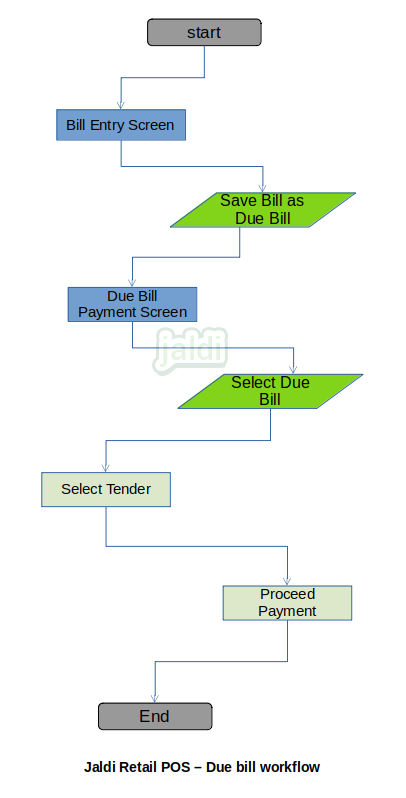

Retail POS Due Bill

Due bill is the bill which is made against the specific non credit customer without bill amount, means customer purchased goods and they will pay later and it will updated in POS due bill screen. It allows partial payment also in POS.

Business rules

- In sales entry screen, user can find the function field named “due bill” after entering all the item details click on that, it will generate the bill number and its print.

- GST split up will be shown in bill print but payment details will not be shown in sales bill print.

- Once user saved bill as due bill, the saved due bill will moved to due bill screen which is under sales module.

- User need to move to due bill screen when customer is ready to pay.

- Due bill payment should be completed on current existing day before day settlement. If customer will pay other day then today, then user should close the bill as credit bill and update the payment details in accounts receipts screen when customer is ready to pay.

- While payment, in due bill screen,user can search the specific due bill by bill no, bill amount and customer name.

- System should allow to select multiple bills to complete the payment once for one particular customer.

- User once selected the required bills, click the function key named “save”, it lead user to the payment screen, where user will update the payment mode to this bill.

- If any offer is applicable for the bill amount offer amount will be applied here before payment.

Retail POS due bill workflow