TO CREATE A SALES VAT REPORT COUNTER WISE-LS

A Sales VAT Report Counter Wise is typically a report used in retail or business environments where sales tax (VAT) is tracked and reported at the level of different counters, sales points, or locations within a business. This kind of report is common in industries like retail, restaurants, or any multi-location operation where sales are recorded at different counters or sections.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Sales VAT Report Counter Wise

Pre-Requisite Activities

- Date Range

Business Rules

- Transaction Categorization by Counter – Each sale transaction must be linked to a specific sales counter or register. – Each counter should have a unique identifier (e.g., counter number, cashier ID).

- VAT Calculation and Application – VAT rates should be applied based on the product or service category.

- Sales transactions should be identified as taxable or non-taxable, and VAT should be computed accordingly.

- VAT Breakdown-Gross Sales Amount-The total value of the sales transaction before VAT.VAT Amount-The actual VAT charged on the transaction.

- Net Sales Amount-The total value of the sales after deducting VAT.

- VAT Percentage-The VAT rate applied for each sale.

User Interface

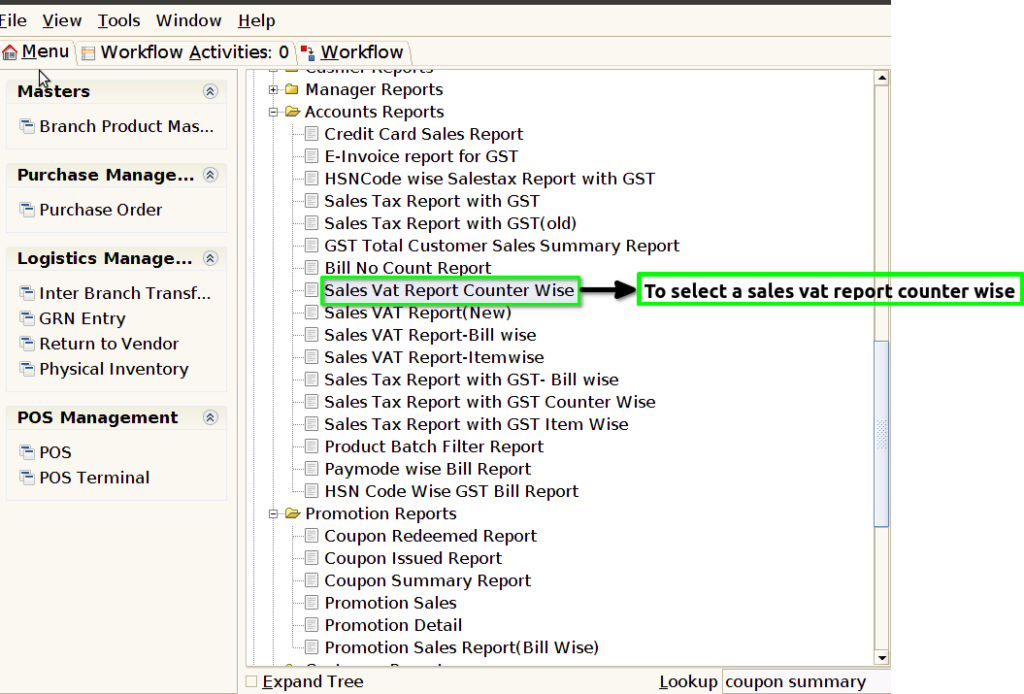

STEP 1: To select a Sales VAT Report Counter Wise.

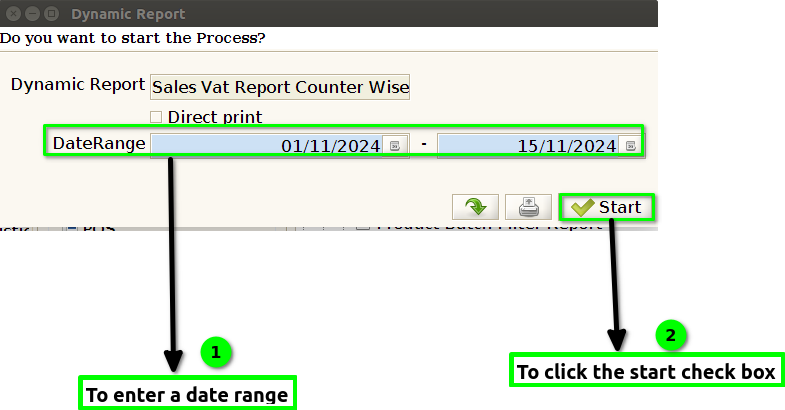

STEP 2: To enter a date range in his filed is mandatory.And then to click the check box to run the proces.

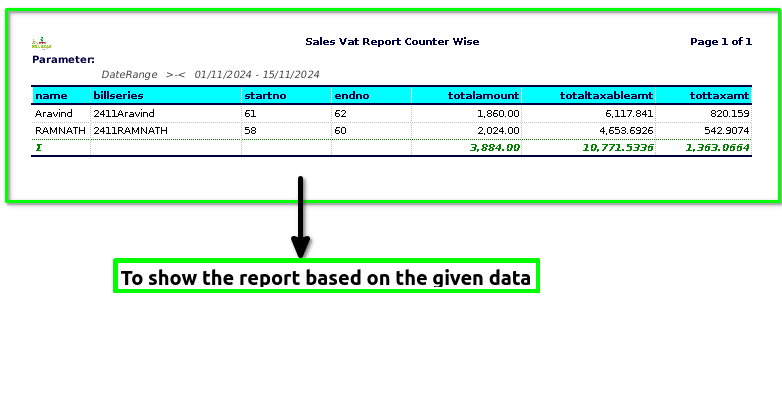

STEP 3: Once to complete the process to show the report based on the given data.

STEP 4: Name-refers to the personal or business name of the individual or organization that is purchasing or has purchased goods or services from a business. It is typically used for identification and communication purposes.

BILL series typically refers to a sequence of bills introduced in a legislative body, such as a parliament or congress, where each bill is numbered sequentially or identified as part of a series addressing related issues.

Start No-This typically indicates the beginning number in a range or sequence.

End No-Similarly, the “end no” refers to the final number in that range or sequence.

Total amount-refers to the complete sum or aggregate of something, whether it’s money, quantities, or values, often after adding all relevant parts together.

Total taxable amount– refers to the portion of income, sales, or other financial values that are subject to taxation by the government. It is the amount on which taxes are calculated after applying relevant deductions, exemptions, or adjustments.

Total tax amount– refers to the sum of all taxes that a person, business, or entity is required to pay to a government authority.

Training Videos

FAQ

SOP