TO CREATE A STOCK ATTRIBUTE REPORT (WITH TAX)-SS

A Stock Attribute Report (with tax) typically refers to a detailed report that provides information about the inventory of stock items, including various attributes of those items and their associated tax information. This type of report is often used in inventory management and accounting to help businesses keep track of their stock levels, costs, and compliance with tax regulations.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Stock attribute Report(with tax)

Pre-Requisite Activities

- Date

- Product

- Product Department

- Product Category

- Brand

Business Rules

- Data Sources-The report should pull data from the Inventory Management System, accounting systems, and Sales Tax Management systems.

- Data fields to include: Stock ID, Item Description, Quantity on Hand, Cost Price, Sale Price, and Sales Tax Rate.

- Attributes to Include

- Stock ID– Unique identifier for each stock item.

- Item Description:-Clear and concise description of the stock item.

- Quantity on Hand-Total number of items available in inventory.

- Cost Price-Purchase cost of the item.

- Sale Price-Suggested retail or sale price of the item.

- Sales Tax Rate-Applicable tax rate for the item, as determined by the jurisdiction.

- Total Value of Stock-Calculated as Quantity on Hand * Cost Price.

- Filtering and Sorting-Users should be able to filter results by categories (e.g., product type, tax category).

- Format and Structure-The report should be structured in a table format with clear headers.

- The report must be exportable in multiple formats (e.g., CSV, Excel, PDF).

- User Access and Permissions-Control access to the report based on user roles within the organization (e.g., finance, inventory management).

- 8. Frequency and Distribution

- The report should be generated on a regular basis (e.g., weekly, monthly) as per business needs.

User Interface

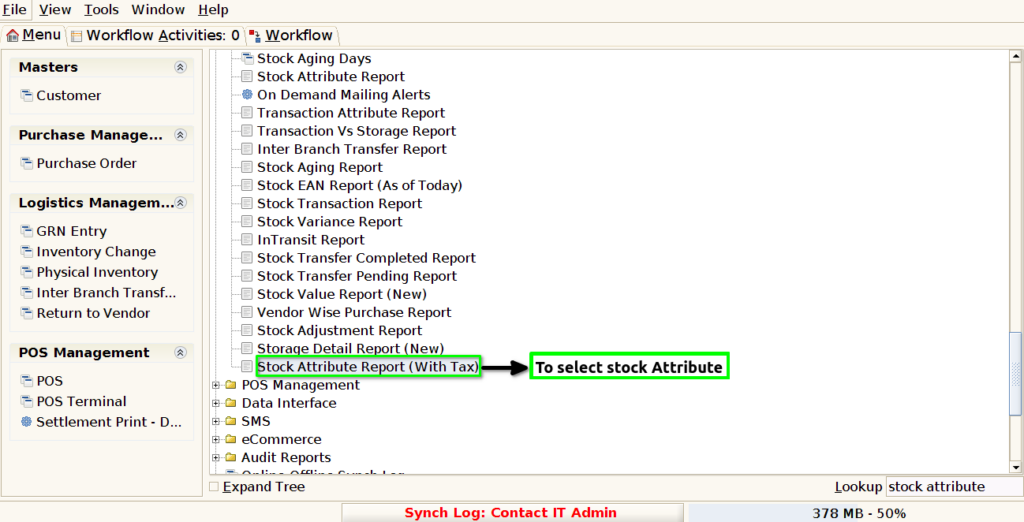

STEP 1: To select a Stock attribute Report(with tax).

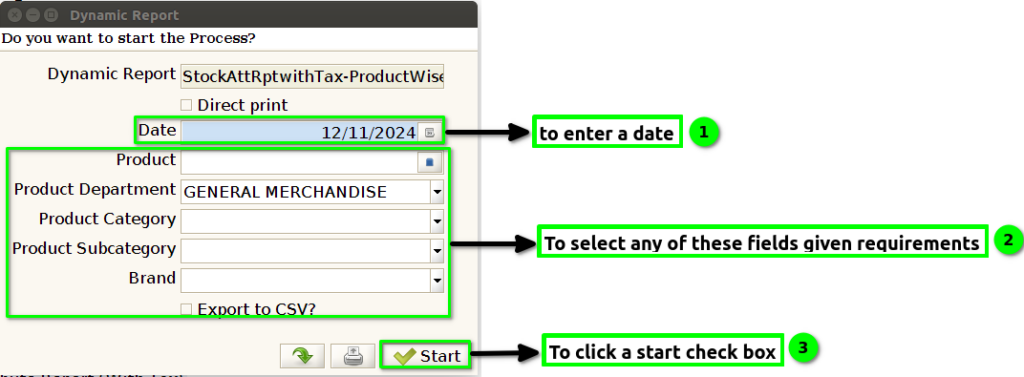

STEP 2:To enter a date mandatory field.And to select any of these fields based on the requirements. To click the start check box to run the process.

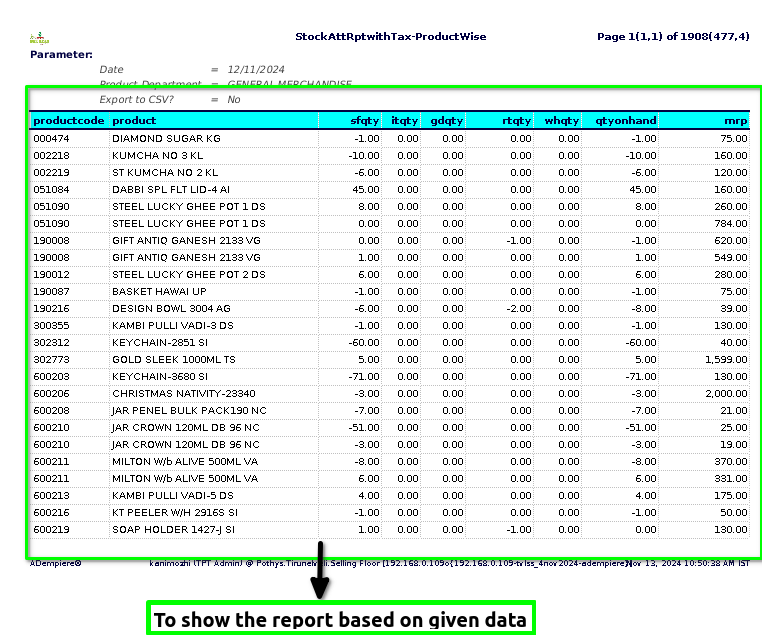

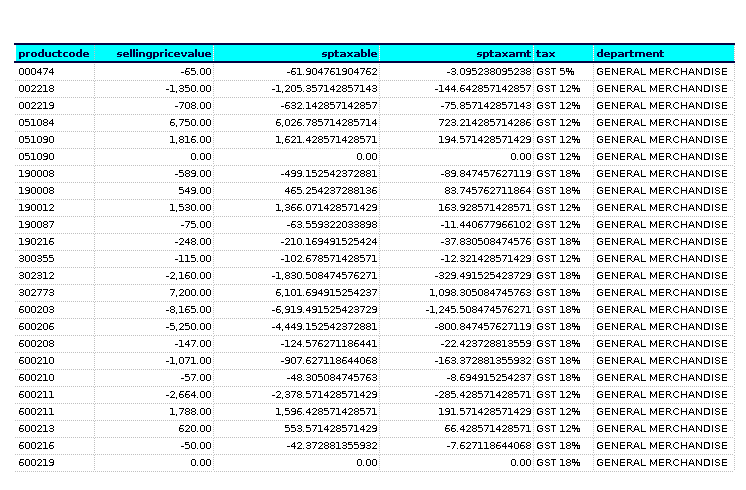

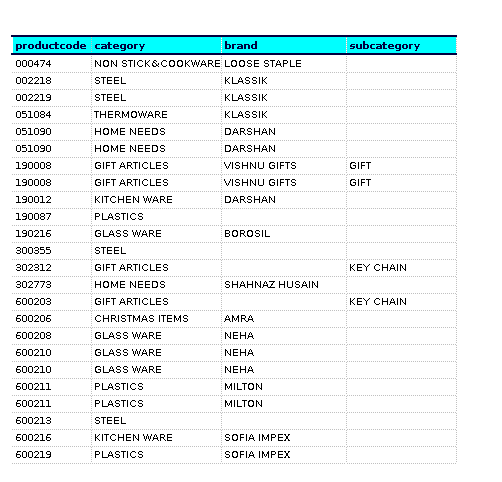

STEP 3:Once to complete the process then to show the report based on given data.

STEP 4: Product code- is a unique identifier assigned to a product. It can be a series of numbers, letters, or a combination of both, designed to distinguish one item from another.

Product name– means the brand name, trade name or code name or code number specified by the supplier.

Sellingfloor Quantity-A floor is a limit for a particular activity or transaction.Selling floor quantity is based on the products and then based on selling floor.

InTransit quantity– refers to the amount of a particular product that is currently in transit from the supplier to the warehouse or from the warehouse to the customer.

Godown quantity– is based on the products and then based on Godown floor .

Return Quantity-The amount of value an investor earns from a security over a specific period, typically one year when all distributions are reinvested.

Wholesale quantity– is a business model where you sell goods in large quantities at a lower price, primarily to those who will resell them.

On-hand quantity – refers to the number of parts that are physically in stock in the primary unit of measure.

MRP & MRP Value– is a system for calculating the materials and components needed to manufacture a product.Maximum retail price (MRP) is a manufacturer-calculated price that is the highest price that can be charged for a product sold in India.

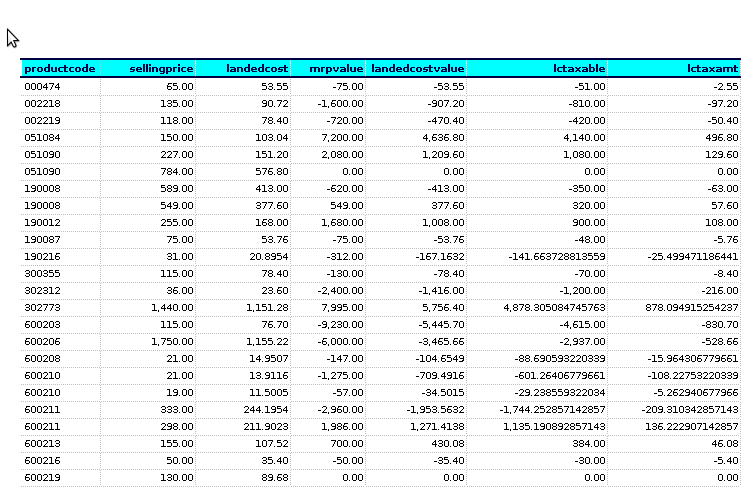

Selling price -is the price that a customer pays to purchase a product or a commodity.

Landed cost & Landed cost value – is the total price of a product or shipment once it has arrived at a buyer’s doorstep.The total cost of getting a product from the factory to a customer’s door.

Landed cost Taxable-In other terms, the landed cost is the sum of retail price, freight transportation, insurance, any taxes and customs charges, processing fees, brokerage fees, dock or terminal fees, and any additional costs incurred to get goods to its final destination.

Landed cost Taxamt-Landed cost is the cost of a good that includes its purchase price and all shipping/transportation costs. The purchase price is the cost of the good itself, while shipping/transportation costs may include customs duties and taxes, handling fees, insurance, and storage fees.

Selling price value-The amount that the buyer pays to buy the product is called the selling price. The actual selling price is the price the buyer pays to buy a product or service. This is the price that is higher than the cost of goods and includes a profit percentage.

Selling price Taxable-The taxable amount is the amount in respect of a taxable transaction on which VAT is chargeable (usually, the price of the goods or services).

Selling price Taxamt-Sales tax is always a percentage of a product’s value which is charged at the point of exchange or buy and is indirect. The different kinds of sales tax are retail, manufacturers, wholesale, use, and value added tax (VAT).

Tax- Tax- axes on products comprise value added tax, taxes and duties on imports and exports and other taxes on products.

Department -for each product and that department controls all activities related to the product including development, production, marketing, sales, and distribution.

Category -is a way for a business to group similar items together for customers to find them, whether in a store or on a website.

Brand– A brand is created through design, packaging, and advertising elements that distinguish the product from its competitors.

Subcategory-based on products is a more specific grouping within a broader product category. Subcategories help to organize products into manageable sections, making it easier for customers to find what they’re looking for and for businesses to manage inventory and marketing strategies.

Training Videos

FAQ

SOP