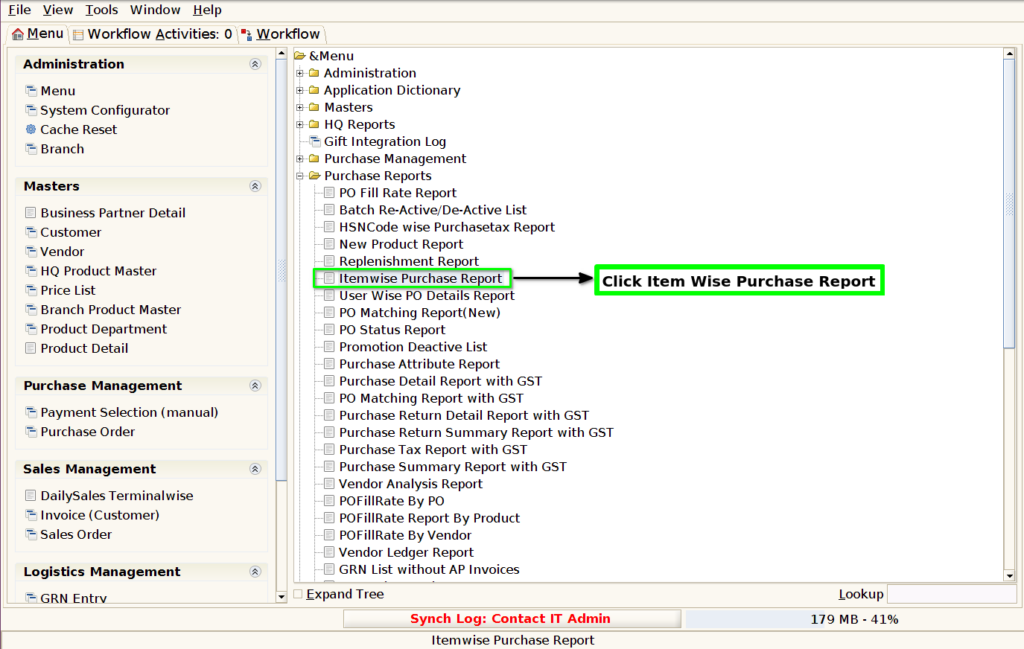

STEP2: Click Item Wise Purchase Report.

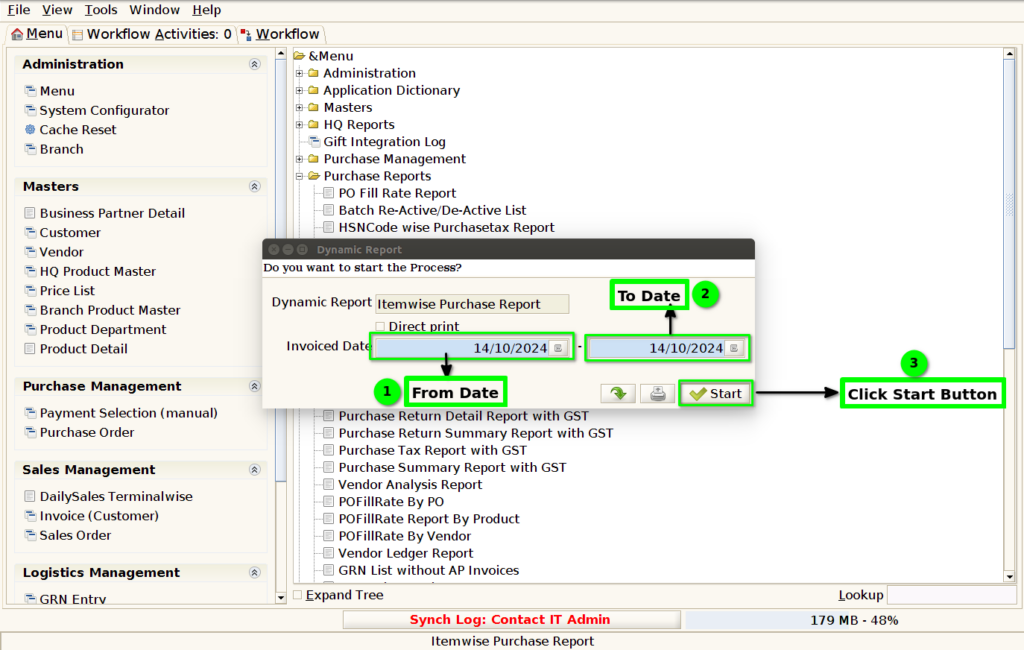

STEP3: Choose Parameter From Date, To Date and Click Start Button.

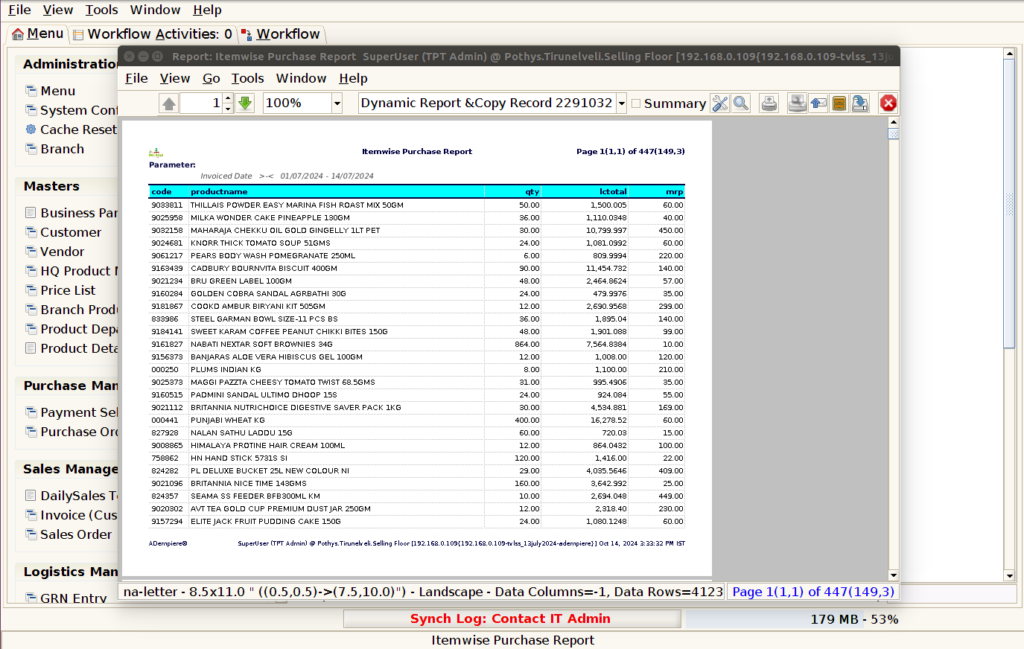

STEP4: Show Columns Details.

1.Product Code

2.Product Name

3.Purchase Quantity.

4.Land cost Total.

5.MRP

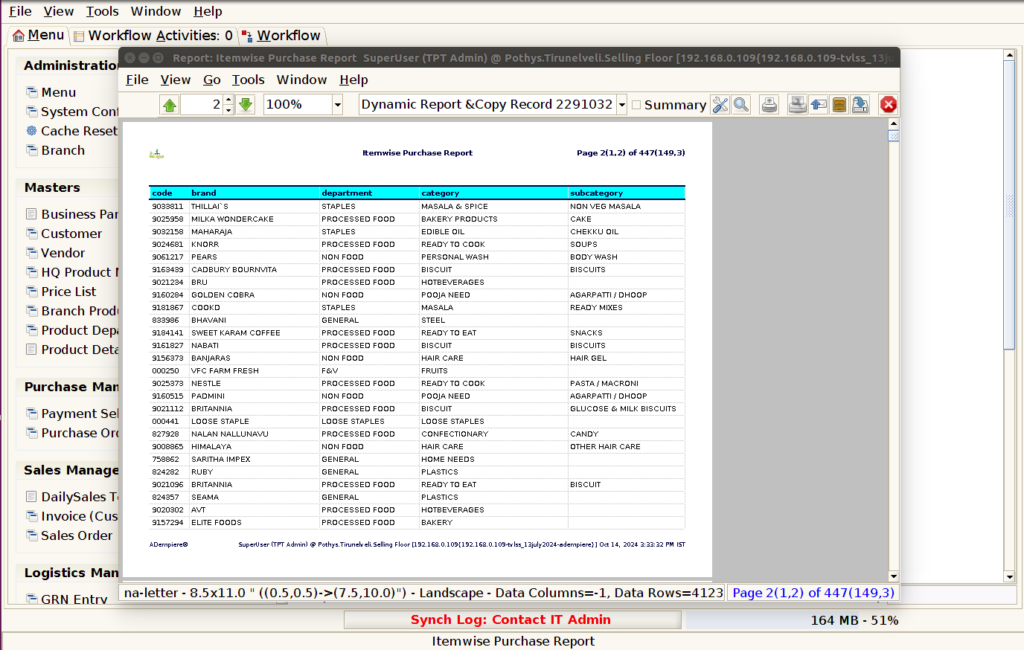

STEP5: Click Page Down Button Show Columns Details.

6.Barand

7.Department

8.Category

9.Sub Category

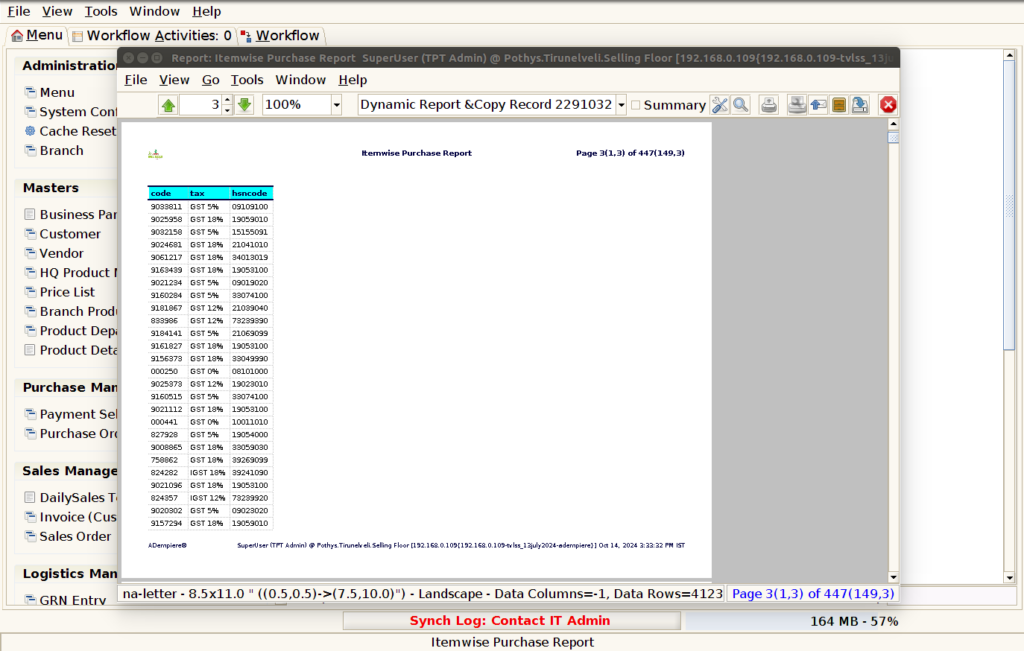

STEP6: Click Page Down Button Show Columns Details.

10.Pruchase Tax%.

11.HSN Code.

1.Product Code

2.Product Name

3.Purchase Quantity.

The purchase order quantity (PO quantity) refers to the amount of a product or material specified in a purchase order (PO) that a buyer requests from a supplier. It represents the number of units of goods or services that the buyer intends to acquire.

4.Land cost Total.

Landed cost refers to the total cost of getting a product to its final destination, and it includes several components beyond the initial purchase price. It accounts for everything involved in bringing goods from the supplier to your location. Here’s how to calculate the landed cost total:

5.MRP

MRP stands for Material Requirements Planning, which is a production planning and inventory control system used to manage manufacturing processes. It helps companies determine the quantity and timing of raw materials, components, and sub-assemblies needed to produce finished goods.

6.Barand

The Product Brand Name.

7.Department

The Product Department Name

8.Category

Product Category Name.

9.Sub Category

Product Sub Category Name

10.Pruchase Tax%.

The “purchase tax%” generally refers to the percentage of tax applied to the purchase of goods or services. This percentage varies depending on the country, region, and sometimes the type of goods or services involved.

11.HSN Code.

The HSN code (Harmonized System of Nomenclature) is an internationally recognized system used for classifying traded products. It was developed by the World Customs Organization (WCO) and is used by countries around the world for customs purposes, including trade tariffs and taxes.

Training Videos

FAQ

SOP