Retail POS Sales Return

Sales return is the transaction which is used to return the items which is purchased by a specific customer along with the Bill no. Both cash return and product exchange should be allowed in POS sales return.

Business rules

- Business uses it as confirmation document of returning products from customer.

- Retails POS will allow sales return by below ways

- Sales return against the bill no with product exchange or payment return.

- Return items using the function key (without bill no) in sales bill entry screen.

Sales Return with Bill no

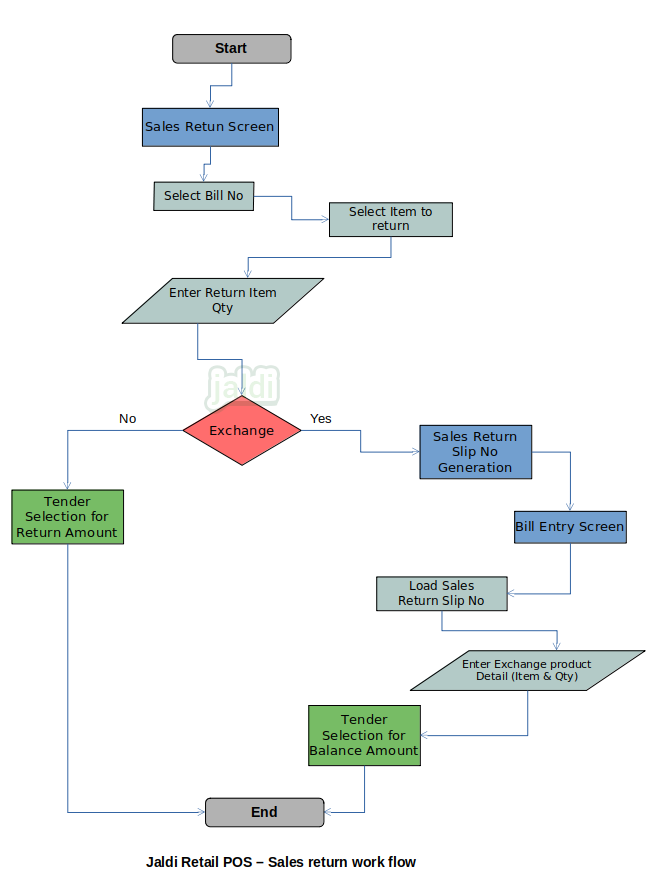

When the customer wants to return any particular items in bill or whole bill to business due to damage or any other reason and wants to get new products or payment refund, user will update the details in sales return screen.

Business rules

- Only sold items which is in customer’s sales bill can be returned.

- Once return is done, the stock should be returned to inventory.

- To make sales return entry, user need to go to the menu called Sales return which is under sales module.

- In that sales return screen, using the date filter load all the bills for specific period.

- Required bill no is searched by using the bill no, customer name or bill amount. User once selected the bill, all the items in particular bill will be shown in list.

- User will select the items by pressing “space bar” or user can select the whole items in bill by pressing Alt+A.

- User once selected the required return qty, press “Enter”, All the selected items will load in sales return page with customer details.

- Modify the return item qty if needed.

- In sales return screen, user can find the input data field named “Sales return slip” with drop down value yes or no.

- Press yes if customer wants product exchange.

- Press no if customer wants cash return.

Sales Return with Payment refund

When the customer wants to get their money back after they returning the purchased goods, user can update “No in Sales return slip” input data.

Business rules

- Only for the returned goods, the amount will be refunded.

- Returned sales return amount should be affect the day sale amount and its reports.

- Bill number is must for cash return.

- Once user updated as no to sales return slip, press the function key save.

- The tender payment screen will be shown, select the tender to return the customer money and click save, the sales return number is generated.

Sales Return with Product exchange

When the customer wants to exchange the product with their return products, user can update “yes to sales return slip” input data.

Business rules

- Bill no must for product exchange return.

- Sales return with product exchange only allowed when the customer is purchasing the exchange product’s amount is more than or equal to sales return amount.

- When customer wants to return product and also want to get new products but with lesser than the sale return amount, it is not possible to do with product exchange return method. User should return the cash by payment refund method and new Product will be saved as new bill.

- Once user updated as yes to sales return slip, press the function key save, then system will generate the sales return slip number.

- Now user have to go to the sales bill entry screen, and press the function key named “Load sales return slip” to load all the returned goods with negative i.e return qty and amount will be shown in negative (-).

- Now user need to load the exchange products to complete the bill.

- If the sales return amount and new exchange product’s bill amount are equal, then system will allow to generate the 0 value bill.

- If the product exchange amount is greater than the sales return amount, Customer will pay only the balance amount and user will update the payment mode and save the bill with product exchange.

- Sales bill edit or cancel is not possible when sales return is done, user should cancel the sales return first and then user needs to cancel sales bill.

Sales return without bill no

When user wants to do sales return without the sales bill number, there is a function key called “sales return” in sales bill entry screen to make quick sales return.

Business rules

- Not recommended to customer, since GST is not applicable for the sales return with out sales bill number. As per GST norms, sales return must proceed against the sales bill number.

- Payment refund is not possible in this quick return process. Only exchange products is possible to do.

- User need to load the sales return item and its qty in sales return screen and press the function key named “sales return”.

- Once the function key is pressed, the item qty and amount will be turned to negative (-) in bill entry screen.

- Now user need to load other purchased items (new items or exchange items), once all the items loaded, customer will pay only the balance amount.

- User will update the payment details in tender screen and save date to generate the bill number.

Retail POS Sales Return workflow