Product tax mapping in Jaldi Superstore POS

Product tax mapping is the feature screen which is used for user to change or update the existing tax value with new updated tax value for bulk products.

Using this product tax mapping screen, user can change following inventory types,

- HSN Code

- Purchase Tax

- Sales Tax

Lets imagine the scenario where you need to change the “sales tax” from GST 18% to GST 12% for all the “Soup” Category products which is supplied by the vendor “3N Health Foods Private Limited”. Follow the below steps to change the sales tax based on the scenario,

How to change Products tax in bulk ?

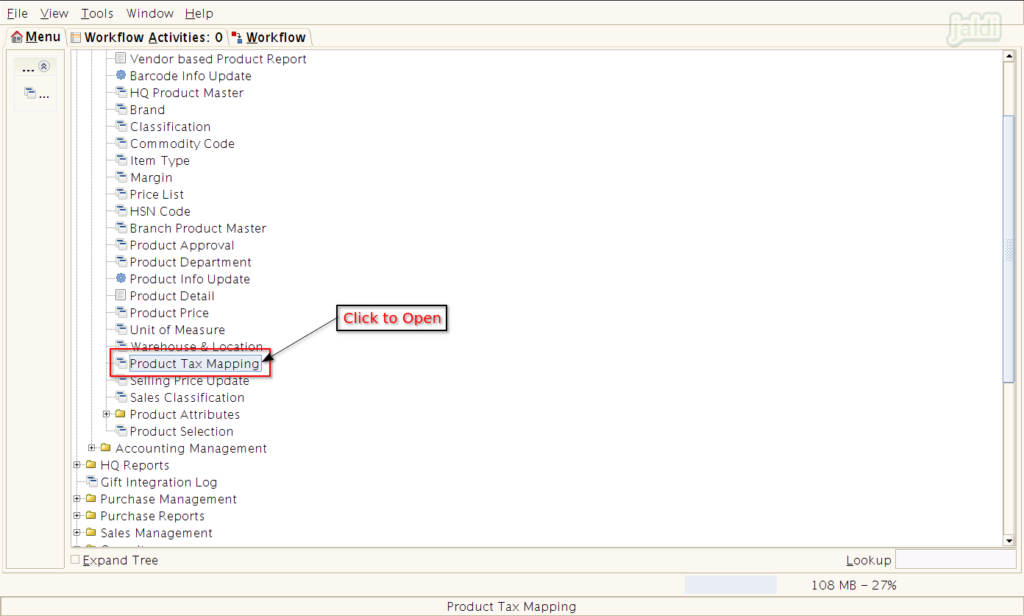

- Go to application path, Masters > Product Management > Product Tax Mapping.

- Double click on “Product Tax Mapping” to open.

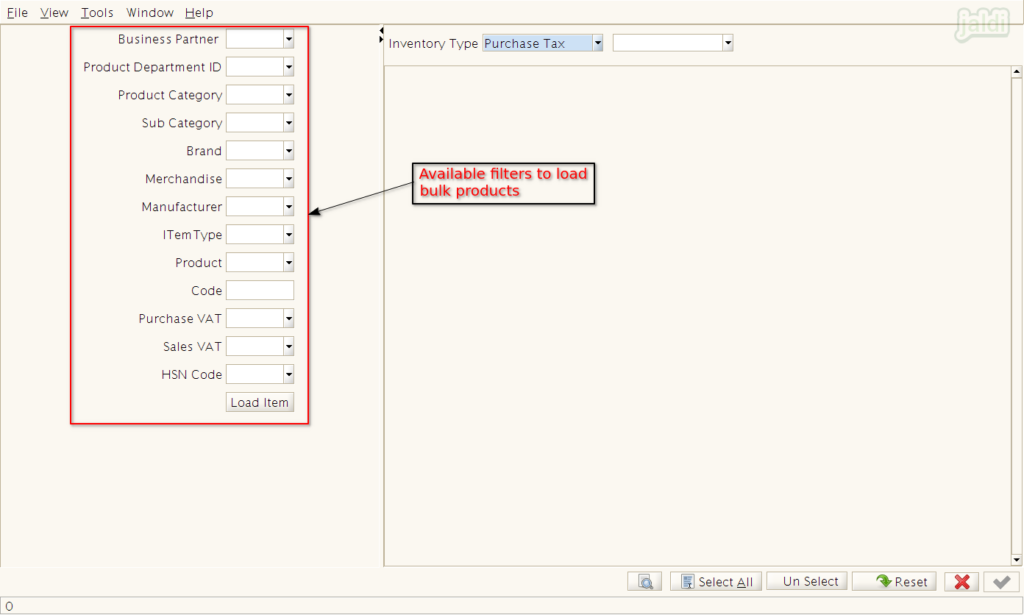

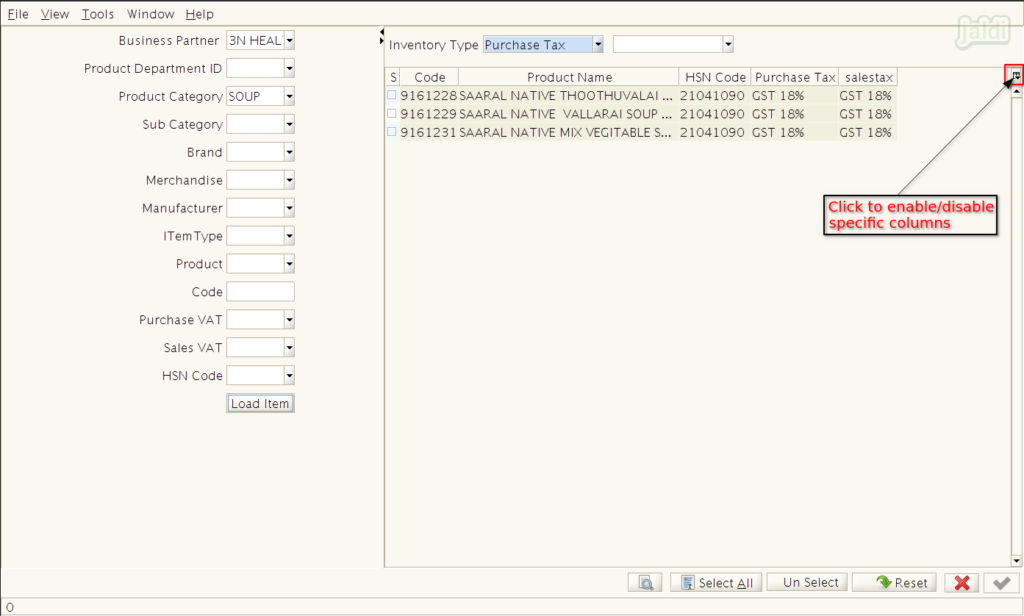

- There should be the multiple available filters to load required products in bulk like marked in below image.

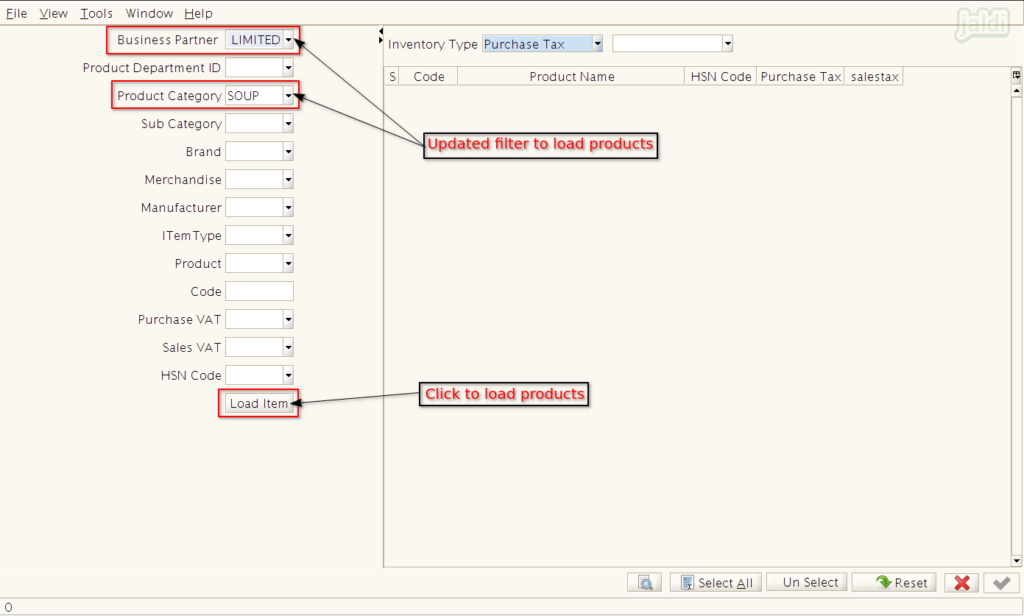

- Select the filter value in respective filter type like shown in below image.

- Then there should be the function key called “Load Item”. Click on that to load filtered products.

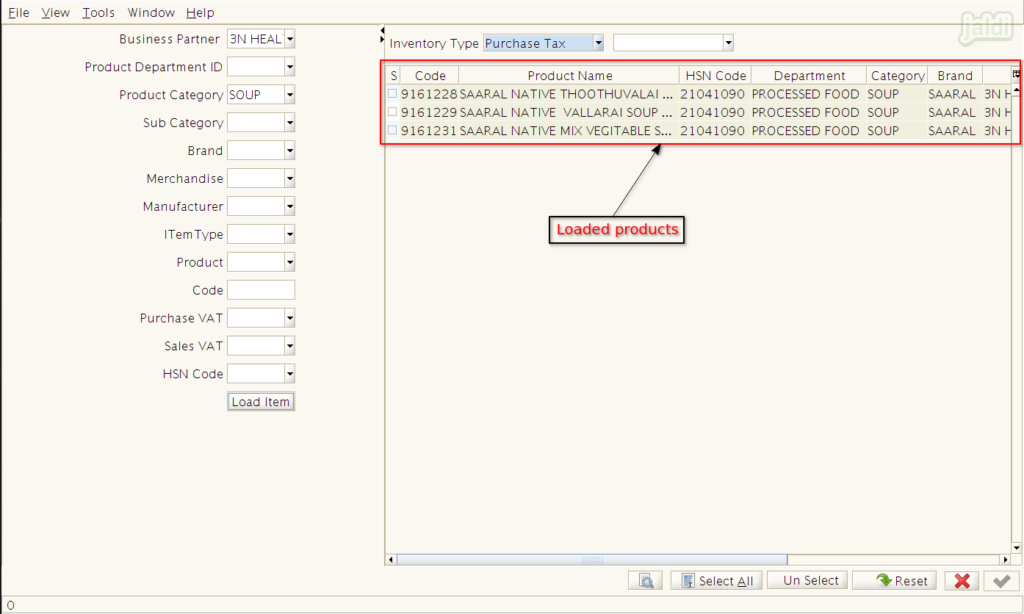

- Then system will load the products which is matched with filters like below shown image.

- There is a option for layout setting marked in below image.

- Click on marked image then enable and disable required columns.

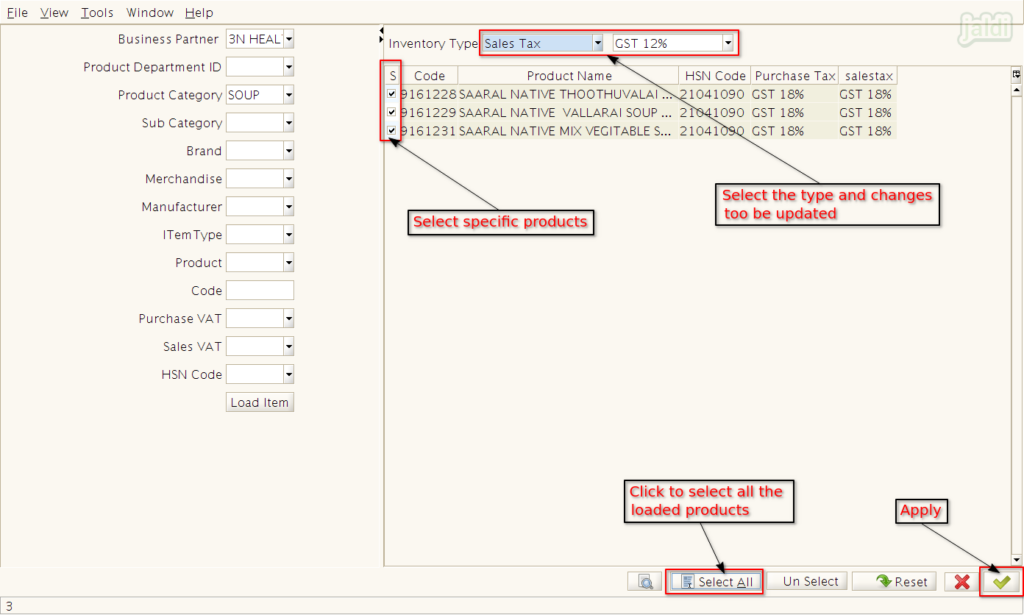

- Select the specific products one by one or press “Select All” function key to select all the products.

- In inventory type field, select the type you want to change and in next field select the new value to be updated in existing value

- Then Press “green tick” symbol to update new value over existing value.

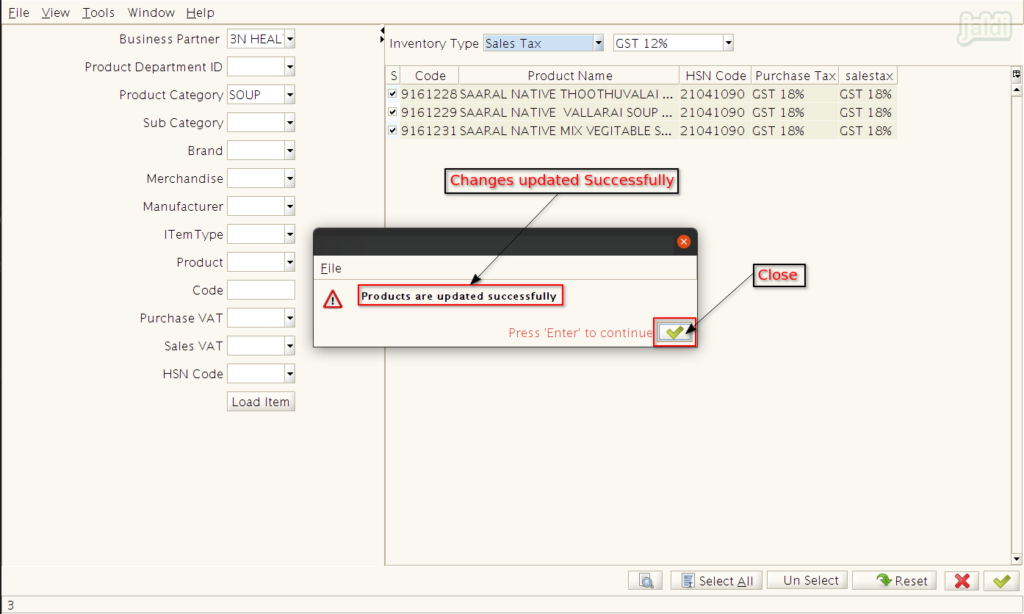

- Once the process is completed, system will show the below shown notification message.

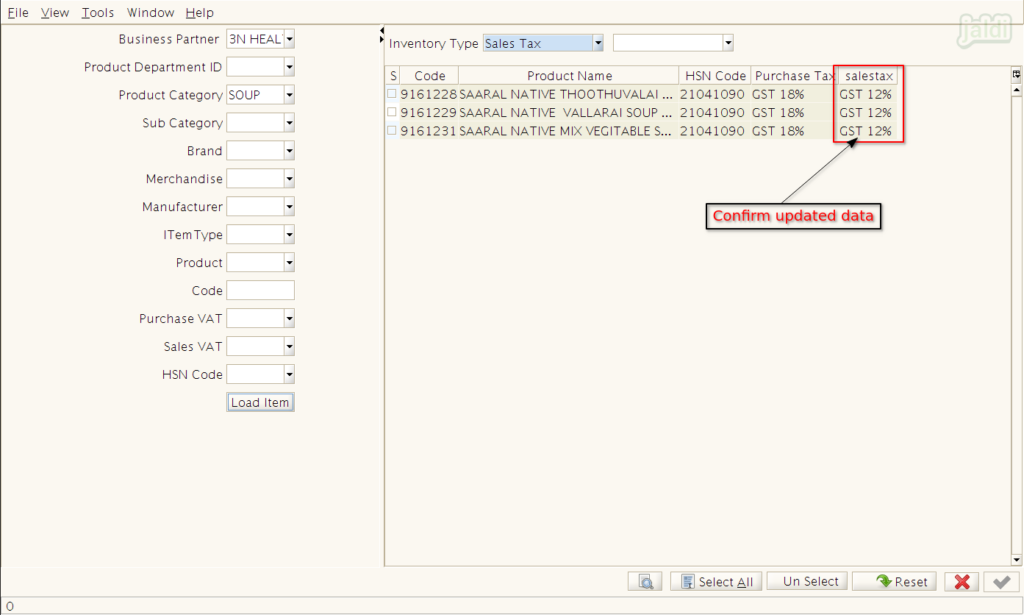

- Then load the same products and check and confirm the updated values like below shown image.

- Using the same above process, user can change HSN code and Purchase tax details also for bulk products.