TO CREATE A SALES TAX REPORT WITH GST

Sales Tax Report with GST refers to a financial document that outlines the sales tax obligations of a business in relation to the Goods and Services Tax (GST) system.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Sales tax report with GST

Pre-Requisite Activities

- Date Range

Business Rules

- Identification of GST Rates- Sales should be classified into different tax categories.

- CGST (Central GST)-Collected by the central government for intra-state sales.

- SGST (State GST): Collected by the state government for intra-state sales.

- IGST (Integrated GST): Collected for inter-state sales (transactions between different states).

- GST rates may vary depending on the product or service, and it’s important to categorize each sale correctly.

- Taxable and Non-Taxable Sales – Taxable Sales: Sales of goods or services subject to GST, based on the applicable GST rate.

- Zero-rated Sales-Exports or certain items that have a 0% GST rate, though they still require reporting.

- Calculation of GST – Output GST– GST collected on sales should be calculated based on the sale price and the applicable GST rate.

User Interface

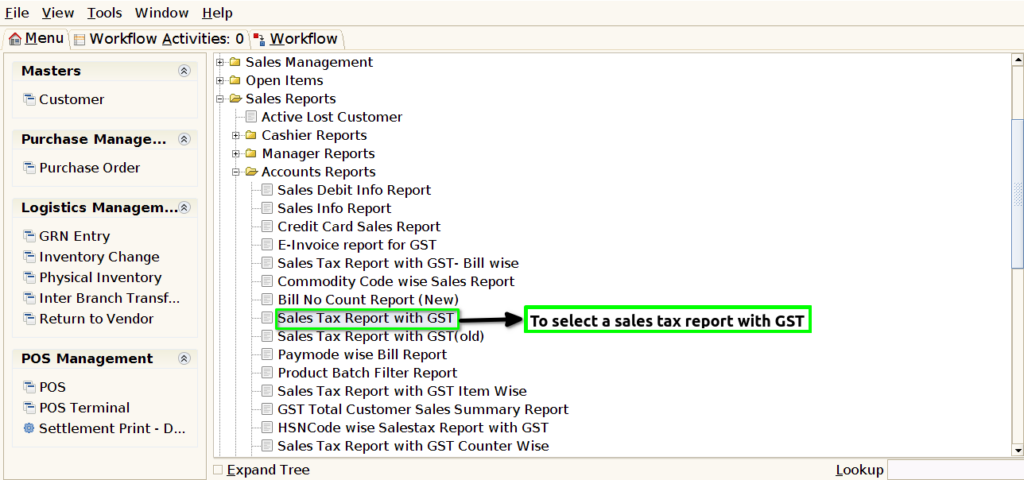

STEP 1: To select a Sales tax report with GST.

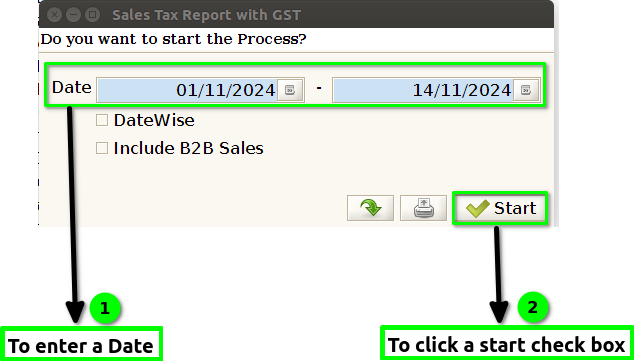

STEP 2: To enter a date in this field is mandatory.To click a start check box to run the process.

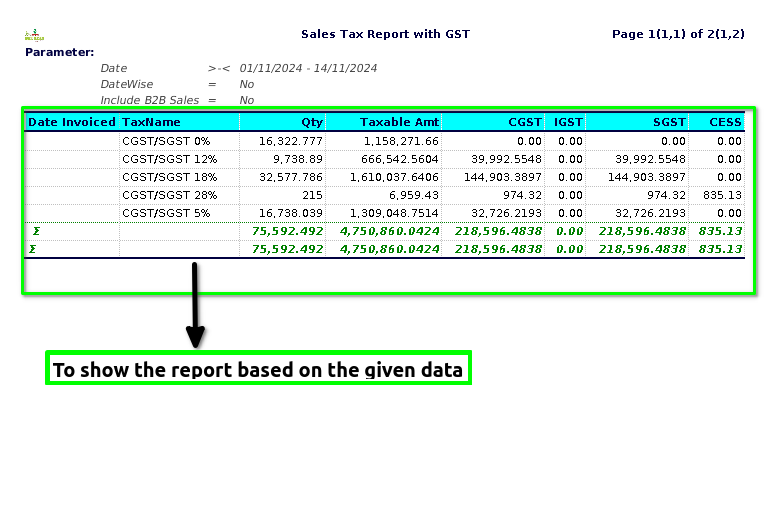

STEP 3: Once to complete the process and to show the report based on the given data.

STEP 4: Date invoiced– refers to the specific date on which an invoice is issued or generated. This is the day when the seller or service provider officially records the transaction and requests payment from the buyer or client.

Tax name-typically refers to the name of the entity (person, business, or organization) that is registered with the tax authorities to pay taxes.

Quantity– generally refers to an amount or measure of something. It can be used in various contexts to describe the size, volume, number, or extent of a particular item, object, or concept.

Taxable amount– refers to the portion of income, sales, or other financial transactions that is subject to tax. It is the amount on which taxes will be calculated based on the applicable tax rate.

CGST– stands for Central Goods and Services Tax. It is a part of India’s Goods and Services Tax (GST) system.

IGST– stands for Integrated Goods and Services Tax, which is a tax levied on goods and services in India as part of the Goods and Services Tax (GST) system.

SGST-stands for State Goods and Services Tax. It is one of the components of the Goods and Services Tax (GST) system implemented in India.

Cess– is a type of tax or levy that is imposed for a specific purpose. It is typically an additional charge on top of other taxes, intended to fund particular services or projects.

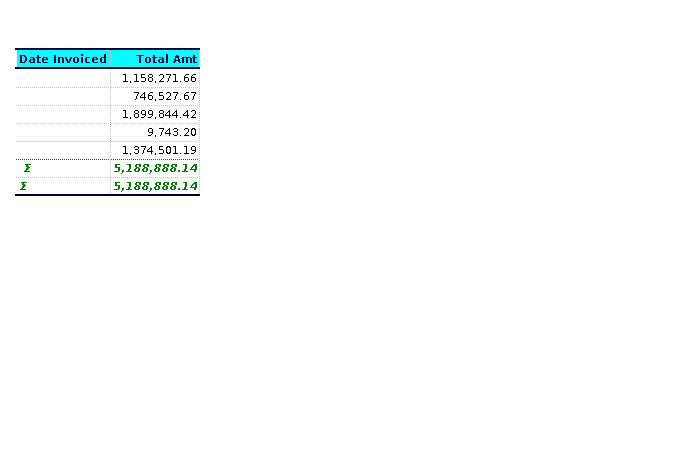

Total amount-which includes the purchase price and sales tax.

Training Videos

FAQ

SOP