TO CREATE A SALES TAX REPORT WITH GST COUNTER WISE

A Sales Tax Report with GST Counter Wise refers to a detailed report that breaks down the Goods and Services Tax (GST) applicable on sales transactions, categorized by different sales counters or locations. This report is often used by businesses with multiple sales points (e.g., retail outlets, branches, or counter-based sales) to monitor and manage their GST liabilities for each specific counter or location.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Sales Tax Report with GST Counter Wise

Pre-Requisite Activities

- Date Range

Business Rules

- Identification of Sales Counters – A sales counter is defined as a point where sales transactions are completed. Each counter should be uniquely identified with an ID or name.

- Each counter must have a corresponding GST registration number if required by local tax laws.

- GST Rates by Counter – GST rates may vary depending on the product category, customer type, and geographic location.

- Each counter should apply the correct GST rate based on the sales transaction (e.g., Standard GST, Reduced GST, Exempt, or Zero-rated).

- Ensure that any counter handling interstate sales applies the Integrated GST (IGST), while intrastate sales should apply State GST (SGST) and Central GST (CGST).

- Recording of Sales Transactions- All sales transactions should be recorded at the point of sale (POS) system with proper categorization of goods/services and applicable GST.

- Adjustments and Refunds- Any cancellations or returns at the counter must be reflected in the sales tax report, with the corresponding reversal of GST.

- GST Payment and Filing-Ensure that each counter’s sales and GST data is included in the overall tax filing (e.g., GSTR-3B for payment and GSTR-1 for outward supplies).

User Interface

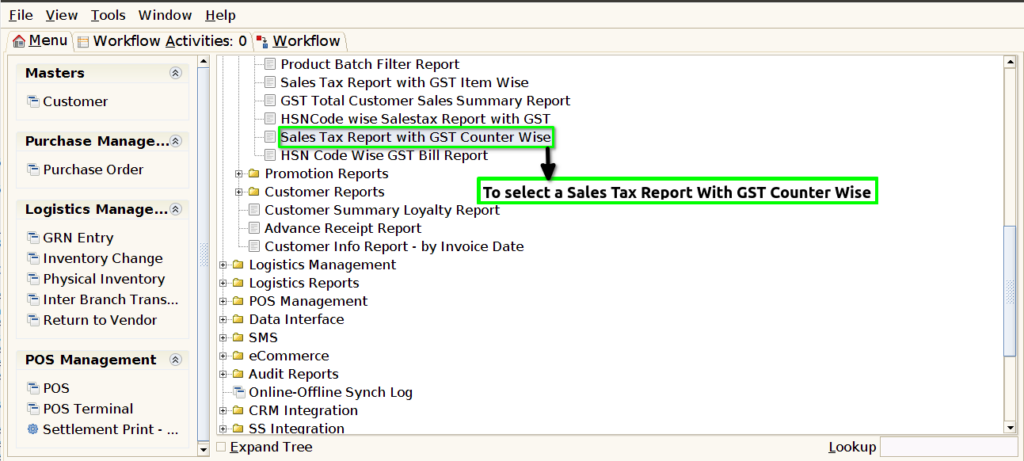

STEP 1: To select a Sales Tax Report with GST Counter Wise.

STEP 2: To enter a Date Range in this field is mandatory.And then to click the start check box to run the process.

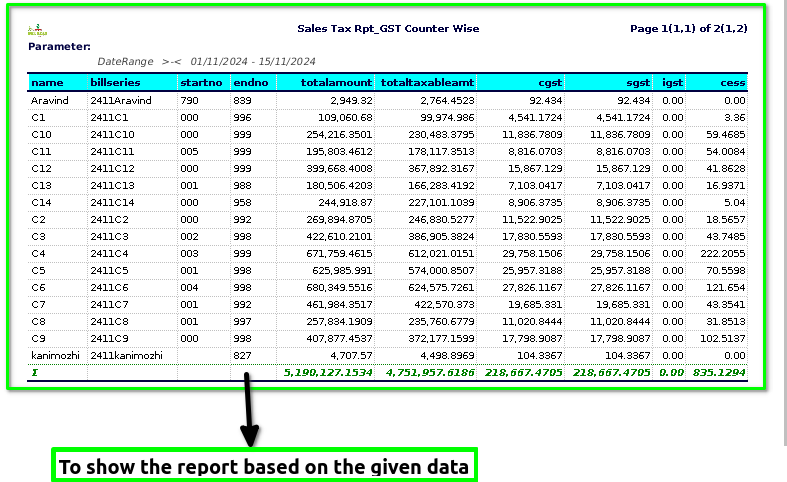

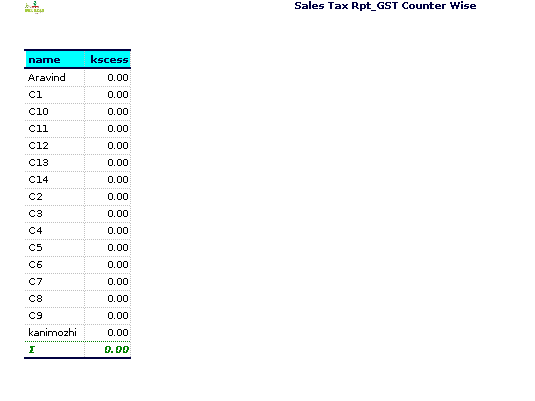

STEP 3: Once to complete the process to show the report based on the given data.

STEP 4: Name-generally refers to a word or set of words by which a person, place, thing, or concept is identified. It serves as a way to distinguish and refer to that entity.

Bill Series-refers to different versions or designs of U.S. paper money issued by the U.S. Treasury. The series are typically denoted by the year in which they were first issued or redesigned.

Start number-is the beginning point of a range.

End number is the final point of that range.

Total amount-generally refers to the sum or aggregate of various individual components. Its specific meaning depends on the context in which it’s used.

Total taxable amount-refers to the portion of income, sales, or transaction value that is subject to tax. It is the amount on which taxes, such as income tax, sales tax, or VAT, are calculated.

CGST (Central Goods and Services Tax)- CGST is the tax levied by the Central Government on the supply of goods and services within a single state.

SGST -(State Goods and Services Tax)- SGST is the tax levied by the State Government on the supply of goods and services within a single state.

IGST (Integrated Goods and Services Tax)- IGST is the tax levied by the Central Government on inter-state transactions, i.e., when goods or services are supplied from one state to another. – IGST is used to ensure seamless flow of credit between states.

Cess is a type of tax or levy that is imposed on top of other taxes, usually for a specific purpose. It is typically earmarked for a particular fund or project, such as education, healthcare, or infrastructure development.

Training Videos

FAQ

SOP