ITEM-WISE SALES REPORT-(V & D)

An Itemwise Sales Report (VAT & Datewise) is a sales report that provides detailed insights into sales transactions, broken down by individual items, VAT (Value-Added Tax), and date. This type of report is commonly used in businesses that are required to track both the sales performance of items and the tax applied to each transaction, while also organizing the data by specific dates for reporting or auditing purposes.

User Access

Who Can Access

- Pothys admin

- Head cashier

- Sales Manager

- manager

What User Can Do

- View Reports

- Analyze Sales

- Export

Pre-Requisite Activities

- Date range

- Cashier

Business Rules

- Item Identification: Ensure unique identification and categorization of each item sold.

- VAT Calculation: Apply the correct VAT rate to each item based on local tax regulations.

- Datewise Organization: Sales data should be grouped and reported by date, enabling easy tracking of daily, weekly, or monthly sales.

- Consistency: Ensure consistency in VAT application, especially in cases of discounts, refunds, and promotional pricing.

- Accurate Reporting: Ensure that the total VAT collected and reported matches the total sales for the reporting period.

- Audit-Ready: Maintain transparency and an audit trail, ensuring that the data can be easily reviewed by tax authorities or auditors.

User Interface

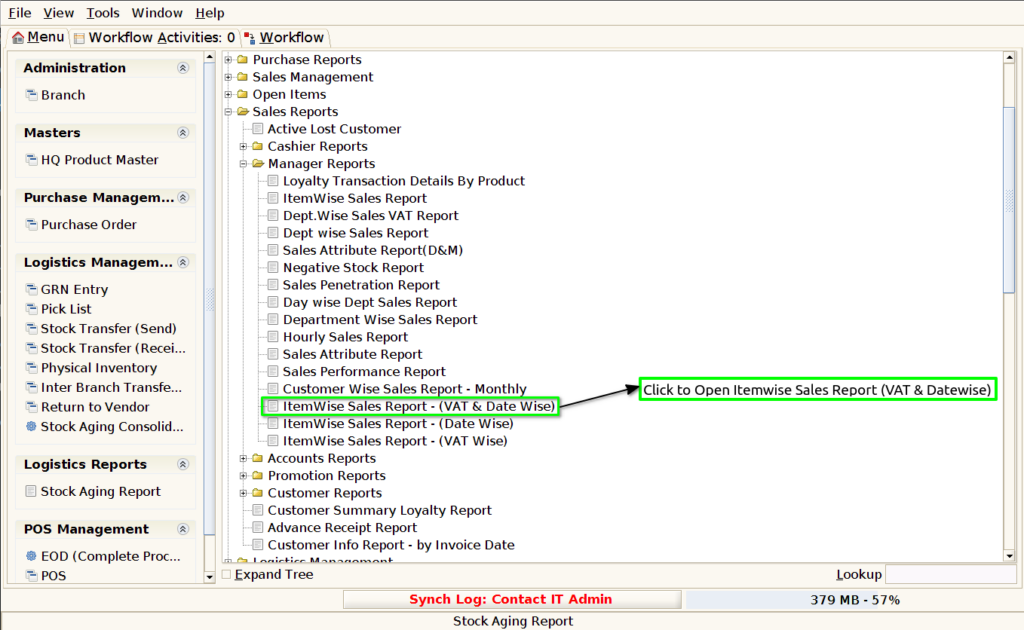

Step 1 : Select ‘Itemwise Sales Report (VAT & Datewise)’ in Menu -> Sales reports > Manager report > Itemwise Sales Report (VAT & Datewise) or Search Itemwise Sales Report (VAT & Datewise).

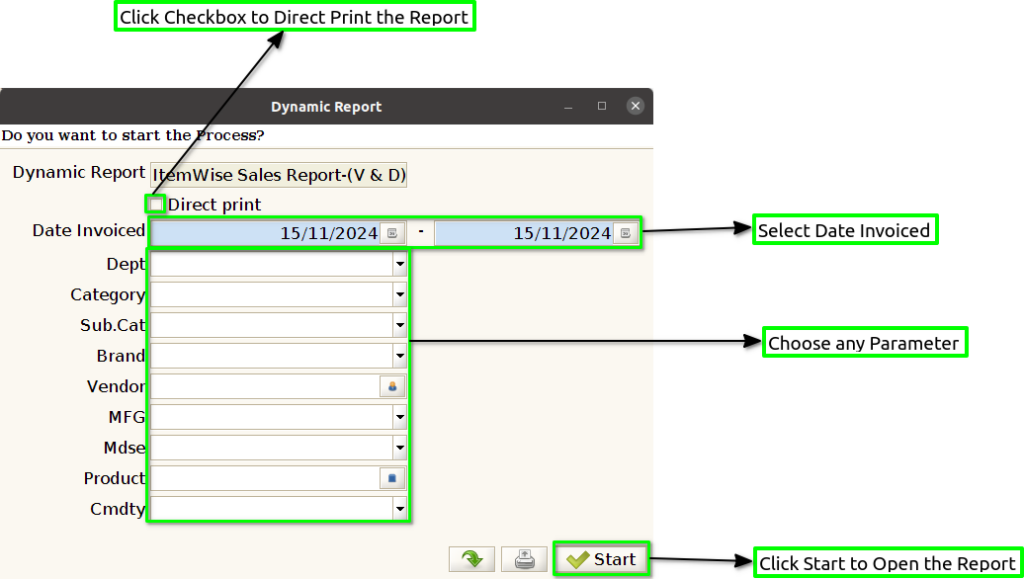

Step 2 : Select the date range and Parameter to open the Itemwise Sales Report (VAT & Datewise).

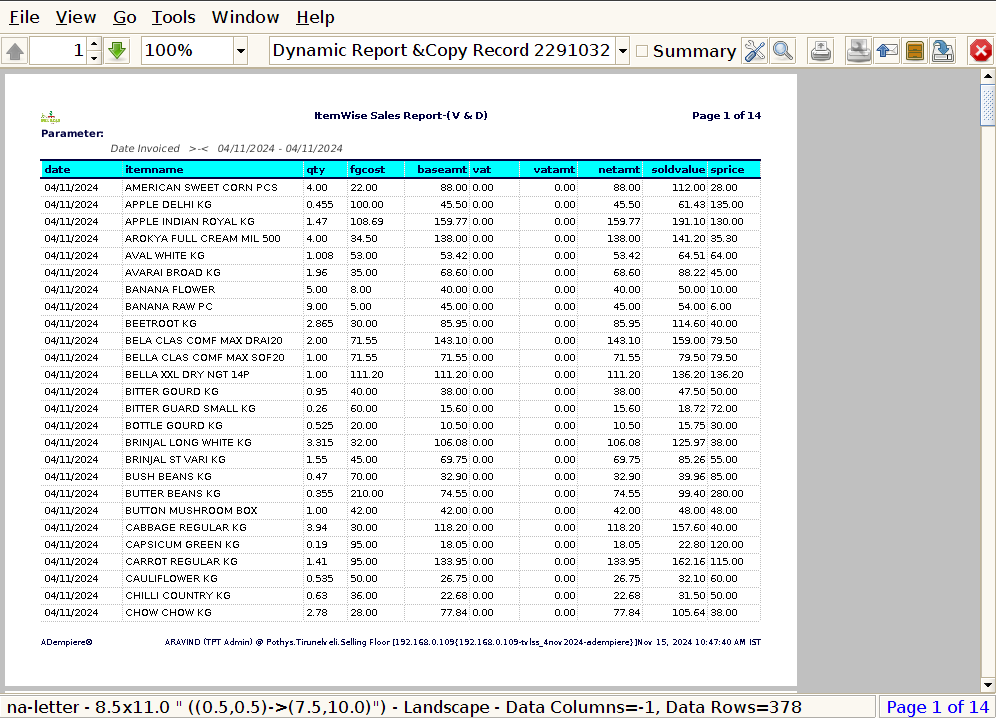

Step 3 : To view a preview of the Itemwise Sales Report (VAT & Datewise) in Jaldi.

Date : In an Itemwise Sales Report (VAT & Datewise), the date column is crucial for organizing and tracking sales transactions on specific days.

Item Name : In an Itemwise Sales Report (VAT & Datewise), the Item Name column displays the name or description of the products or services that were sold. This column is essential for identifying which specific items contributed to the total sales, along with the corresponding VAT calculation and date of sale.

Quantity : The Quantity Sold column in an Itemwise Sales Report (VAT & Datewise) is critical for understanding how many units of each item were sold, the total revenue generated, and the VAT applicable.

Final Gross Cost : The Final Gross Cost in an Itemwise Sales Report (VAT & Datewise) typically refers to the total cost of goods sold (COGS), which includes the cost price of the items sold, VAT, and any other relevant costs or adjustments.

Base Amount : The Base Cost in an Itemwise Sales Report (VAT & Datewise) refers to the cost price of an item or product without including any additional expenses like VAT or other indirect costs.

VAT : In an Itemwise Sales Report (VAT & Datewise), the VAT column shows the Value Added Tax (VAT) applied to each item sold, based on the applicable VAT rate and the sale price of the item. This column is critical for businesses to track their VAT obligations, as it indicates the total VAT charged on each sale and helps in VAT filing and tax compliance.

Net Amount : The Net Amount in an Itemwise Sales Report (VAT & Datewise) is essential for businesses to track their actual sales revenue, excluding VAT. It allows for clear distinction between net sales and tax liabilities.

Sold Value : In an Itemwise Sales Report (VAT & Datewise), the Sold Value typically refers to the total amount of revenue earned from selling the item before adding VAT (excluding taxes). It represents the total value of the goods sold for each item, based on the unit price excluding VAT and the quantity sold.

Selling Price : In an Itemwise Sales Report, the Selling Price refers to the price at which each item was sold. Depending on the reporting requirements, this price could either be the price excluding VAT (net price) or the price including VAT (gross price).