TO CREATE A SALES VAT REPORT (NEW)-LS

A Sales VAT Report (new) typically refers to a report that details the sales transactions of a business, specifically showing the Value Added Tax (VAT) charged on those transactions. This report is often required for tax purposes and helps businesses comply with VAT regulations.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Sales VAT Report(new)

Pre-Requisite Activities

- Date Range

Business Rules

- VAT Rates and Rules – Taxable Sales: Only taxable sales (sales subject to VAT) should be included in the report.

- Sales that are exempt from VAT (e.g., certain educational, medical, or food-related products) should be excluded from the VAT report or separately categorized.

- Zero-Rated Sales- Sales that are zero-rated (subject to VAT at 0%, such as exports in many jurisdictions) should be included but with a VAT value of 0.

- VAT Rate Application-The correct VAT rate (standard or reduced) should be applied to each sale based on the product/service type and jurisdiction.

- Standard Rate- The default rate applicable to most goods/services.

- Reduced Rate-Some jurisdictions have reduced VAT rates for specific items (e.g., food, books, public transportation).

- Special Rates- Some countries apply VAT differently for specific goods or services, such as VAT on digital products, exports, etc.

- Sales Date and Transaction Date – The VAT report should use the transaction date or invoice date (depending on accounting method) to determine the applicable VAT period.

- Gross and Net Sales Amount-Net Sales Amount.

User Interface

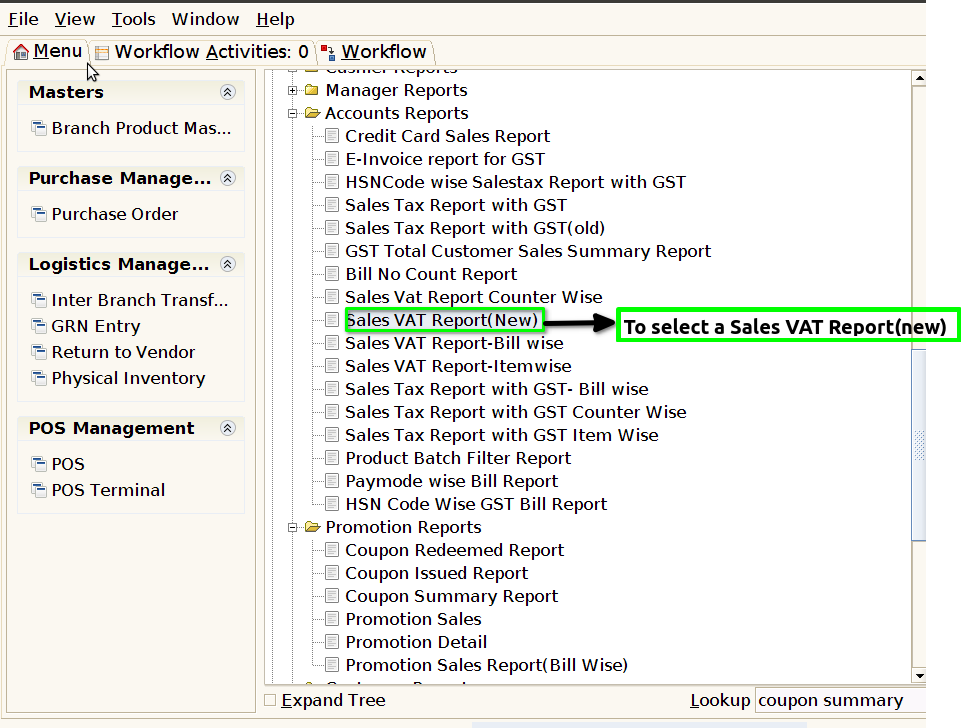

STEP 1: To select a Sales VAT Report (new)

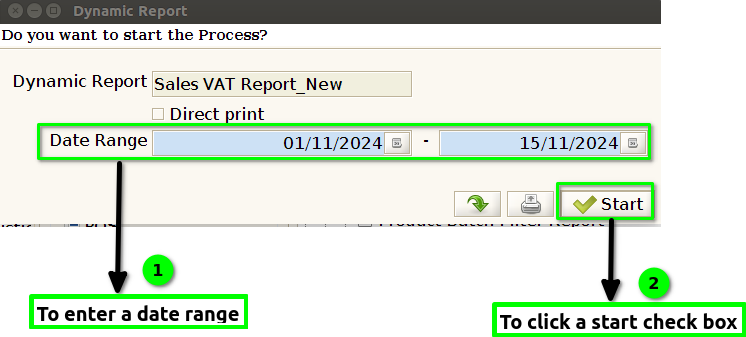

STEP 2: To enter a Date range inthis field is mandatory. And then to click the start check box to run the process.

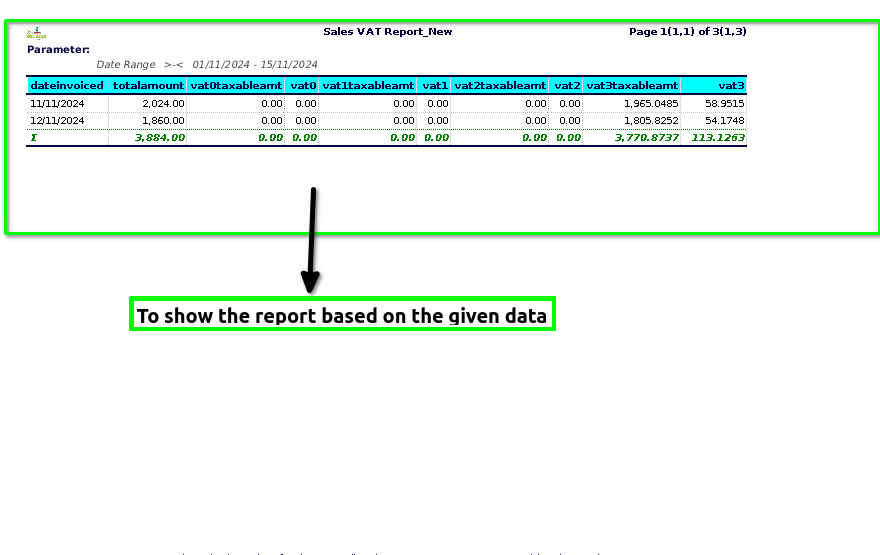

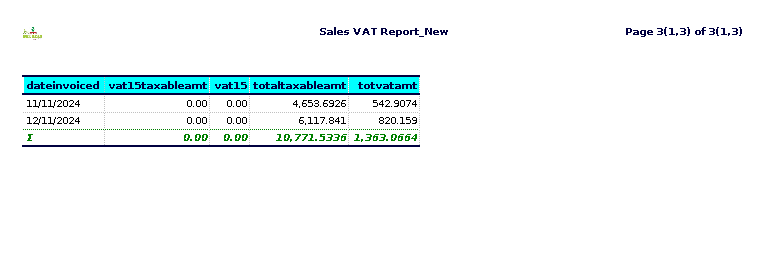

STEP 3: Once to complete the process to show the report based on the given data.

STEP 4: Date invoiced– refers to the specific date on which an invoice is created or issued to a customer. This is the date when the goods or services are billed, marking the formal request for payment.

Total amount– on an invoice refers to the full sum of money that the customer is required to pay for the goods or services provided.

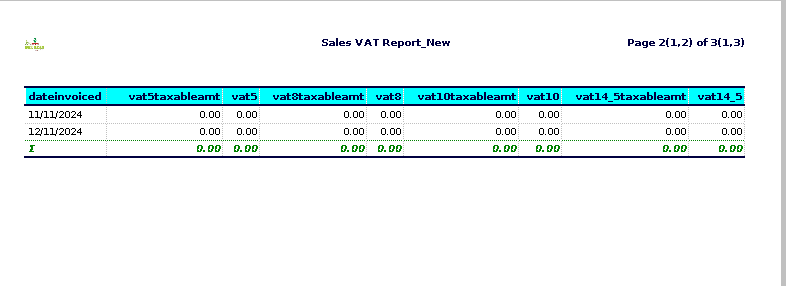

VAT (Value Added Tax) 0,1,2,3,5,8,10,14,15- is a type of indirect tax that is applied to goods and services at each stage of production or distribution. It is typically levied on the value added to a product at each step in the supply chain.

VAT taxable amount 0,1,2,3,5,8,10,14,15-refers to the amount on which Value Added Tax (VAT) is calculated. In other words, it is the base value of a transaction (such as the sale of goods or services) to which VAT is applied.

Total VAT (Value Added Tax) amount– is the sum of tax charged on a product or service based on its value. It is calculated by applying the VAT rate to the price of goods or services.

Total taxable amount-refers to the portion of income, sales, or transactions that are subject to taxation by a government authority. The specifics can vary depending on the type of tax (income tax, sales tax, etc.), but in general, it represents the amount after applying all relevant exemptions, deductions, or allowances that can be taxed.

Training Videos

FAQ

SOP