TO CREATE A ADVANCE RECEIPT REPORT

Advance Receipt Report is typically a financial or accounting document that records and tracks payments received in advance for goods or services that have not yet been delivered or performed. It is commonly used in businesses that require deposits or prepayments from customers before the actual provision of products or services.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Advance Receipt Report

Pre-Requisite Activities

- Date Range

Business Rules

- An advance receipt is a payment made by a customer before the delivery of goods or services.

- Eligible Transactions – Only payments made in advance for orders or contracts that are not yet fulfilled should be considered for this report.

- Payment Methods – Advances may be received through various methods such as checks, wire transfers, credit cards, or cash.

- Recording of Advance Payments-advance receipts liability account (e.g., “Unearned Revenue” or “Customer Deposits”)

- Advance Receipt Report Structure – Customer Information**: The report should include customer name, contact details, and unique identifiers (e.g., customer ID).

- Transaction Date-The date when the advance payment was received must be recorded.

- Refund and Adjustments – Refunds-In the event of a cancellation or refund, the report must reflect any refunds issued against the advance payment.

- Reporting Period – Frequency -The report should be generated periodically, either daily, weekly, or monthly, depending on the business’s needs.

User Interface

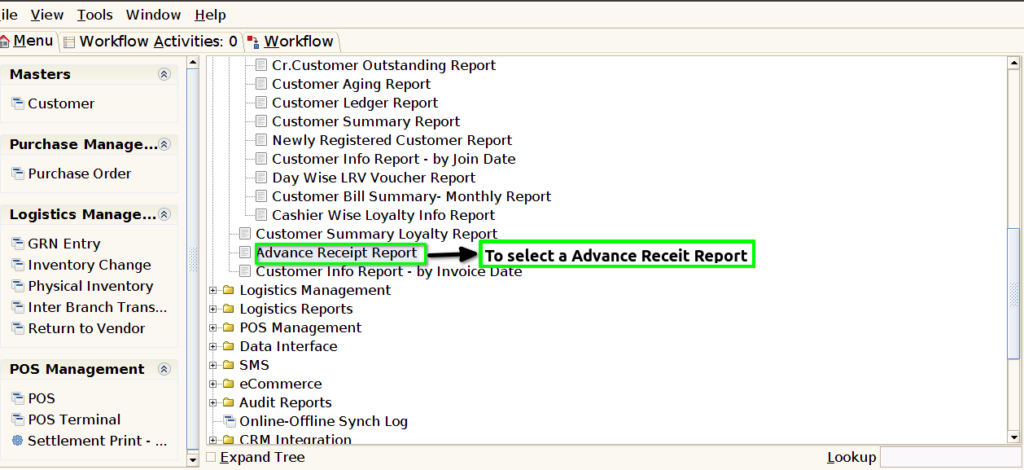

STEP 1: To select a Advance Receipt Report.

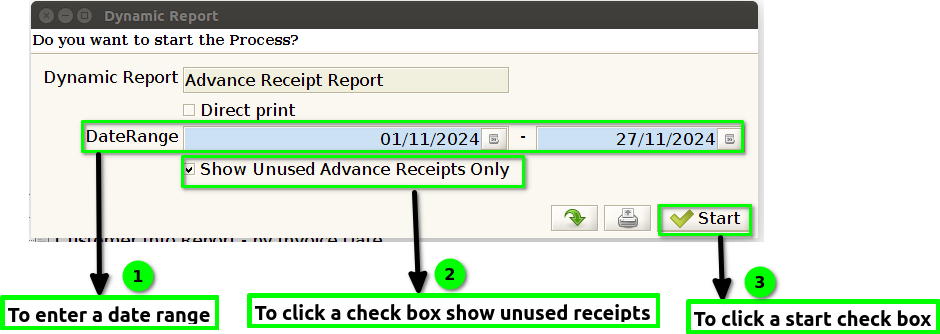

STEP 2:To enter a date range in this field is mandatory,Then to click a start check box to run the process.

STEP 3:

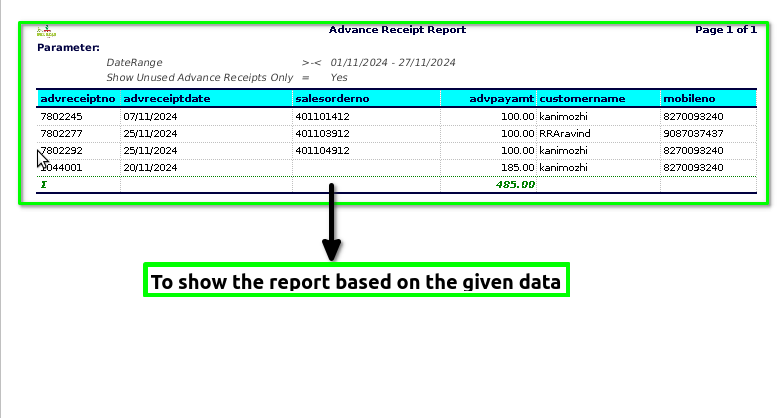

STEP 4: Advance Receipt Number – typically refers to a reference number issued when an advance payment is made for a service or product, or when an advance booking is confirmed for something like travel, events, or other purchases.

Advance receipt date – typically refers to the date on which a payment or deposit is made in advance for a product or service that will be delivered or provided at a later time. It is a common term in accounting, finance, and business transactions.

Sales Order Number – typically refers to a reference number associated with a sales order in an accounting or enterprise resource planning (ERP) system. It is used to track the specific order that a customer has placed, for which the advance payment has been received.

Advance payment – is a partial or full payment made before the delivery of goods, services, or completion of a project. It is typically required in various business transactions to ensure that the buyer is committed to the purchase or agreement and to provide the seller with financial security upfront.

Customer name – typically refers to the name of the individual or organization that has made an advance payment for goods or services. This report is often used in accounting or financial systems to track payments made before the delivery of goods or services.Its helps identify which customer has made the payment.

Mobile number – typically refers to the phone number of the customer who has made an advance payment or deposit for a product or service.

Training Videos

FAQ

SOP