TO CREATE A HSN CODE WISE GST BILL REPORT

An HSN Code Wise GST Bill Report is a detailed report that lists the Goods and Services Tax (GST) transactions of a business, organized by the HSN (Harmonized System of Nomenclature) codes of the goods or services involved. This report helps businesses maintain compliance with GST regulations by showing sales and purchases based on product categories, as defined by their HSN codes.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- HSN Code Wise GST Bill Report

Pre-Requisite Activities

- Date Invoiced

Business Rules

- HSN Code Assignment – Every product/service must be assigned an HSN code in the GST bill based on its classification under the Harmonized System.

- The HSN code should be updated correctly in the billing system, reflecting the actual code for each product/service.

- HSN Code Format – HSN codes are typically 6 digits, though for businesses with turnover exceeding ₹5 crore, they are required to report at 8 digits.

- Ensure that the correct number of digits (6 or 8) are used based on the turnover threshold.

- GST Rate and HSN Code Mapping- For each product or service, the applicable GST rate (CGST, SGST, IGST, or UTGST) should be mapped to the relevant HSN code.

- HSN Code- The correct 6 or 8-digit code associated with each item.

- Quantity-Quantity of the product/service sold.Rate-The unit price or rate for the product/service. –

- Taxable Value-The taxable value of the goods or services (Quantity * Rate).

User Interface

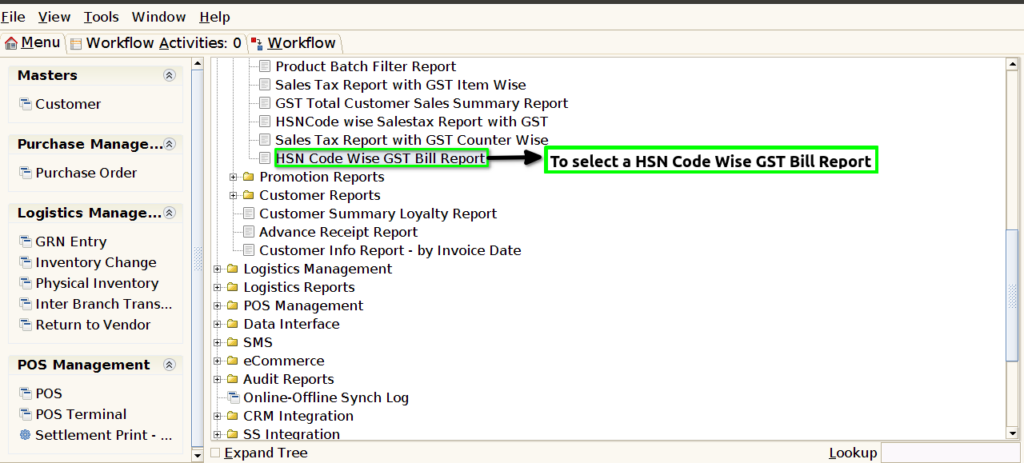

STEP 1: To select a HSN Code Wise GST Bill Report.

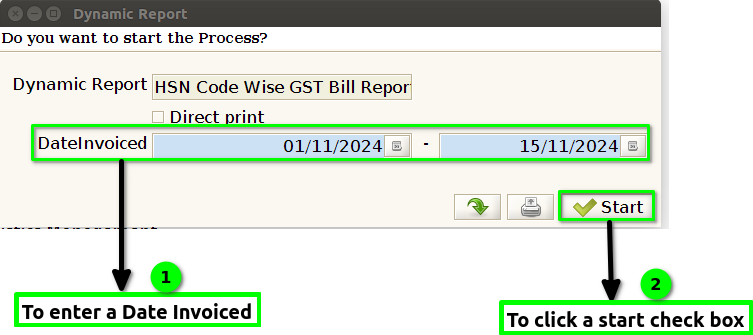

STEP 2: To enter a date invoiced in this field is mandatory.And then to click the start check box to run the process.

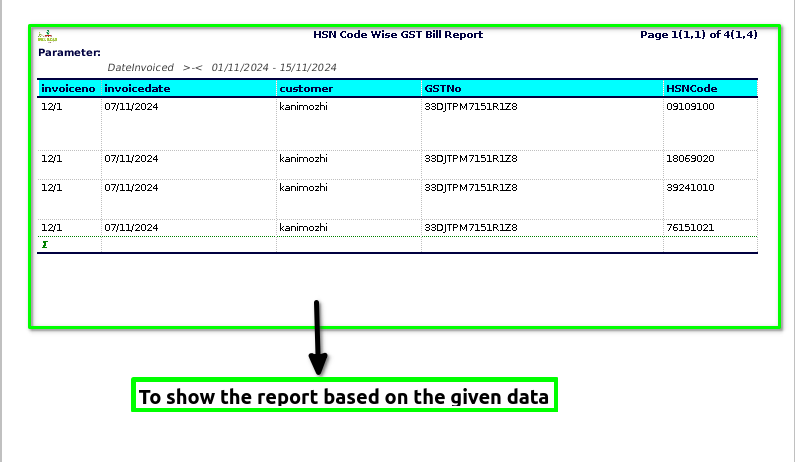

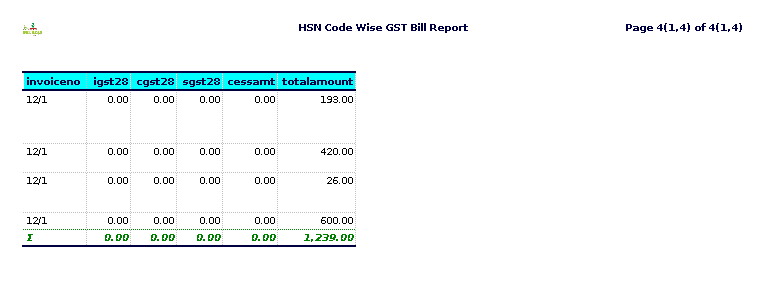

STEP 3: Once to complete the process to show the report based on the given data.

STEP 4: Invoice number-is a unique identifier assigned to an invoice, which helps businesses keep track of transactions. It is usually a sequential or randomized number that distinguishes one invoice from another.

Invoice date– is the date on which the invoice is issued or generated. It represents when the transaction was officially documented, and it serves as the reference point for payment terms, due dates, and accounting purposes.

Customer– is an individual or organization that purchases goods or services from a business or company. Customers are the primary drivers of a company’s revenue, and their needs, preferences, and behaviors significantly influence business strategies and decisions.

GST number (Goods and Services Tax number) is a unique identification number assigned to businesses and entities that are registered under the Goods and Services Tax (GST) system in countries like India.

HSN code– (Harmonized System of Nomenclature) is a globally standardized system used to classify goods in international trade. Developed by the World Customs Organization (WCO), it is used to identify products in a systematic way for customs purposes, ensuring uniformity in the classification of goods across different countries.

HSN (Harmonized System of Nomenclature) description -refers to the detailed description or classification of goods based on a standardized international system.

Quantity– refers to the amount or number of units of a product or item. It is a fundamental measurement used in various contexts, including trade, inventory management, manufacturing, and everyday transactions.

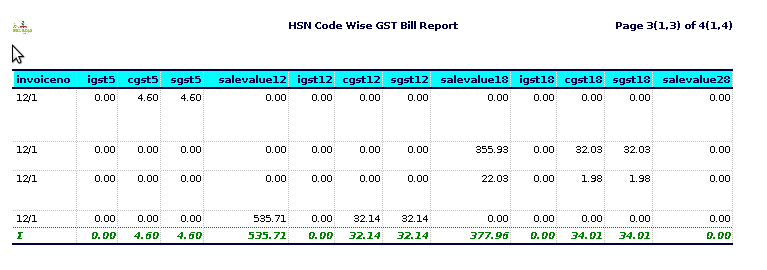

Sale value 0,5,12,18,28– refers to the amount of money for which an item or service is sold. It is the price at which a transaction takes place between a buyer and a seller.

Total amount-generally refers to the sum or aggregate of various individual components. Its specific meaning depends on the context in which it’s used.

CGST 0,5,12,18,28 (Central Goods and Services Tax)- CGST is the tax levied by the Central Government on the supply of goods and services within a single state.

SGST 0,5,12,18,28 -(State Goods and Services Tax)- SGST is the tax levied by the State Government on the supply of goods and services within a single state.

IGST 0,5,12,18,28 (Integrated Goods and Services Tax)- IGST is the tax levied by the Central Government on inter-state transactions, i.e., when goods or services are supplied from one state to another. – IGST is used to ensure seamless flow of credit between states.

Cess is a type of tax or levy that is imposed on top of other taxes, usually for a specific purpose. It is typically earmar0.16ked for a particular fund or project, such as education, healthcare, or infrastructure development.

Training Videos

FAQ

SOP