TO CREATE A CREDIT SALES RECEIPT REPORT

A Credit Sales Receipt Report is a financial report used by businesses to track the payments received from customers for goods or services that were sold on credit. When a business sells on credit, it allows customers to pay at a later date rather than immediately at the time of purchase.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Credit Sales Receipt Reports.

Pre-Requisite Activities

- Date Invoiced

Business Rules

- Only credit sales transactions should be included. A credit sale is defined as a sale where payment is deferred, and the customer is billed rather than paying upfront.

- Invoice/Receipt Association-Each credit sale must have an associated invoice or sales receipt number.

- Customer Information- The customer name, contact information, and account number must be included on the report.

- Transaction Date- Include the transaction date and ensure it’s within the reporting period (e.g., daily, weekly, monthly).

- Sales Value- The amount due should reflect the total sale value minus any discounts or adjustments.

- Payment Terms-Credit terms (e.g., Net 30, Net 60) must be specified to indicate the payment due date.

- Receipt Allocation – Partial Payments – If payments have been made on credit sales, show the portion of the original balance paid and the remaining outstanding balance.

User Interface

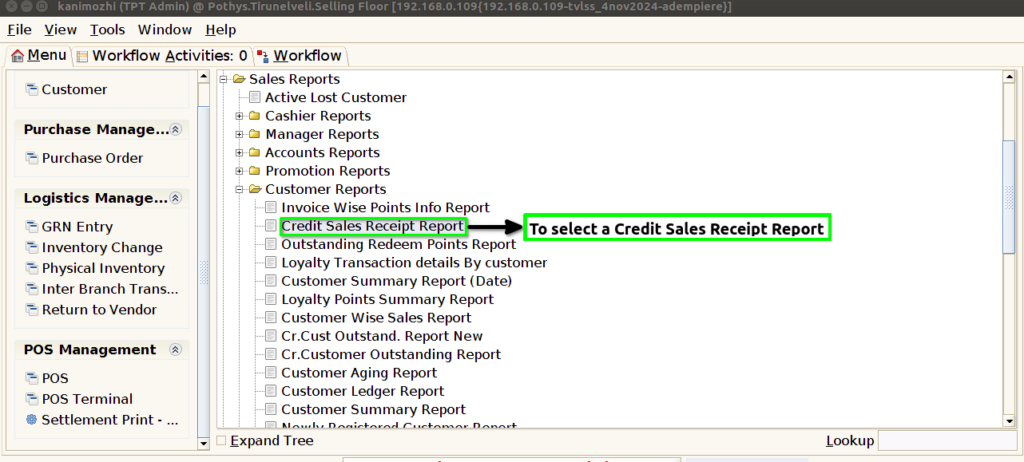

STEP 1: To select a Credit Sales Receipt Reports.

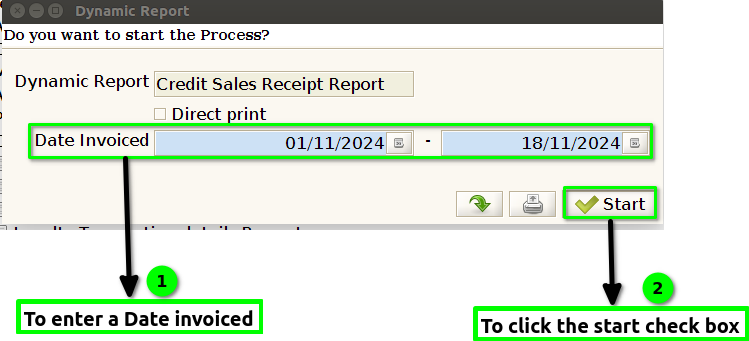

STEP 2: To enter a date invoiced in this field is mandatory.Then to click a start check box to run the process.

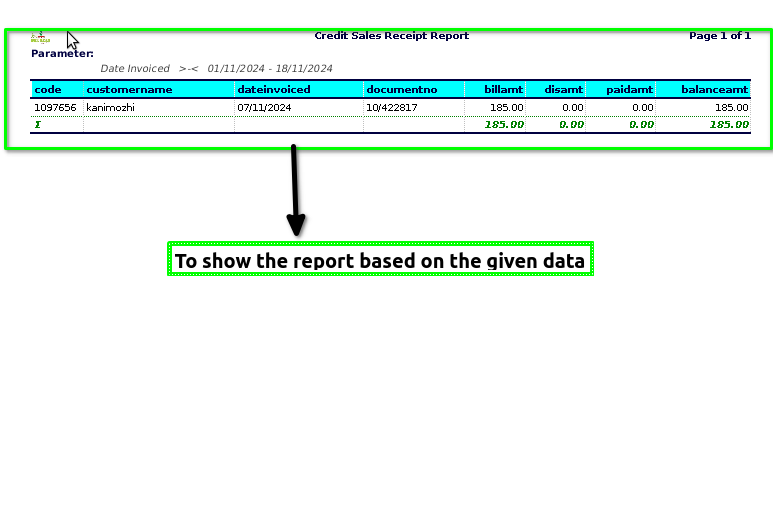

STEP 3: Once to complete the process to show the report based on the given data.

STEP 4: Code – is a unique identifier assigned to a product to help differentiate it from other products. It can be used for inventory management, sales tracking, or identification purposes. Product codes come in different forms, depending on the industry and company, and they are often found on product labels, packaging, or digital listings.

Customer name – refers to the name of a person or organisation who purchases or is considering purchasing products or services from a business. It is typically used to identify the individual or entity in transactions, records, or interactions with the business.

Date invoiced – refers to the specific date on which an invoice is issued by a business to a customer. It is the date when the business officially records the sale or transaction and requests payment for goods or services provided. The date invoiced is important for tracking payment terms, due dates, and ensuring proper accounting for sales and revenue.

Document No– typically refers to a unique identifier or reference number assigned to a specific document. This number helps track, organize, and retrieve documents within a system, especially in settings like businesses, legal institutions, or record-keeping systems.

Bill amount -refers to the total sum of money that is due for payment on a bill. It includes all the charges, taxes, and any additional fees that the customer is required to pay for goods or services received.

Discount amount – refers to the amount of money that is subtracted from the original price of a product or service. It’s typically given as a percentage or a fixed amount off the original price.

Paid amount – is the actual amount of money that a customer pays after any discounts, taxes, or additional charges have been applied to the original price of a product or service.

Balance amount – typically refers to the remaining amount of money that is owed or remaining in an account after previous transactions have been considered.

Training Videos

FAQ

SOP