ITEM-WISE SALES REPORT-(VAT Wise)

An Item-wise Sales Report (VAT Wise) is a detailed report that breaks down sales data for each item based on different VAT rates applied to those items. This report is useful for businesses that sell products or services at varying VAT rates, and it helps in tracking and managing VAT liability for each item sold. By showing sales figures grouped by VAT rates, this report helps ensure accurate tax calculations and compliance with tax regulations.

User Access

Who Can Access

- Pothys admin

- Head cashier

- Sales Manager

- manager

What User Can Do

- View Reports

- Analyze Sales

- Export

Pre-Requisite Activities

- Date range

- Cashier

Business Rules

- Scope: The report should cover a specified period and only include finalized sales.

- VAT Rate Classification: Sales should be grouped by VAT rate (e.g., 5%, 10%, 18%) and VAT amounts should be calculated accurately.

- Item Details: Item name, SKU, quantity sold, selling price, VAT rate, VAT amount, and total sales (excl. and incl. VAT) should be displayed for each item.

- Sales Data: The report should exclude canceled, refunded, or returned sales, unless marked as negative values.

- VAT Calculations: VAT should be calculated and displayed both for each item and for overall totals (excl. and incl. VAT).

- Returns and Refunds: Sales returns or refunds should be shown as negative values, reducing VAT and total sales.

- Discounts: Discounts should be applied before VAT calculation, and the discounted price should be used to compute VAT.

- Tax Compliance: The report must comply with local VAT laws, showing VAT rates and amounts correctly.

- Export Options: The report should allow exporting to multiple formats for analysis and sharing.

- User Access: Access to the report should be restricted to authorized personnel with appropriate permissions.

- Historical Data: The report should allow for comparisons across different periods and display trends in VAT sales.

User Interface

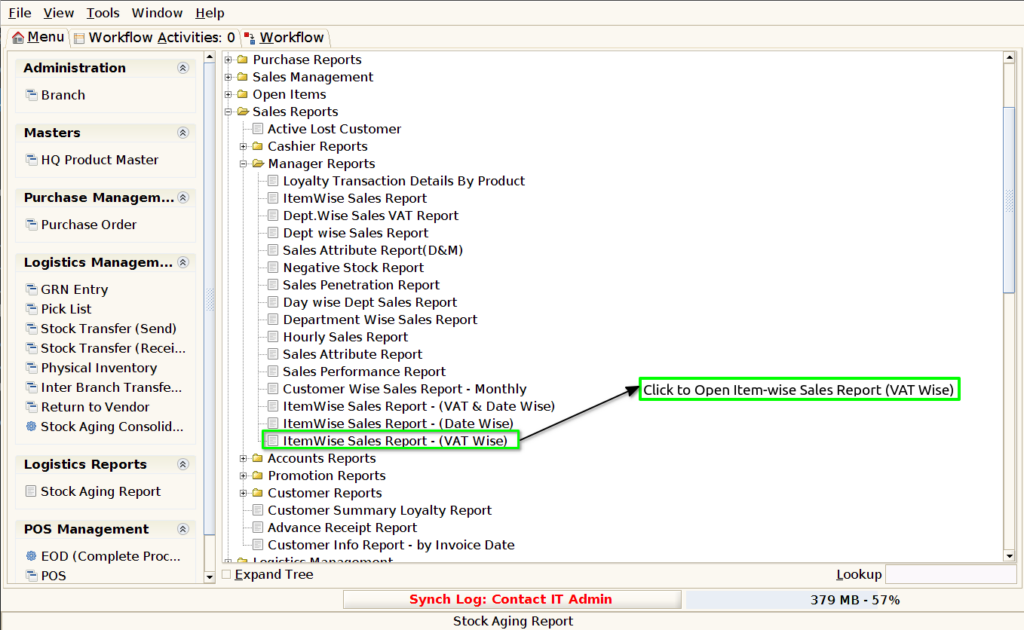

Step 1 : Select ‘Item-wise Sales Report (VAT Wise)’ in Menu -> Sales reports > Manager report > Item-wise Sales Report (VAT Wise) or Search Item-wise Sales Report (VAT Wise).

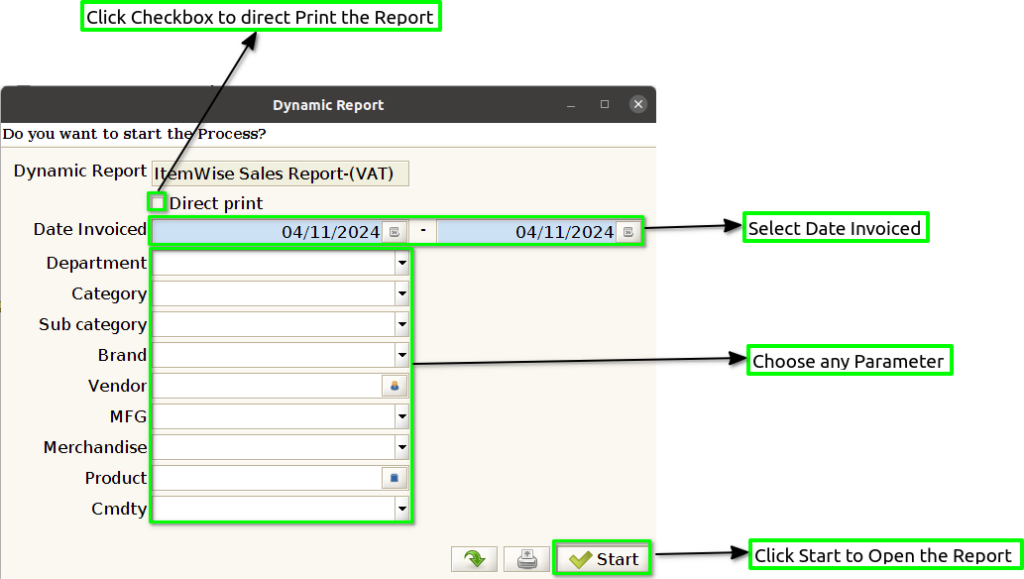

Step 2 : Select the date range and Parameter to open the Item-wise Sales Report (VAT Wise).

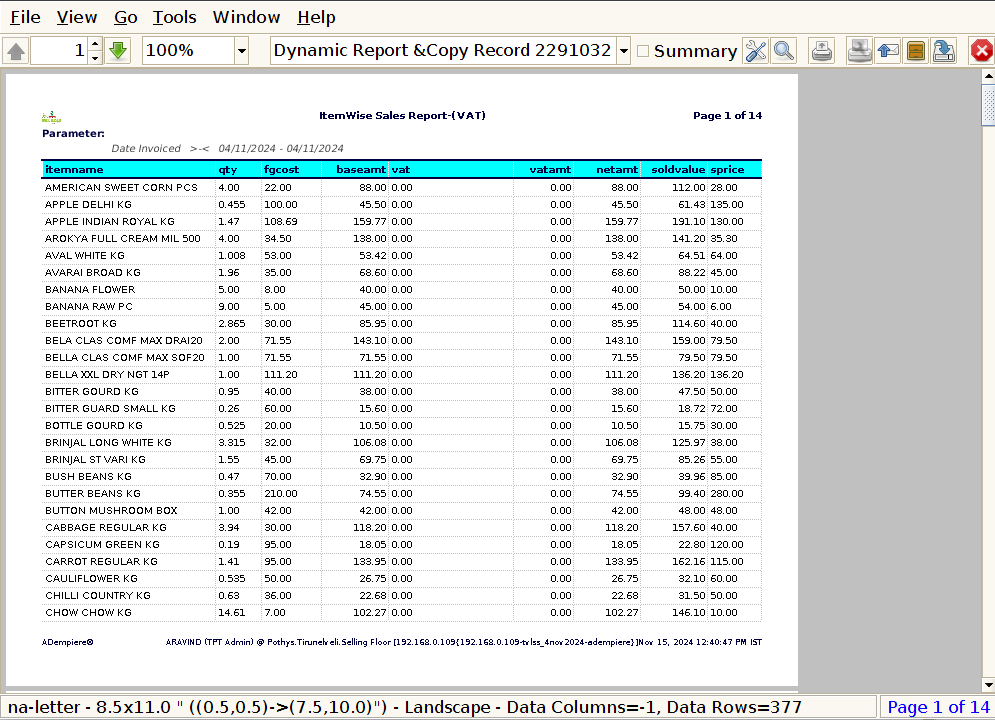

Step 3 : To view a preview of the Itemwise Sales Report (VAT Wise) in Jaldi.

Date : In an Item-wise Sales Report (VAT Wise), the date column is crucial for organizing and tracking sales transactions on specific days.

Item Name : In an Item-wise Sales Report (VAT Wise), the Item Name column displays the name or description of the products or services that were sold. This column is essential for identifying which specific items contributed to the total sales, along with the corresponding VAT calculation and date of sale.

Quantity : The Quantity Sold column in an Item-wise Sales Report (VAT Wise) is critical for understanding how many units of each item were sold, the total revenue generated, and the VAT applicable.

Final Gross Cost : The Final Gross Cost in an Item-wise Sales Report (VAT Wise) typically refers to the total cost of goods sold (COGS), which includes the cost price of the items sold, VAT, and any other relevant costs or adjustments.

Base Amount : The Base Cost in an Item-wise Sales Report (VAT Wise) refers to the cost price of an item or product without including any additional expenses like VAT or other indirect costs.

VAT : In an Item-wise Sales Report (VAT Wise), the VAT column shows the Value Added Tax (VAT) applied to each item sold, based on the applicable VAT rate and the sale price of the item. This column is critical for businesses to track their VAT obligations, as it indicates the total VAT charged on each sale and helps in VAT filing and tax compliance.

Net Amount : The Net Amount in an Item-wise Sales Report (VAT Wise) is essential for businesses to track their actual sales revenue, excluding VAT. It allows for clear distinction between net sales and tax liabilities.

Sold Value : In an Item-wise Sales Report (VAT Wise), the Sold Value typically refers to the total amount of revenue earned from selling the item before adding VAT (excluding taxes). It represents the total value of the goods sold for each item, based on the unit price excluding VAT and the quantity sold.

Selling Price : In an Item-wise Sales Report (VAT Wise), the Selling Price refers to the price at which each item was sold. Depending on the reporting requirements, this price could either be the price excluding VAT (net price) or the price including VAT (gross price).