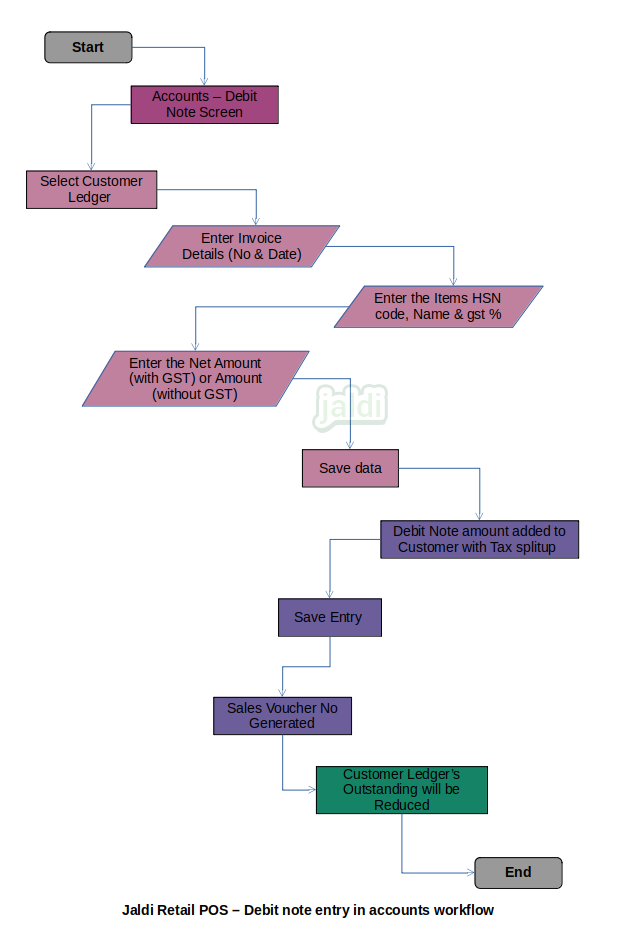

Debit Note entry in Retail POS Accounts

Debit Note is Nothing but the sales return from the ledgers. . When the Sales entry made in accounts and then user wants to raise debit note or sales return to specific customer, this screen will be useful to the user.

Business rule

- There should be the menu called debit note under transaction module for user to create debit note.

- In that debit note screen, user will select the cutsomer ledger and then system will show the screen to enter invoice details.

- In that shown popup screen, enter invoice number and invoice date and then enter item name, HSN or SAC code and GST tax % for each items.

- Then user will enter net amount (with gst) or amount (without gst) and click save function key.

- Then entered amount or net amount will be added to supplier with tax split up.

- Then user will enter the reason for debit note or sales return.

- Then user should click on the function key called “save” to save debit note entry.

- Store return credit sold products with product details with reason for the return.

- Debit note affect the ledger outstanding value.

- Debit note raised to both suppliers and customers.

Debit note entry in retail POS accounts workflow