TO CREATE A SALES TAX REPORT WITH GST-BILL WISE

Sale Stax Report with GST Bill Wise is typically a detailed report used by businesses to track their sales and the associated Goods and Services Tax (GST) for each transaction, broken down by individual invoices or bills.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Sales tax report with GST-Bill wise

Pre-Requisite Activities

- Date Invoiced

- Customer

Business Rules

- Invoice Classification-Invoice Type- Sales Tax reports must differentiate between regular invoices, debit notes, credit notes, advance receipts, etc.

- Each invoice type must be identified properly for accurate tax calculation.GST Invoice Classification -CGST (Central GST) -SGST (State GST) for intra-state transactions -IGST(Integrated GST) for inter-state transactions .

- Taxable Value Calculation -Taxable Value- The taxable value should be calculated based on the transaction amount excluding GST.

- Taxable Amount per Invoice-For each bill, the total taxable amount should be computed.

- GST Payment and Liability Tracking.

- Tax Rate Application-Standard Tax Rate- Apply the correct GST rate (CGST, SGST, or IGST) based on the transaction type and the applicable GST slab for the specific product/service.

- GST Reporting on a Bill-Wise Basis- Bill-Wise Reporting)

- HSN Code-For each invoice, the appropriate HSN (Harmonized System of Nomenclature).

- GSTIN Reporting -Seller GSTIN.

- Reverse Charge and Exemptions- Reverse Charge.

- Advance Payments and Adjustments – Advance Receipts.

- Credit and Debit Notes.

User Interface

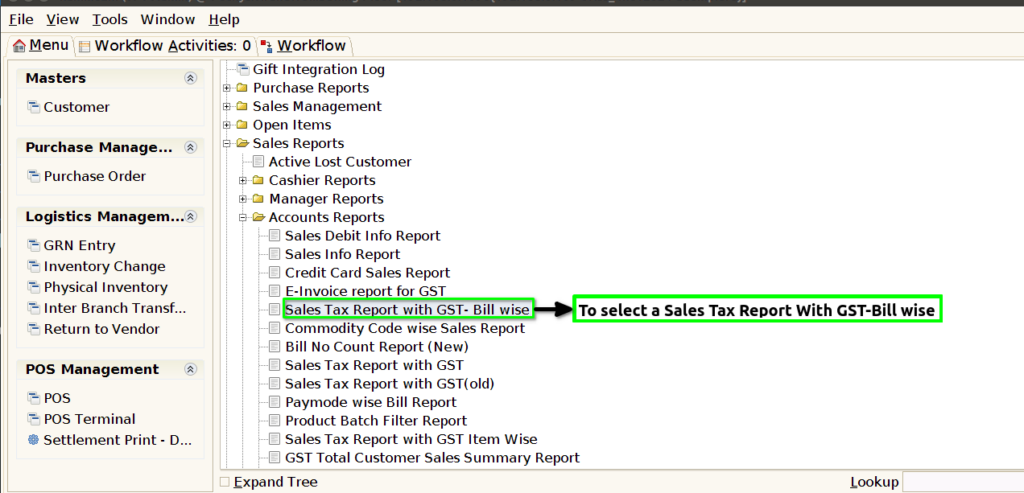

STEP 1: To select a Sales Tax Report with GST-Bill wise.

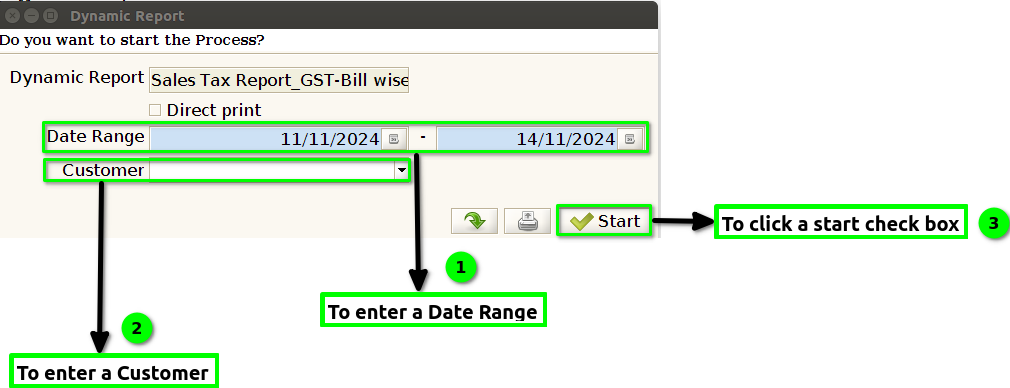

STEP 2:To enter a Date range.In this field is mandatory and to enter a customer its optional.Then to click the start check box to run the process.

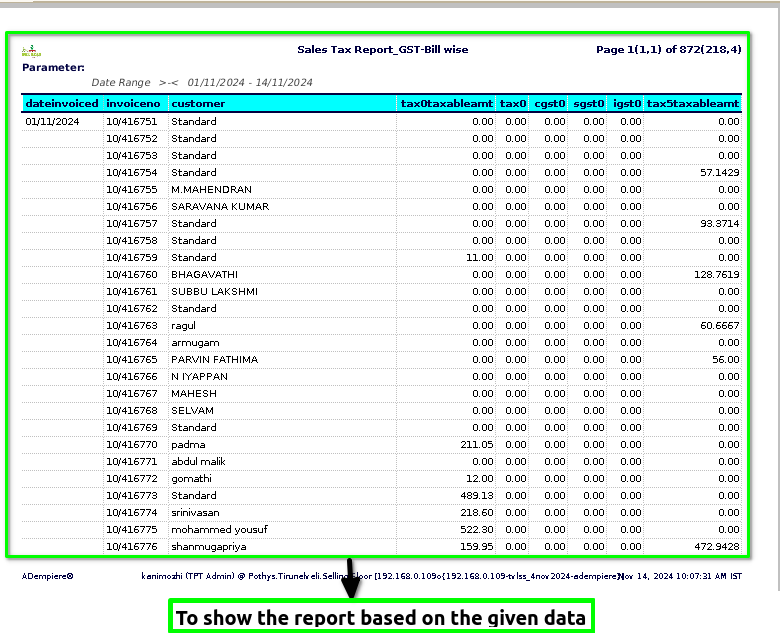

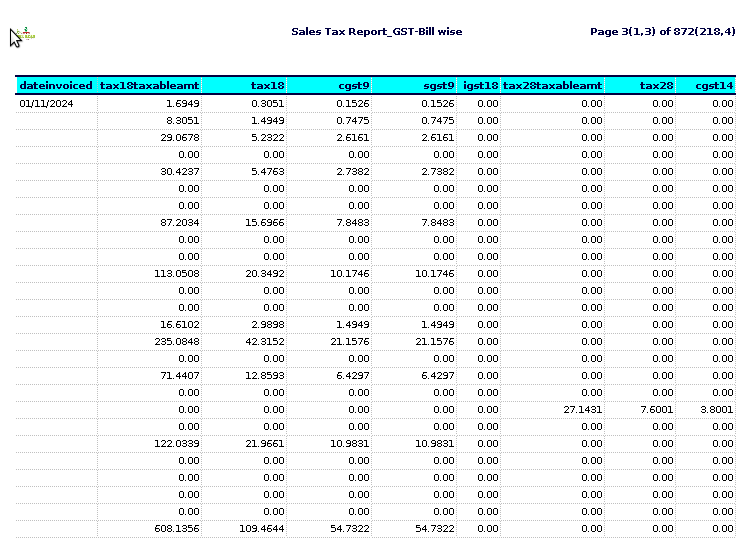

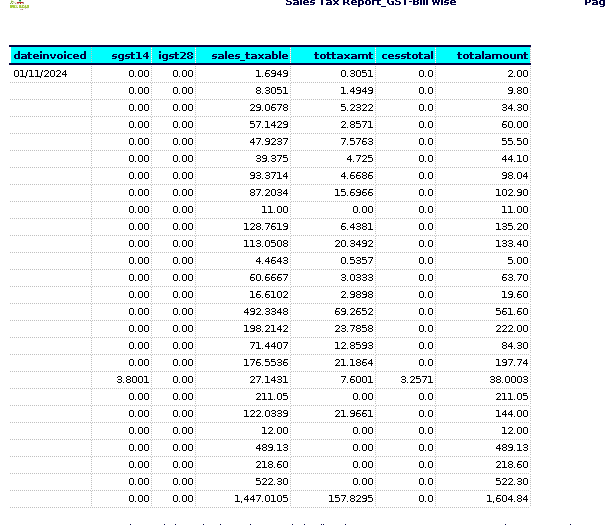

STEP 3:Once to complete the Process to show the report based on the given data.

STEP 4: Date invoiced -refers to the specific date on which an invoice is issued to a customer or client. This is the date the seller formally bills the buyer for goods or services provided.

Invoice number– is a unique identifier assigned to an invoice to help track and reference it in financial records.

Customer-is an individual or organization that purchases goods or services from a business. Customers are essential to a business’s success, as they generate revenue and provide feedback that can drive improvements.

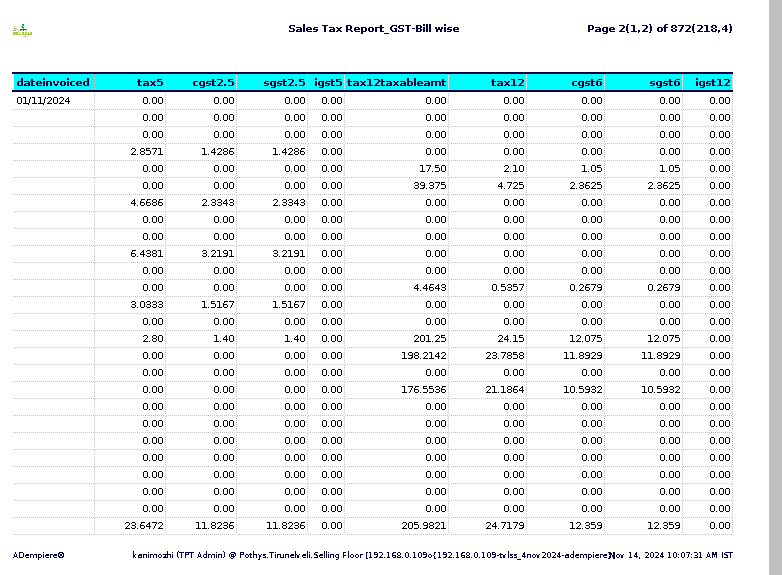

Taxable amount 0,5,12,18,28– generally refers to the portion of income, sales, or other transactions that is subject to tax.

Tax 0,5,12,18,28– is a compulsory financial charge or levy imposed by a government on individuals, businesses, or other entities to fund public services, infrastructure, and government operations.

CGST 0,2.5,6,9,14– stands for Central Goods and Services Tax. It is one of the two components of the Goods and Services Tax (GST) system in India.

SGST 0,2.5,6,9,14-stands for State Goods and Services Tax. It is one of the three types of GST (Goods and Services Tax) levied in India.

IGST 0,5,12,18,28 -stands for Integrated Goods and Services Tax. It is one of the taxes introduced under the Goods and Services Tax (GST) regime in India.

Sales taxable– is a consumption tax imposed by governments on the sale of goods and services. What is subject to sales tax can vary by jurisdiction, but in general, the following categories tend to be taxable.

Total tax amount -generally refers to the total sum of taxes owed or paid by an individual, business, or entity.

Cess total– could refer to the total amount of cess levied or collected under a specific tax system. In general, cess refers to a tax or levy that is imposed in addition to the existing tax structure, often for a specific purpose like funding a particular project or program.

Total amount– typically refers to the total value of sales or supplies made by a business and the corresponding GST that needs to be reported and paid to the government.

Training Videos

FAQ

SOP