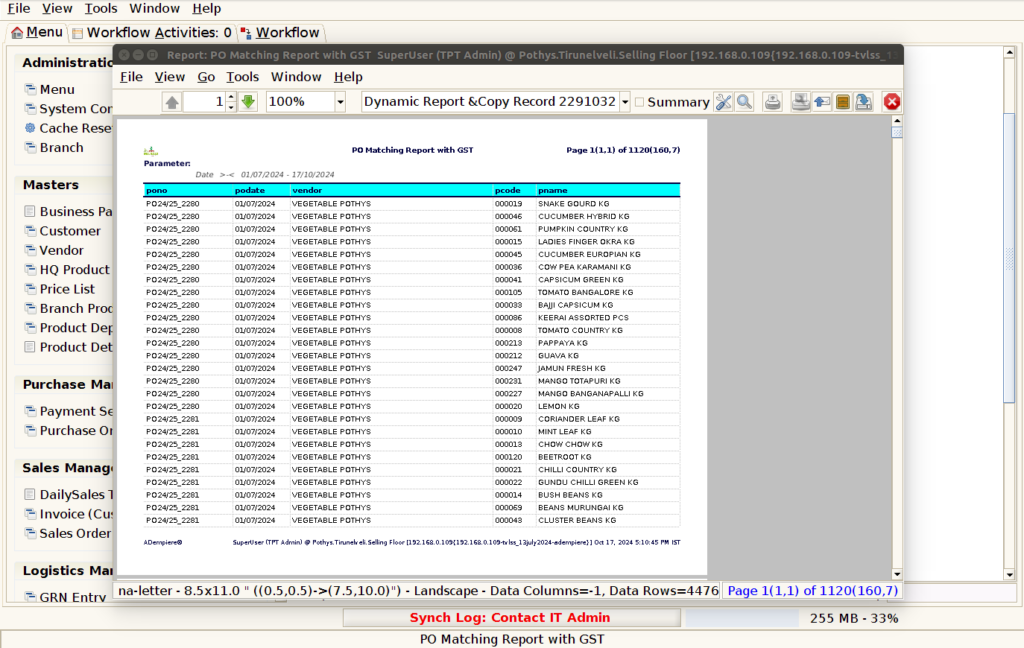

PO Matching Report with GST

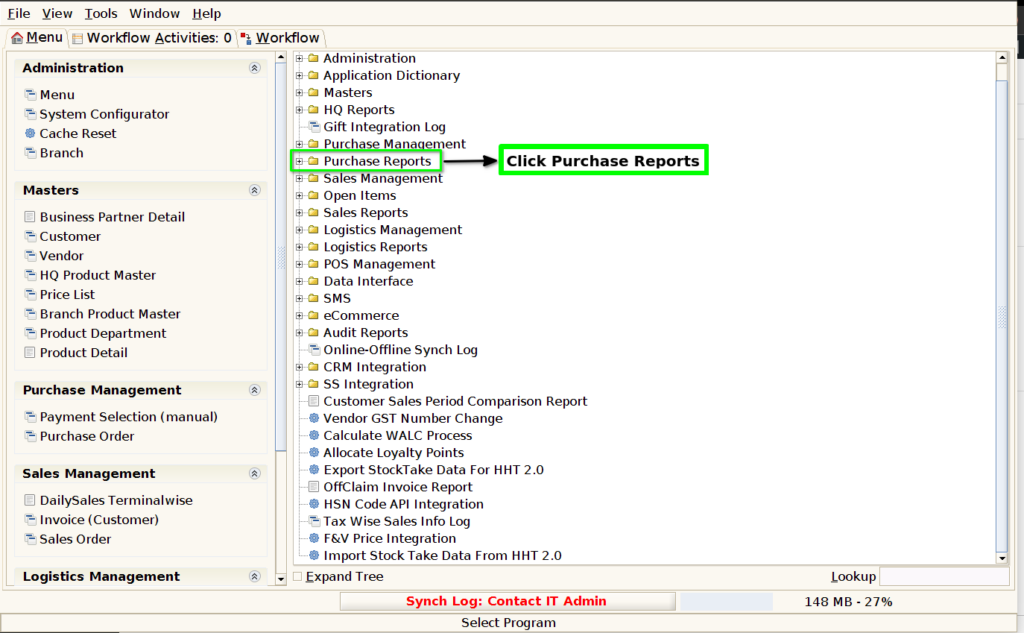

STEP1: Click Purchase Reports Folder.

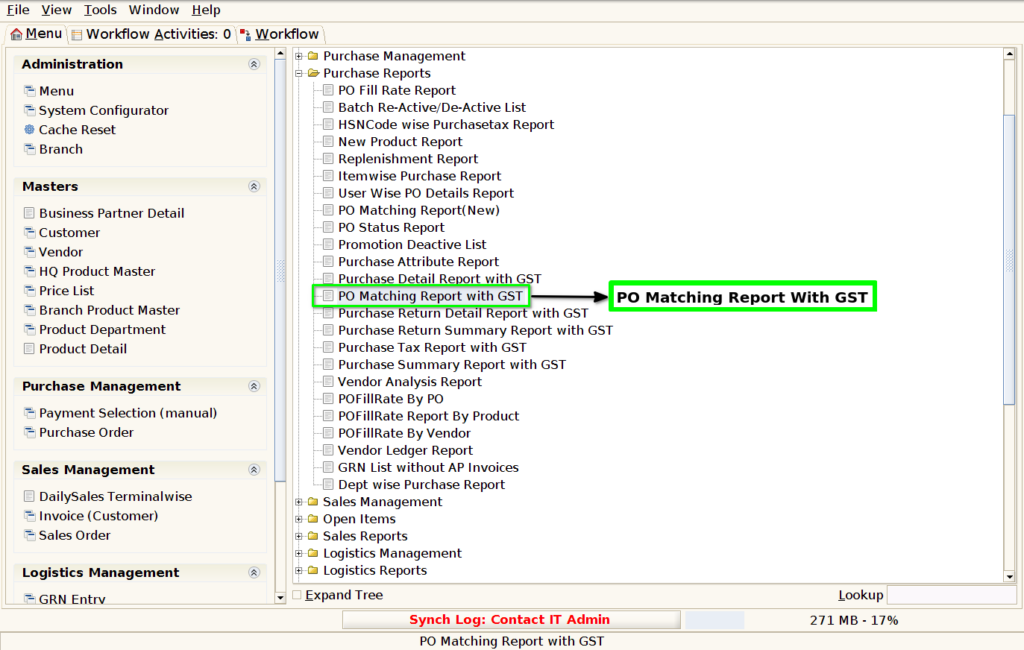

STEP2: Click PO Matching Report With GST.

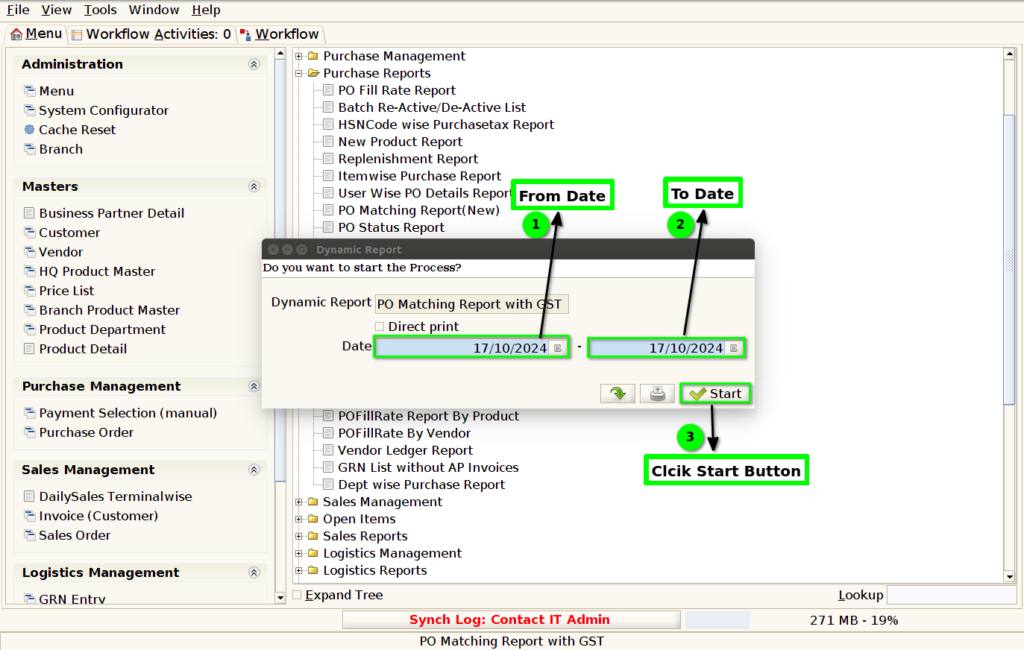

STEP3: Choose Parameter From Date, To Date .

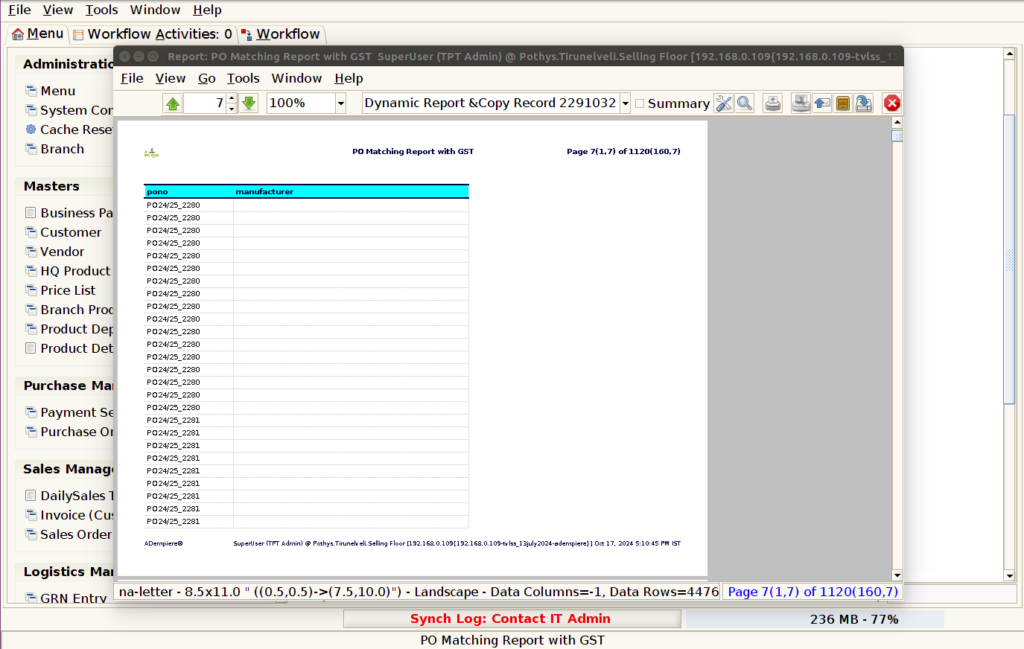

STEP4: Show Columns Details.

1.Purchase Order Number.

2.Purchase Order Date.

3.Venodr Name.

4.Product Code.

5.Product Name.

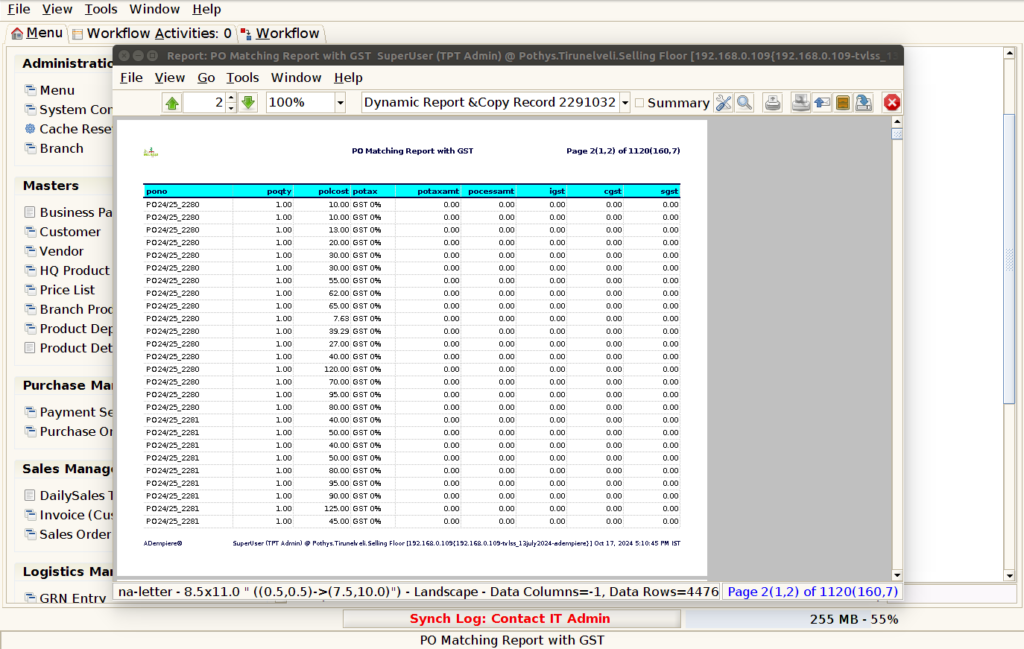

STEP5: Click Page Down Button Show Columns Details.

6.Purchase Order Quantity.

7.Purchase Order Land Cost.

8.Purchase Order Tax.

9.Purchase Order Tax Amount.

10.Process Amount.

11.IGST Tax.

12.CGST Tax.

13.SGST Tax.

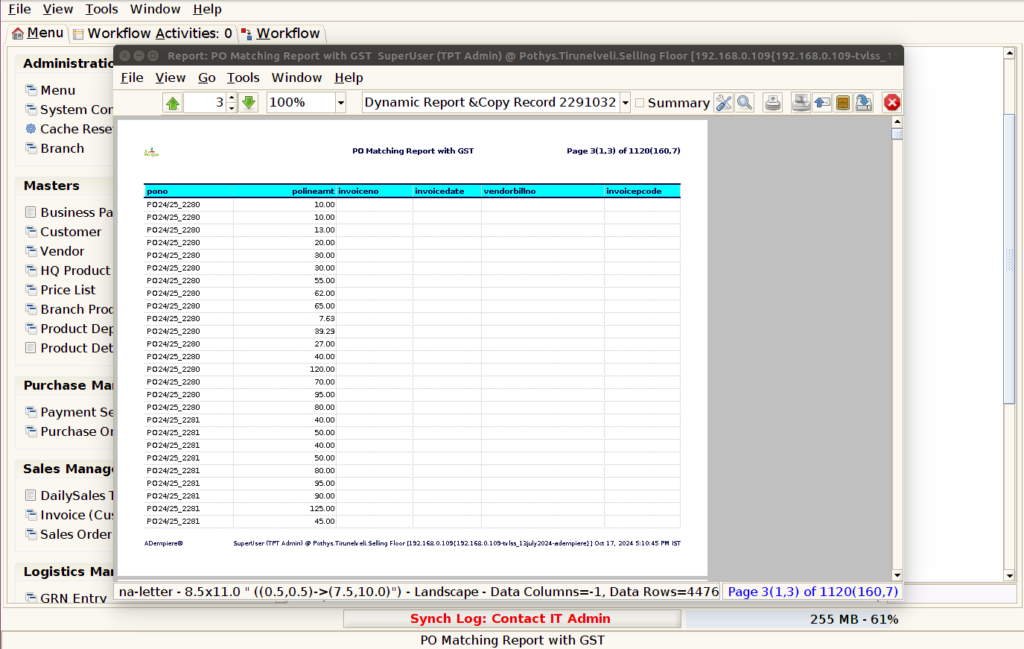

STEP5: Click Page Down Button Show Columns Details.

14.Purchase Order Line Amount.

15.Invoice Number.

16.Venodr Bill Number.

17.Invoice Product Code.

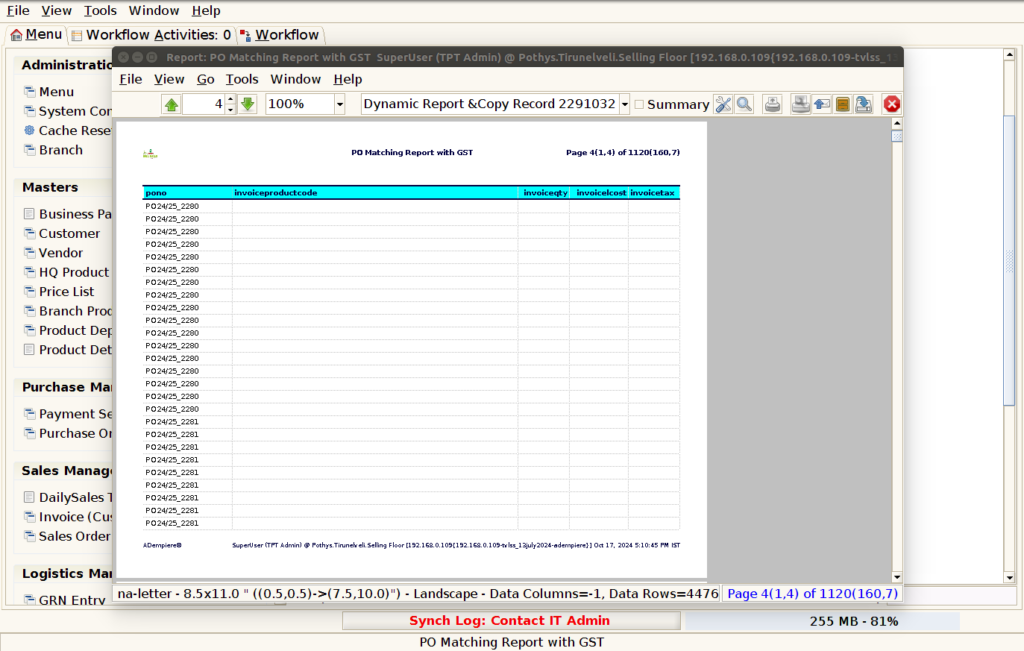

STEP6: Click Page Down Button Show Columns Details.

18.Invoice Product Code.

19.Invoice Quantity.

20.Invoice Land Cost

21.Invoice Tax.

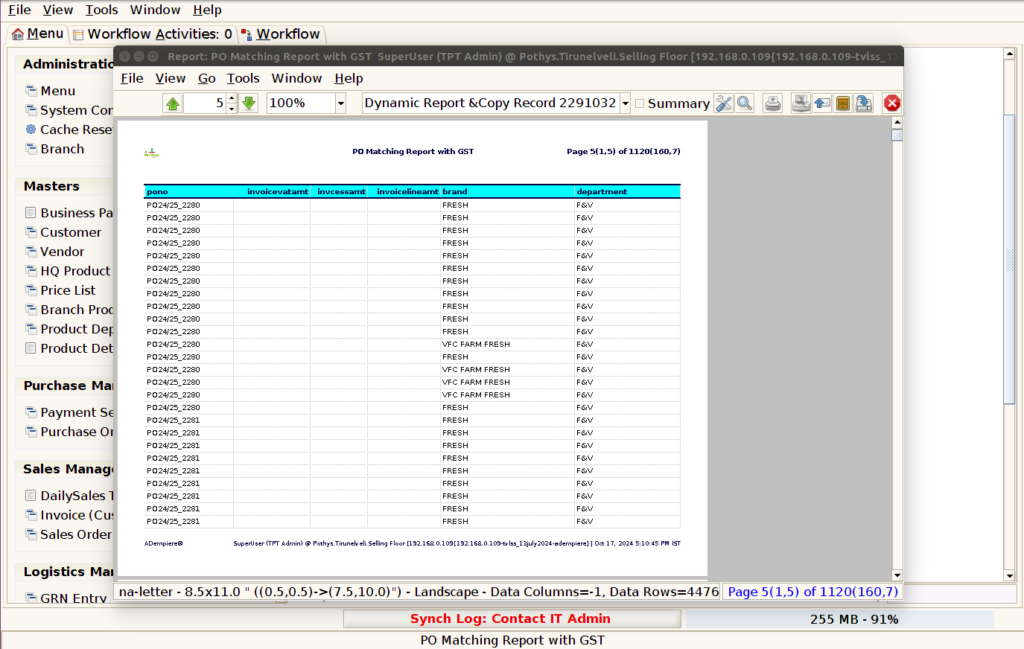

STEP7: Click Page Down Button Show Columns Details.

22.Invoice VAT Amount.

23.Invoice Cess Amount.

24.Invoice Line Amount.

25.Brand.

26.Department

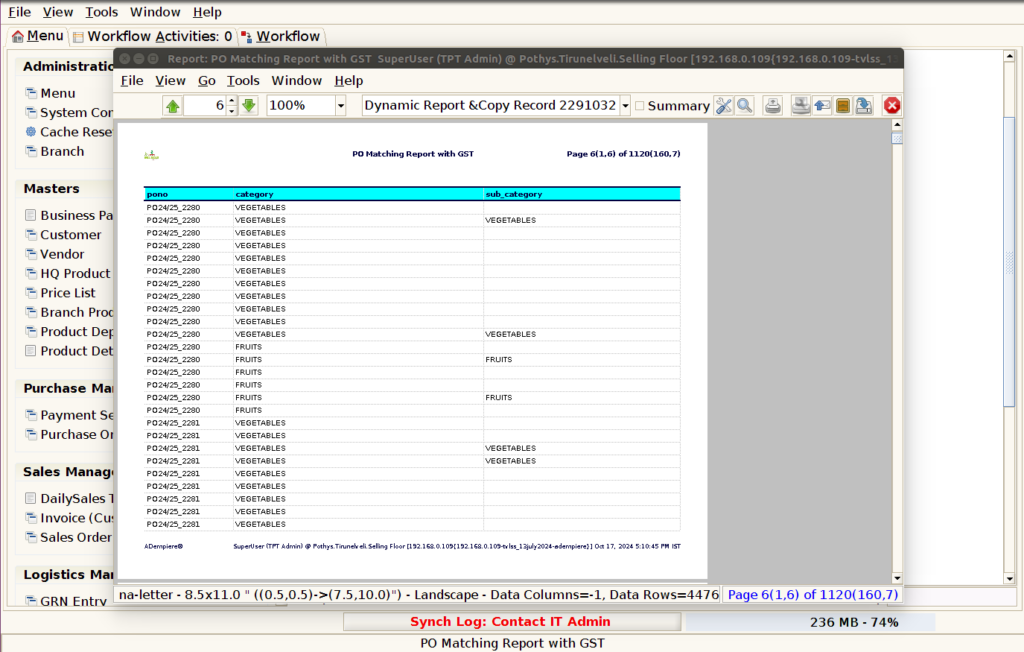

STEP8: Click Page Down Button Show Columns Details.

27.Category.

28.Sub Category.

STEP9: Click Page Down Button Show Columns Details.

29.Manufacturer.