HSN Code master in Jaldi Lifestyle POS

HSN code is used for the better identification of a goods in India, in simple words it is a numeric or systematic classification of goods. It will be minimum 4 digits to maximum 8 digits in size. It is very much recommended to update the HSN code with tax rate to each products for better GST filing.

Lets imagine the scenario where you need to create the HSN code for your “Denim brand jeans” in jaldi application, HSN code & tax rate for denim jeans is 12300112 & 12% and you will get this number already from the vendor invoice, So follow the below steps to create the HSN code in jaldi application.

HSN Code Creation

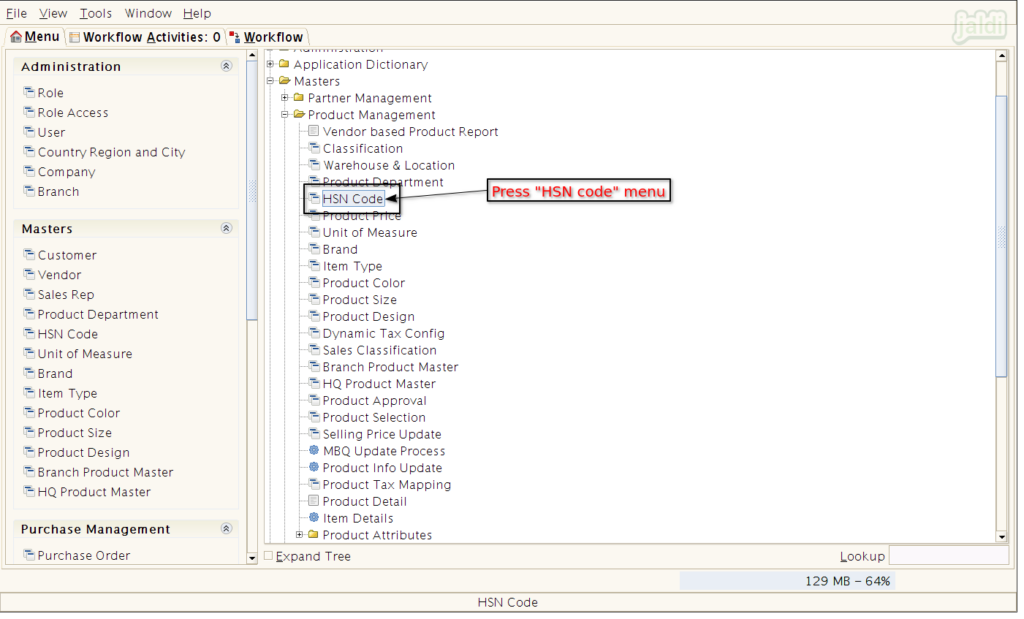

- To create a new HSN code, go to application path Masters > Product Management > HSN Code.

- Press HSN code menu which is shown below to create a new one.

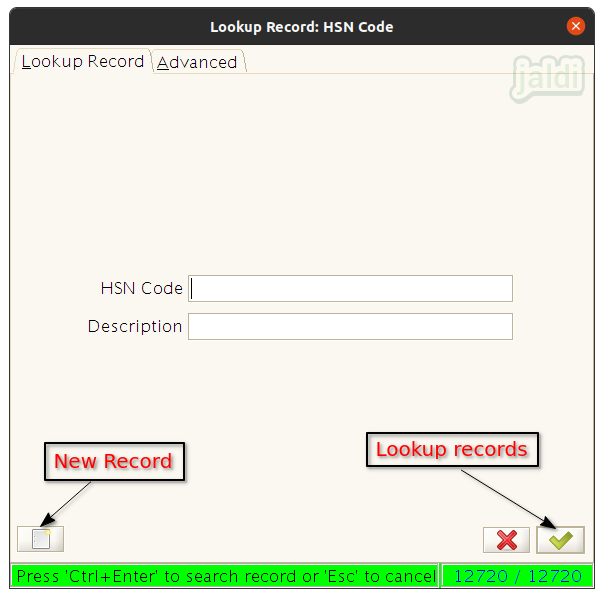

- To create a new HSN code press “New” button in the screen which is shown in below image.

- Press Green tick mark if you wanted to see the list of HSN available.

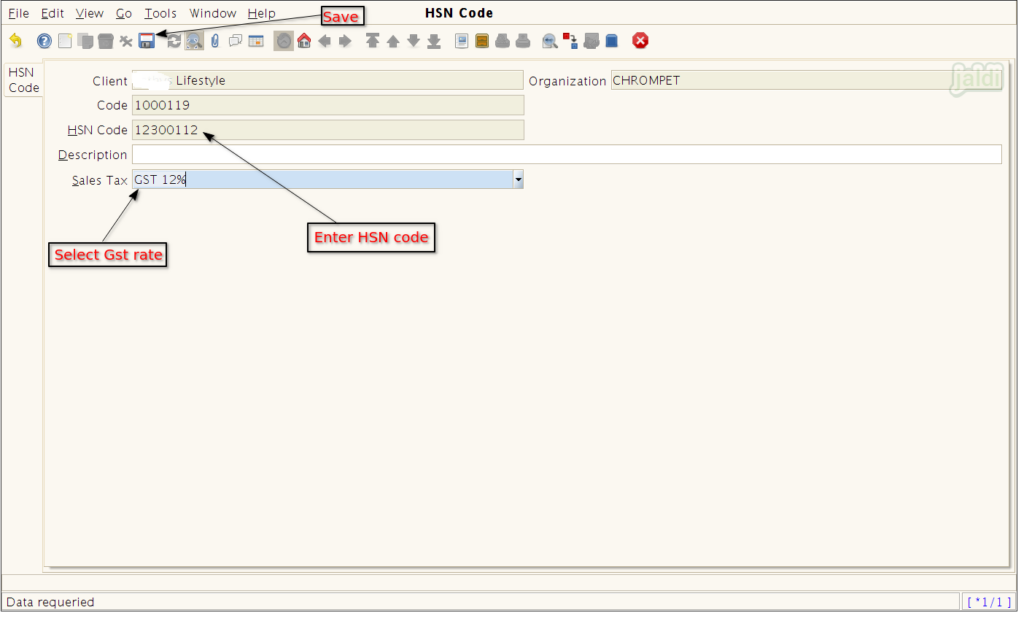

- In new screen, Enter HSN code in HSN Code field and You can also enter the description of an goods for the entered HSN code.

- Then select the GST rate from the predefined list in “Sales Tax” drop down filed.

- Same HSN code will not be allowed to create again.

Edit HSN code

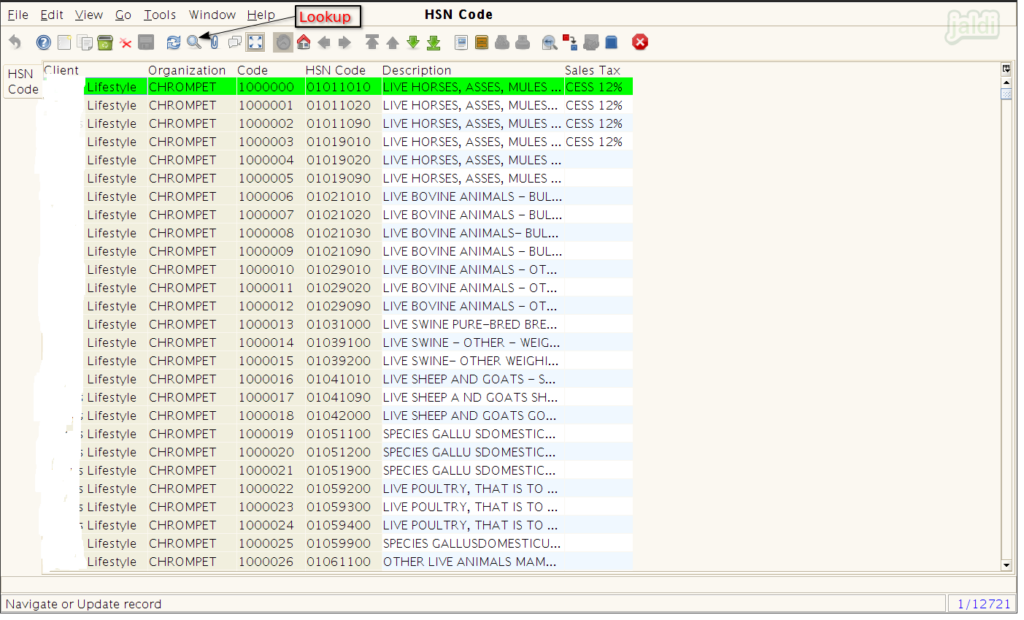

- Press on the search or lookup option which is shown in below image.

- It will lead user to the lookup screen. In that screen enter the HSN code you want to find and edit and press green tick button.

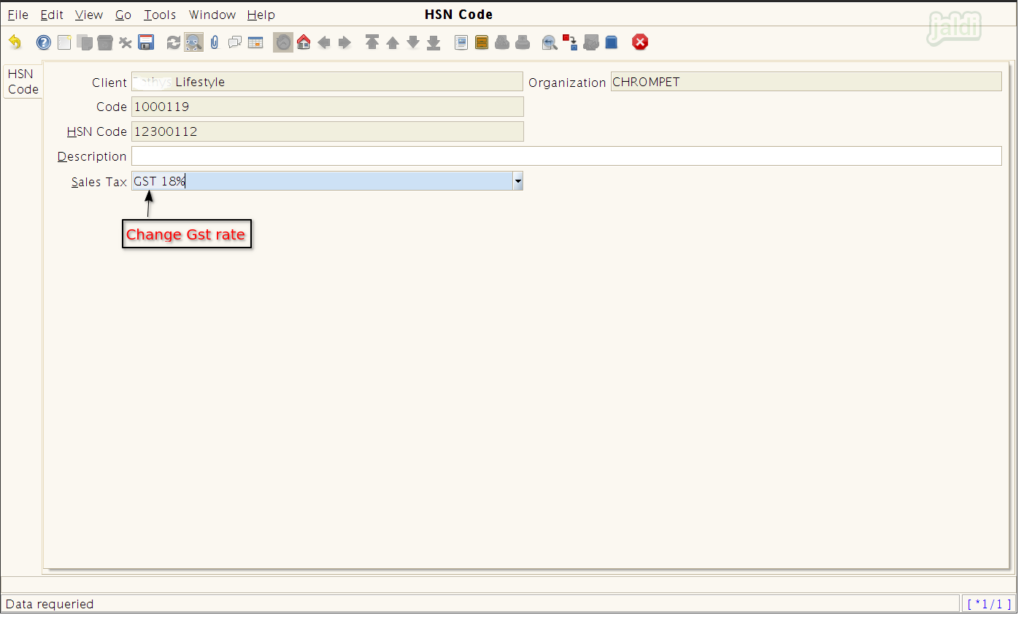

- Once the required HSN code is open in the screen, you can change the data and save.

- Only sales tax (GST rate) can be changed, HSN code cannot be edited.

- If you wanted to edit the HSN code then you must delete and create new HSN code.

- To save updated sales tax, press “save” button.

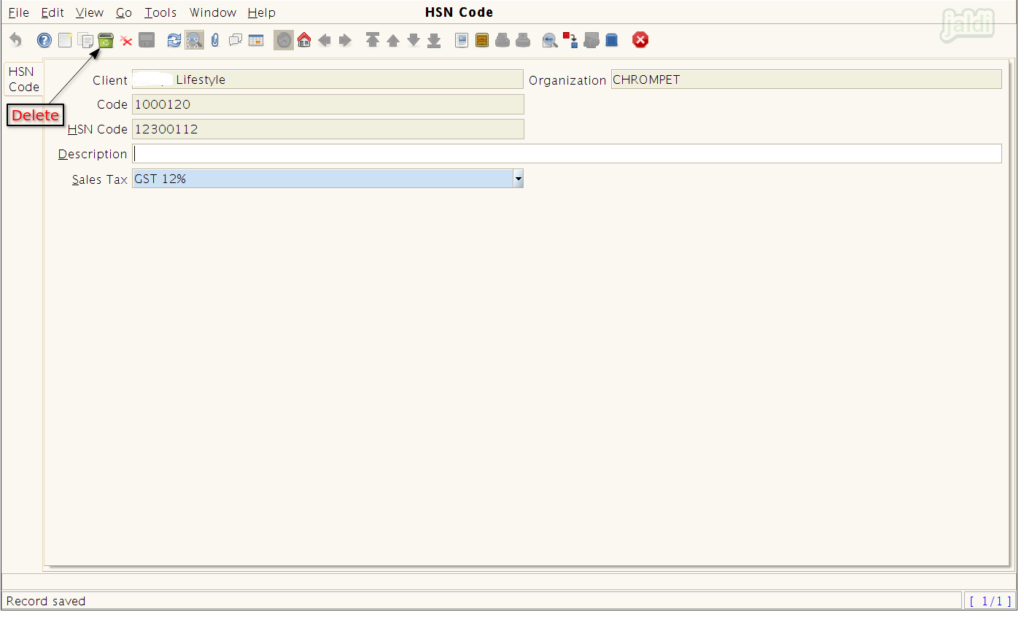

Delete HSN code

- HSN code cannot be deactivated but it can be deleted using the “delete” button which is shown in below image.

- You can also delete the HSN code from the list (press Grid Toggle) using the same “delete” button.