GST TOTAL CUSTOMER SALES SUMMARY REPORT

The GST Total Customer Sales Summary Report is a financial report that summarizes the total sales made to customers and the corresponding Goods and Services Tax (GST) that has been applied to those sales. It is typically used by businesses in countries that have implemented a GST system (such as Australia, India, and Canada) to track the sales tax collected on goods and services sold to customers.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- GST Total Customer Sales Summary Report

Pre-Requisite Activities

- Date Range

Business Rules

- Data Collection and Categorization-Transaction Date:Only sales transactions within the reporting period should be included (e.g., monthly, quarterly).

- Customer Information:The report should list all customers, either by customer ID or name.

- Sales Data: Include both taxable and non-taxable sales.

- GST Rates: The appropriate GST rate should be applied based on the type of product/service and the jurisdiction (e.g., standard rate, reduced rate, exempt, or zero-rated).

- Total Sales Calculation- Total Sales Value:Calculate the total sales value for each customer, including the subtotal before taxes.

- GST on Sales:Calculate the GST applied on the sales based on the applicable GST rate.

- Customer-wise Summary- Customer Breakdown:Display the total sales and GST for each customer individually, including both taxable and non-taxable amounts.

- GST Reporting – GST on Sales:The total GST collected from customers should be included, along with a breakdown of the taxable sales.

User Interface

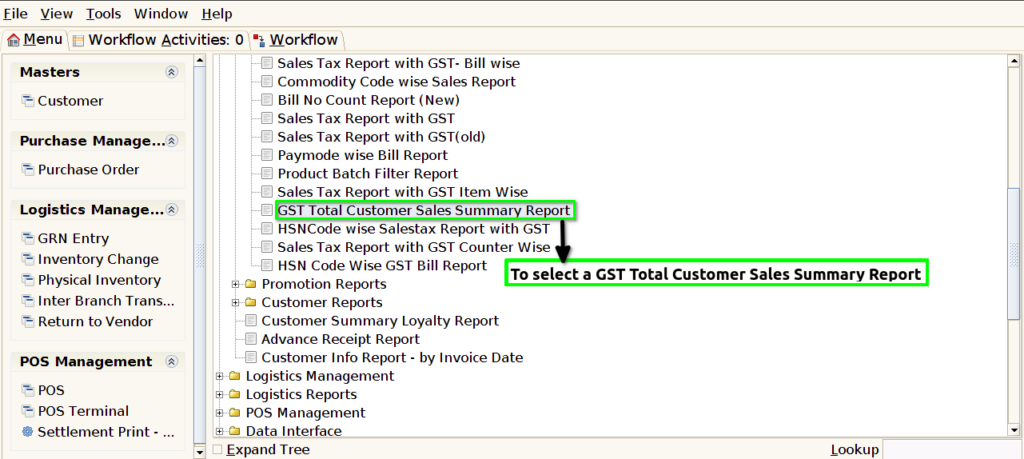

STEP 1: To select a GST Total Customer Sales Summary Report.

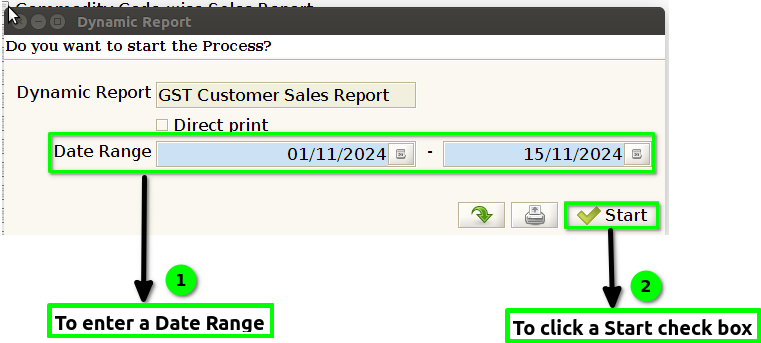

STEP 2: To enter a date Range in this field is mandatory.Then to click a start check box and to run the process.

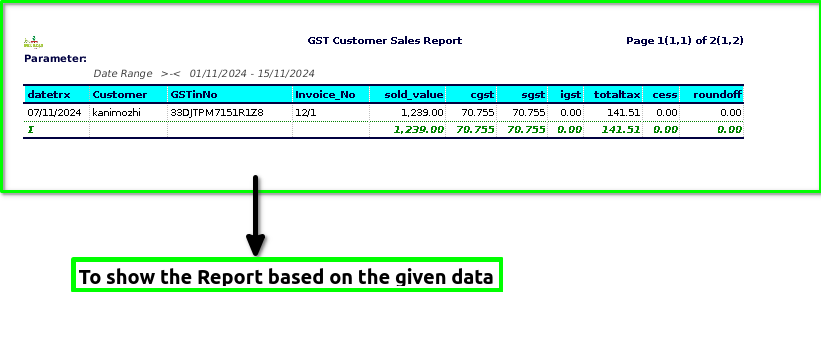

STEP 3: Once to complete the process and to show the report based on the given data.

STEP 4: DateTRX– is a tool or service designed to help users manage, track, and analyze their romantic or dating experiences. It is generally used to log and organize various details about dates, relationships, and interactions, providing users with insights into their dating patterns or improving their social interactions.

Customer– is an individual or organization that purchases goods or services from a business or seller.

GSTIN-stands for Goods and Services Tax Identification Number. It is a unique identification number that is assigned to businesses and entities registered under the Goods and Services Tax (GST) system in India. The GSTIN is used to track and manage tax compliance and transactions under GST.

Invoice number-is a unique identifier assigned to a specific invoice. It serves as a reference number for both the buyer and the seller to track and manage transactions. The invoice number helps ensure that invoices are processed, paid, and recorded correctly.

Sold value-refers to the total amount of money received from a sale or transaction. It typically includes the price of the goods or services sold, excluding any discounts, taxes, or additional fees unless specified otherwise.

CGST -(Central Goods and Services Tax)-This is the tax collected by the central government on the intra-state supply of goods and services (within the same state).

SGST– (State Goods and Services Tax)-This is the tax collected by the state government on the intra-state supply of goods and services (within the same state).

IGST -(Integrated Goods and Services Tax)-This is the tax levied on inter-state transactions, i.e., when goods or services are supplied from one state to another.

Total tax– generally refers to the total amount of taxes a person, business, or organization is required to pay to government authorities over a given period, such as a year. This can include a variety of taxes depending on the tax system in a particular country or jurisdiction.

Cess-is a form of tax or levy imposed by governments to fund specific projects or activities, typically in addition to regular taxes. It is usually temporary or dedicated to a particular cause, such as infrastructure, education, health, or disaster relief.

Rounding off-is the process of adjusting a number to a nearby, simpler value, usually for ease of calculation or to express it more concisely. The idea is to reduce the complexity of a number while keeping it close to the original value.

Amount received-generally refers to the total sum of money or value that is actually obtained in a transaction, after all relevant deductions or adjustments (like taxes, fees, or discounts) have been applied.

Training Videos

FAQ

SOP