HSN Code Wise GST

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- E-Invoice Report for GST

Pre-Requisite Activities

- Date Invoiced

- Bill no

Business Rules

User Interface

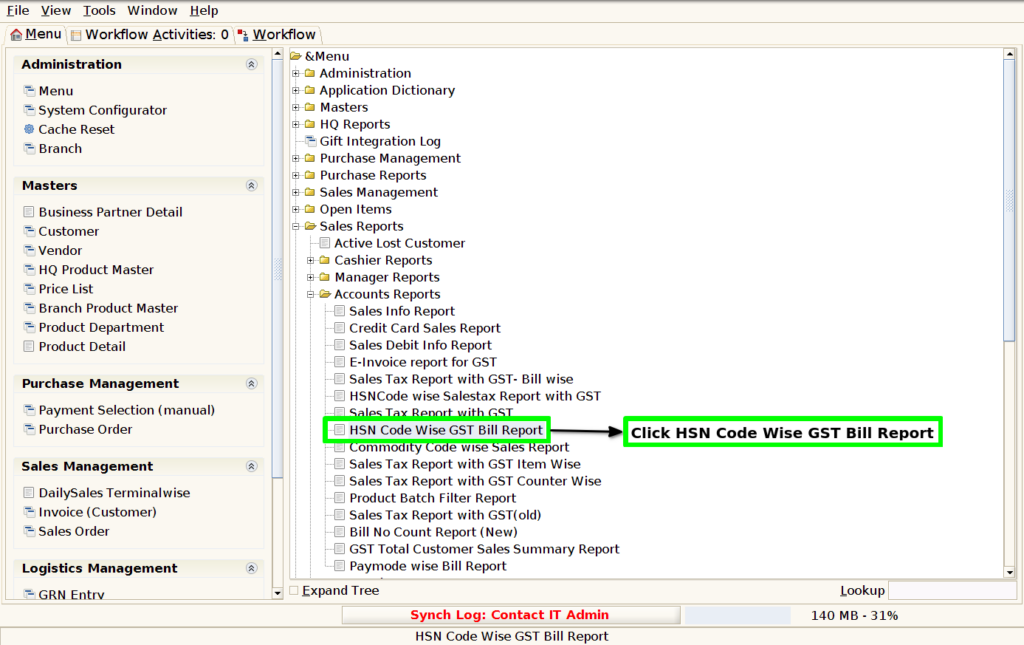

STEP 1: Click Sales Report Folder –> Accounts Report Folder –> HSN Code Wise GST Bill Report.

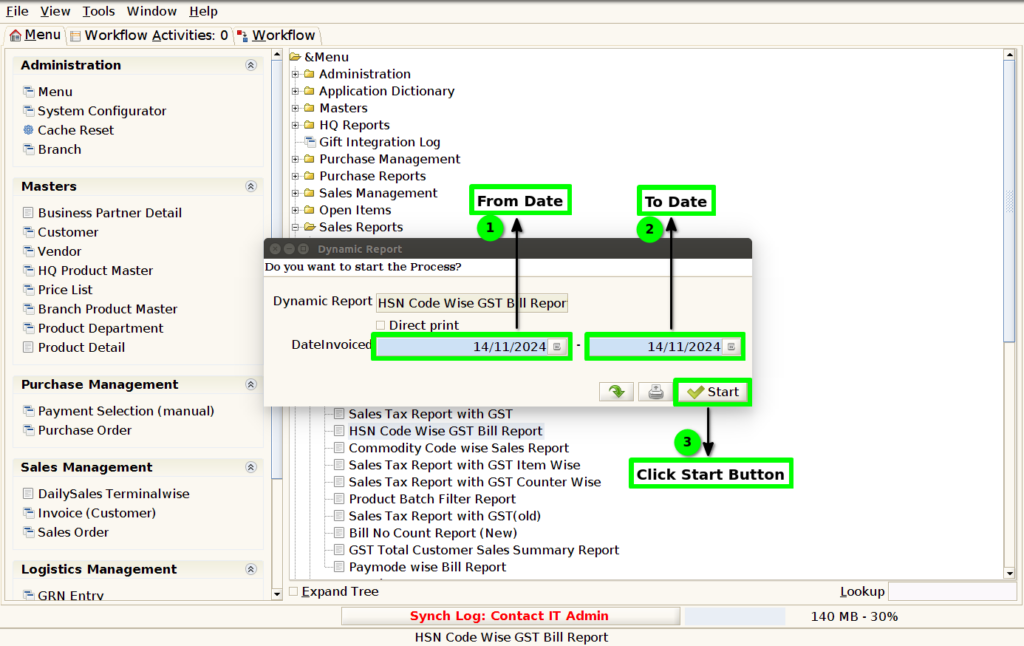

STEP 2: Choose Parameters From Date and To Date Mandatory.

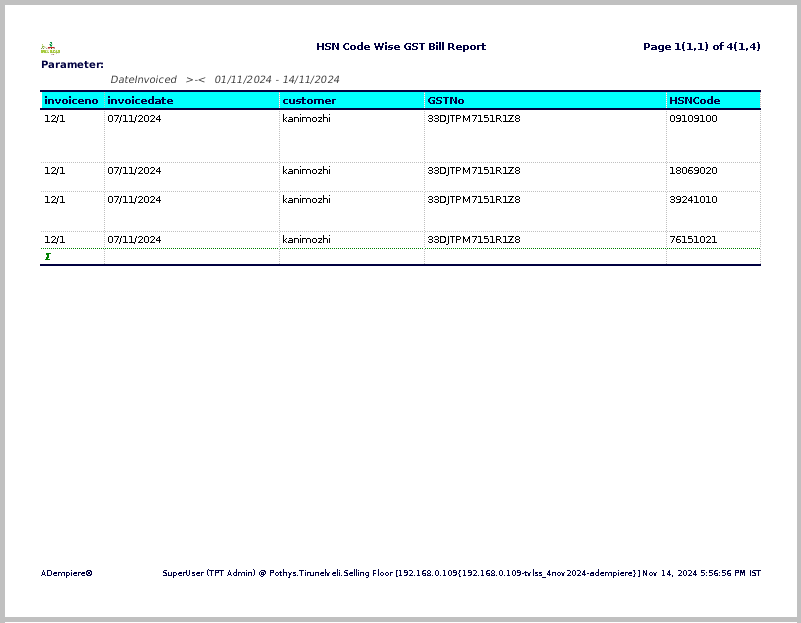

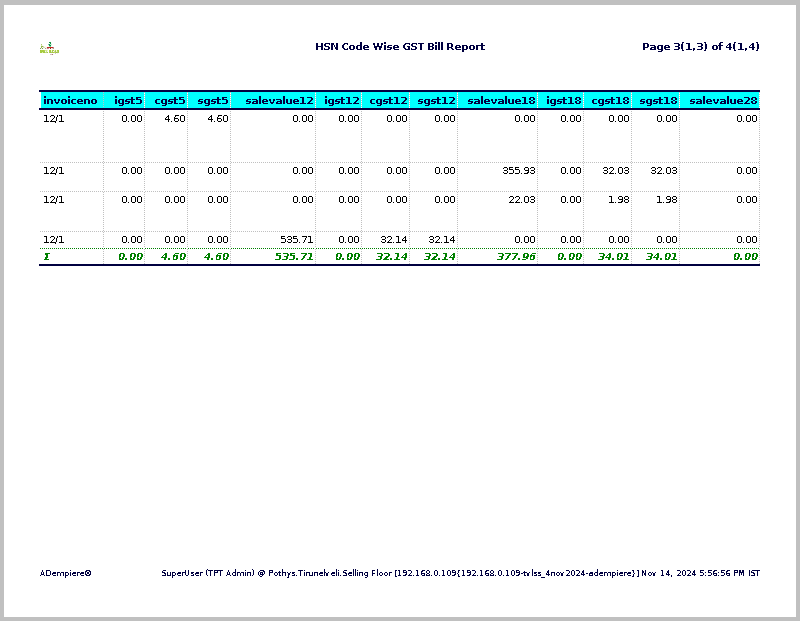

STEP3: Show Columns Details in Reports.

1.Invoice Document Number.

2.Invoice Date.

3.Customer.

4.GSTNo.

5.HSN Code.

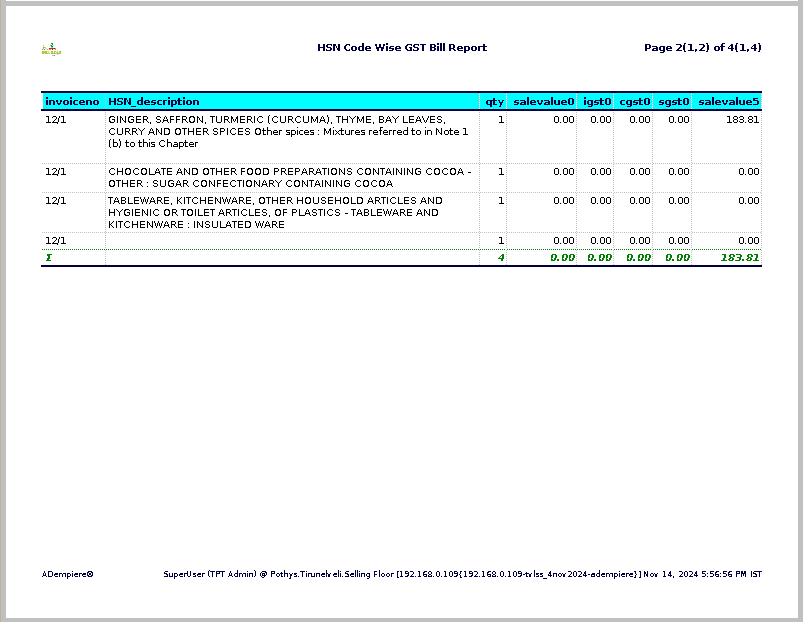

STEP4: Show Columns Details in Reports.

6.HSN Description

7.Quantity.

8.Sale Value 0.

9.IGST 0%.

10.CGST 0%.

11.SGST 0%.

12.Sale Value5.

STEP5: Show Columns Details in Reports.

13.IGST 5%.

14.CGST 5%.

15.SGST 5%.

16.Sale Value12.

17.IGST 12%.

18.CGST 12%.

19.SGST 12%.

20.Sale Value18.

21.IGST 18%.

22.CGST 18%.

23.SGST 18%.

24.Sale Value28.

STEP6: Show Columns Details in Reports.

25.IGST28.

26.CGST28.

27.SGST28.

28.CESS AMT.

30.Total Amount.

Training Videos

FAQ

SOP