TO CREATE A COMMODITY CODE WISE SALES REPORT-SS

A commodity code-wise sales report is a detailed document or analysis that breaks down sales data according to specific commodity codes. These codes are often used in international trade, inventory management, and taxation to classify products and goods. The purpose of such a report is to track the performance of different commodities or product categories based on their unique commodity codes.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Commodity Code Wise Sales Report

Pre-Requisite Activities

- Date Range

Business Rules

- Sales Data Inclusion – Applicable Sales- The report should include all sales transactions within the reporting period (daily, weekly, monthly, quarterly, etc.)

- Commodity Code Assignment-Mandatory Commodity Code- Every product or service in a sales transaction must have a corresponding commodity code.

- Uncategorized – Unique Commodity Code Structure.Ensure that each commodity code is unique and structured consistently (e.g., 4-digit, 6-digit, etc.) based on the taxonomy adopted by the organization (e.g., UNSPSC, NAICS, Harmonized System, etc.).

- Reporting Period-Date Range.

- Sales Metrics-The report should capture the following metrics, organized by commodity code- Quantity Sold .

User Interface

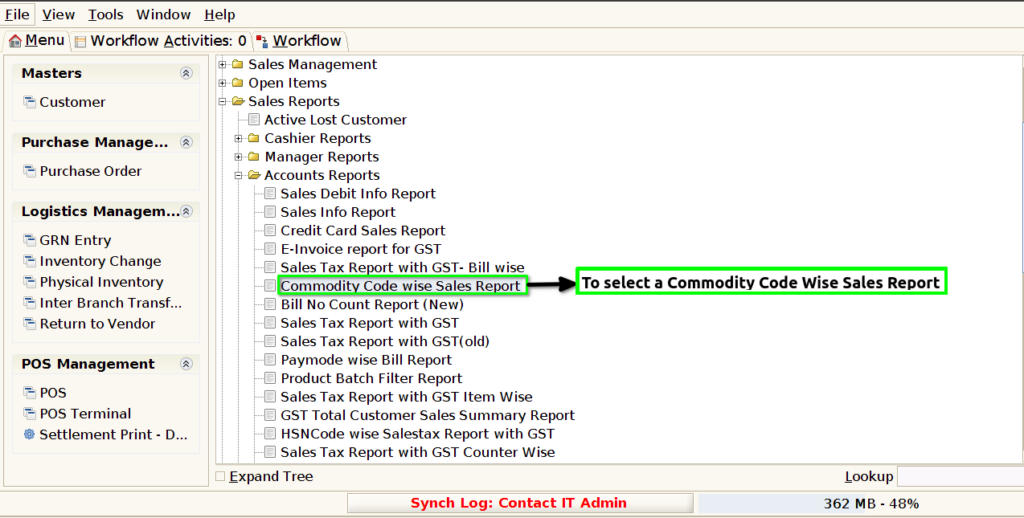

STEP 1: To select a Commodity Code Wise Sales Report.

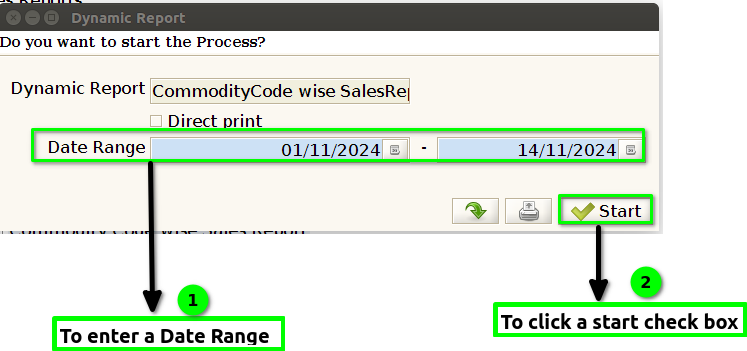

STEP 2: To enter a Date Range in this field is mandatory.And to click the start check box to run the process.

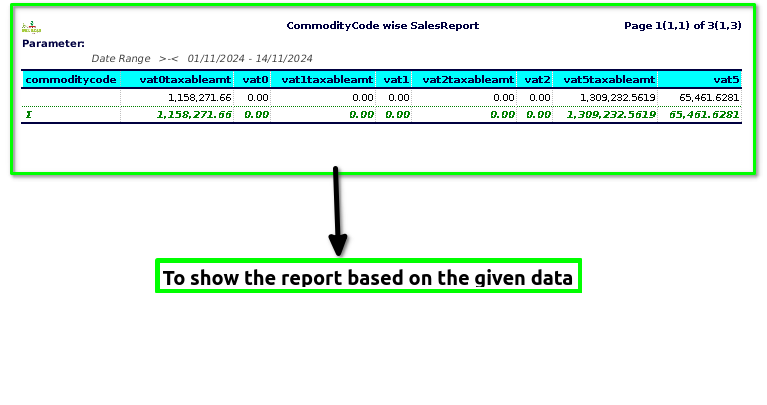

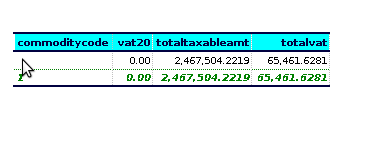

STEP 3: Once to complete the process and to show the report based on the given data.

STEP 4: Commodity code-(also known as a HS code, tariff code, or Customs code) is a numerical code used to classify goods and products for international trade.

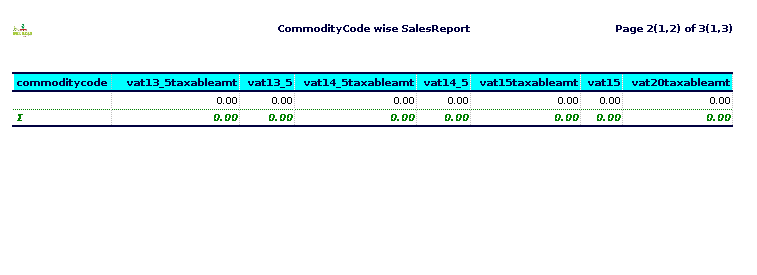

VAT taxable amount 0,1,2,5,13,14,15,20-refers to the base amount on which Value Added Tax (VAT) is calculated. It is the value of the goods or services before VAT is added, and it typically includes the price paid for the goods or services, excluding VAT itself.

VAT 0,1,2,5,13,14,15,20 -stands for Value-Added Tax. It is a type of indirect tax that is applied to the value added at each stage of the production and distribution process of goods and services.

Total taxable amount-refers to the total value of income, earnings, or transactions that are subject to taxation under the laws of a specific jurisdiction. It can include various forms of income, such as wages, salary, business profits, interest, dividends, and other sources of revenue, depending on the tax system in place.

Total VAT-typically refers to the sum of the Value Added Tax (VAT) charged on all sales for each commodity or product category, based on their specific commodity codes.

Training Videos

FAQ

SOP