DEPT.WISE SALES VAT REPORT

A Dept. Wise Sales VAT Report (Department Wise Sales VAT Report) is a type of sales report that breaks down sales performance by department and includes the Value Added Tax (VAT) component associated with each sale. This report provides businesses with a detailed overview of sales made within different departments or categories, along with the VAT that has been charged on these sales.

User Access

Who Can Access

- Pothys admin

- Head cashier

- Sales Manager

- manager

What User Can Do

- View Reports

- Analyze Sales

- Export

Pre-Requisite Activities

- Date range

- Cashier

Business Rules

- he Dept. Wise Sales VAT Report is generated to provide a comprehensive breakdown of sales performance by department, along with the corresponding Value Added Tax (VAT) collected on those sales.

- It follows the business rule that for each department, the total sales before VAT are calculated, the applicable VAT rate is applied to determine the VAT amount, and the final sales value (including VAT) is displayed.

- This report ensures that the business accurately tracks VAT liabilities, facilitates compliance with tax regulations, and helps assess the sales performance of individual departments for better financial and operational decision-making.

User Interface

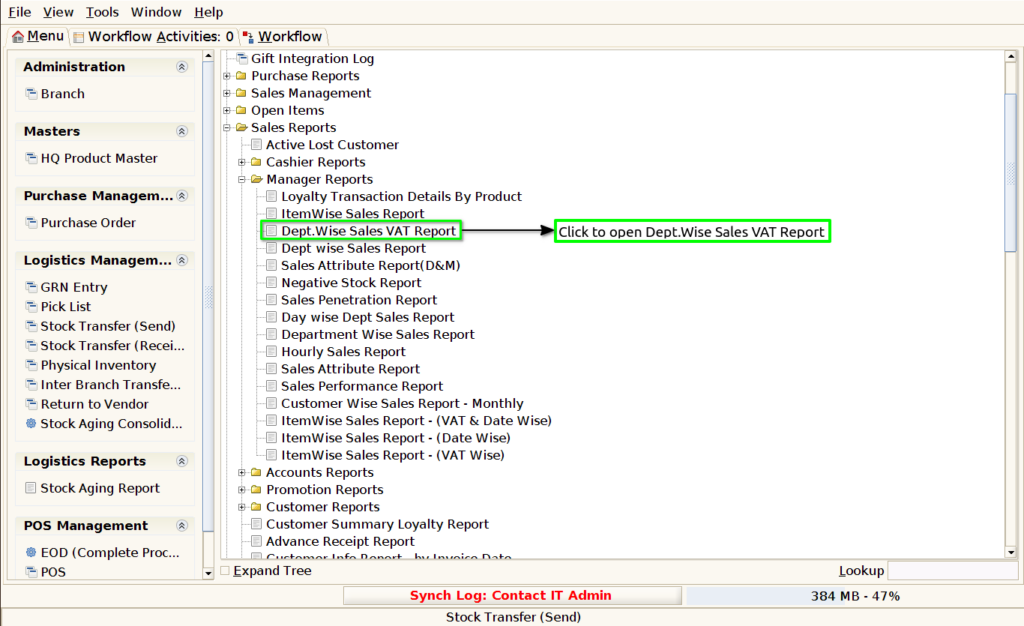

Step 1 : Select ‘Dept. Wise Sales VAT Report’ in Menu -> Sales reports > Manager report > Dept. Wise Sales VAT Report or Search Dept. Wise Sales VAT Report.

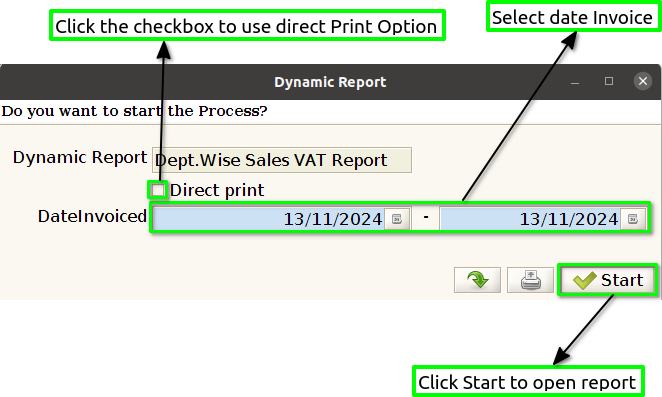

Step 2 : Select the date range to open the Dept. Wise Sales VAT Report.

Step 3 : To view a preview of the Dept. Wise Sales VAT Report in jaldi

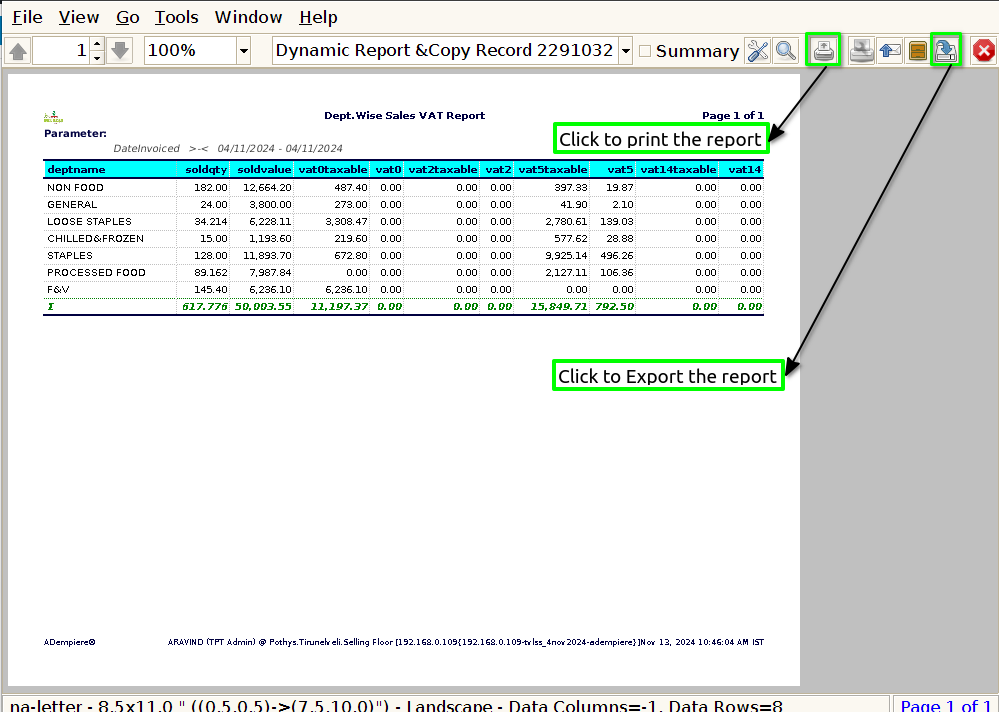

Department Name : In a Dept. Wise Sales VAT Report, showing the department name provides clear and organized breakdowns of sales data by department.

Sold Quantity : Showing the sold quantity helps track how many units of products were sold in each department. This provides insight into the volume of sales, which is crucial for understanding overall business performance and for comparing sales figures across different departments.

Sold value : The sold value in a Dept. Wise Sales VAT Report is essential because it offers a comprehensive understanding of revenue generation, tax compliance, profit analysis, and inventory needs.

VAT Taxable : The system may be generating the report to break down VAT by department, so “VAT taxable” indicates the total sales in that department that are subject to VAT. The VAT amount could be based on the sales value of taxable goods or services in that department.

VAT : The report is showing the VAT that has been applied to sales transactions for each department. If your organization is VAT-registered, VAT is collected on most taxable sales (depending on the country and its VAT laws).