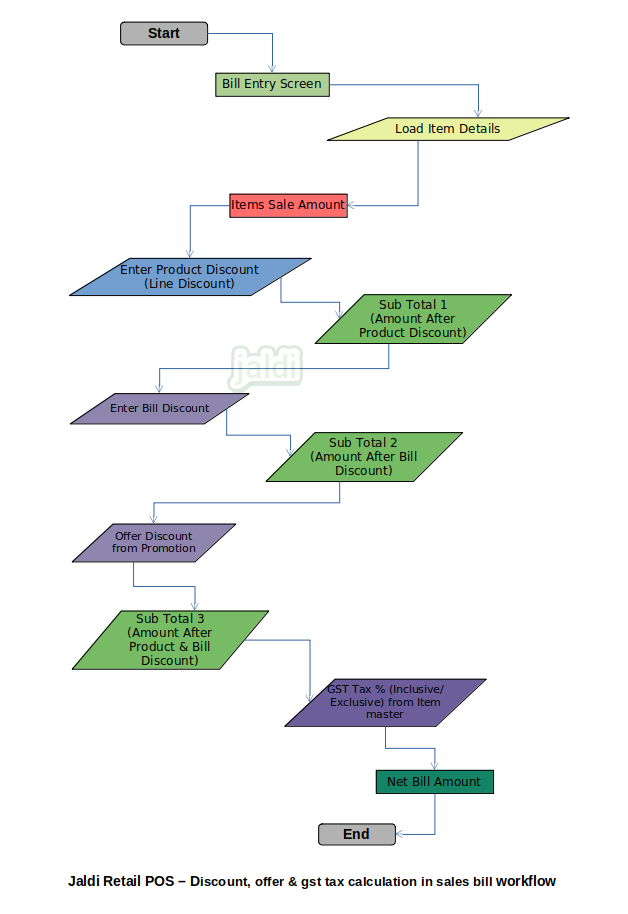

Discount, Offers & Tax calculation flow in Retail POS bill entry

In POS, the discounts and tax will be applied on the item sales amount by following order to calculate the net bill amount.

- Item discount

- Bill discount

- Offer or promotion

- GST tax %

Business rules

- Item discount will be both percentage or amount based discount.

- User can update the item wise pre defined discount in item master. Also user can enter item wise discount at POS billing screen.

- Bill discount will allow both percentage or amount based. Bill discount will be entered by user in POS billing screen while billing.

- Offers will be created in promotion screen with certain conditions, when the existing bill is applicable for the created offer, then the offer discount will be calculated to calculate the bill amount.

- Once all the discount is applied on item sale amount, then the GST tax % will be applied on the bill amount.

- There is two type of GST tax. That is Inclusive and Exclusive. (In retail Business Inclusive is Highly used)

- Formula for GST Tax calculation shown below

- Exclusive Tax Amount = (Amount * GST tax%)/100 )

- Inclusive Tax Amount = ((Amount * GST tax%)/(100+GST tax%))

Discount, Offers & Tax calculation flow in Retail POS bill entry workflow