Purchase Details Report With GST

The Purchase Details Report with GST is a comprehensive report that provides detailed information about the purchases made by a business, including the Goods and Services Tax (GST) associated with each purchase. This report is essential for tracking purchases, managing tax liabilities, and maintaining accurate records for GST compliance.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Purchase Summary Report With GST.

Pre-Requisite Activities

- From Date

- To Date

- Vendor

- Warehouse

Business Rules

- The business rules of the Purchase Details Report with GST are focused on ensuring accurate tracking of purchases and tax details, proper GST compliance, and efficient management of tax credits and returns.

- By following these rules, businesses can maintain transparent and reliable purchase records that support both financial reporting and GST compliance.

- This report plays a critical role in managing Input Tax Credit (ITC) claims, facilitating GST returns, and ensuring that purchases and taxes are properly accounted for.

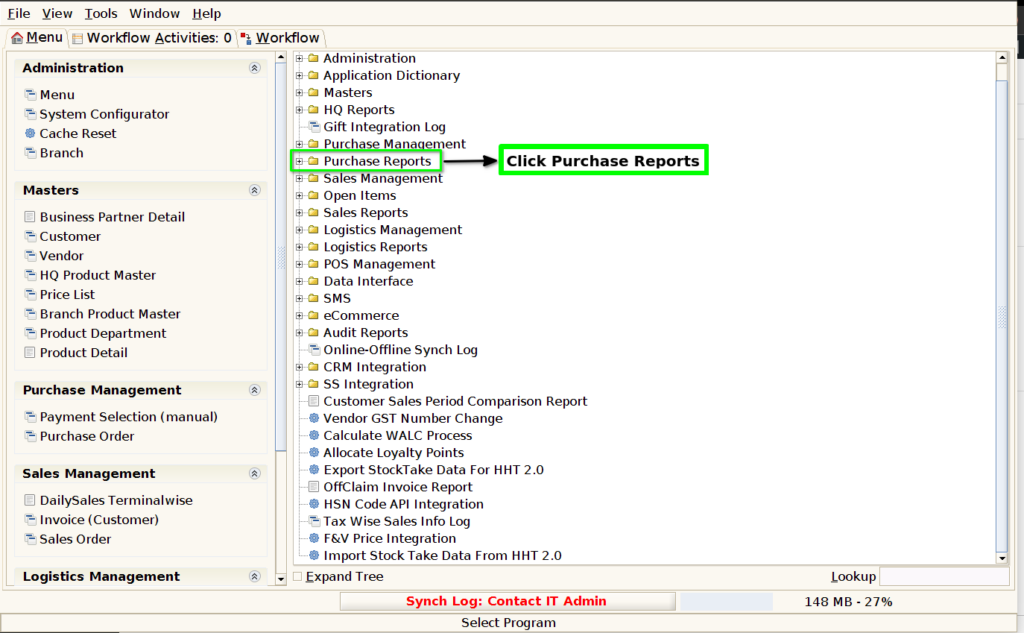

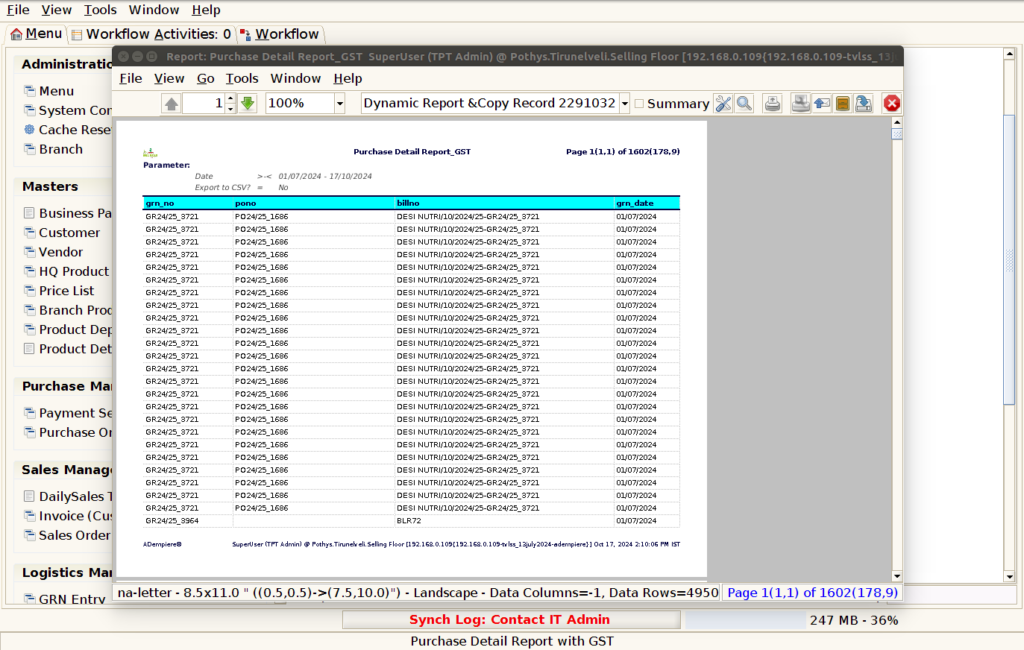

STEP1: Click Purchase Reports Folder.

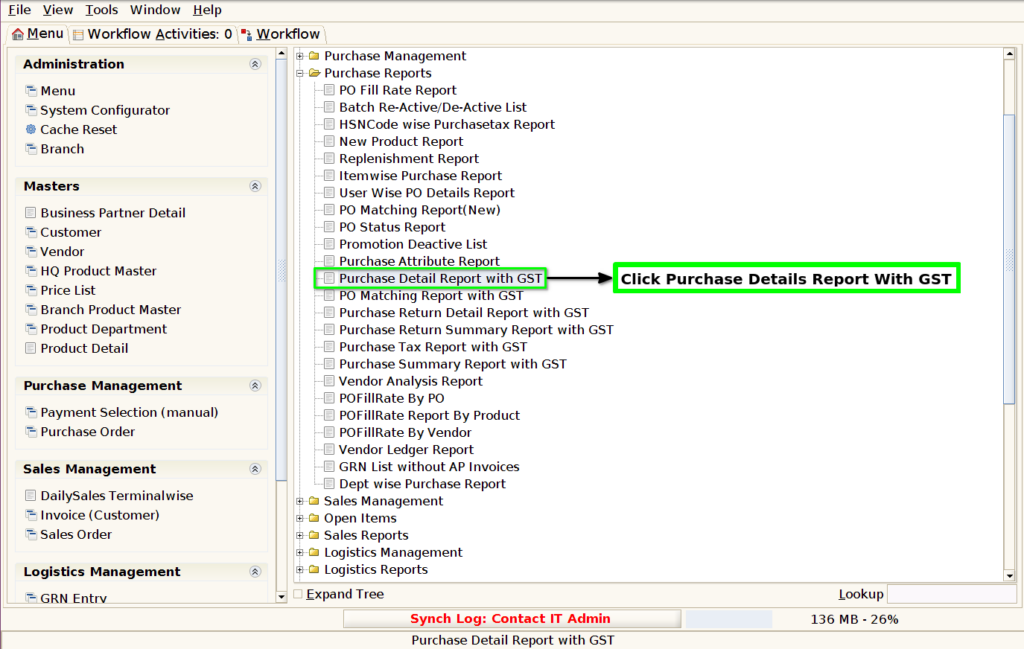

STEP2: Click Purchase Details Report with GST.

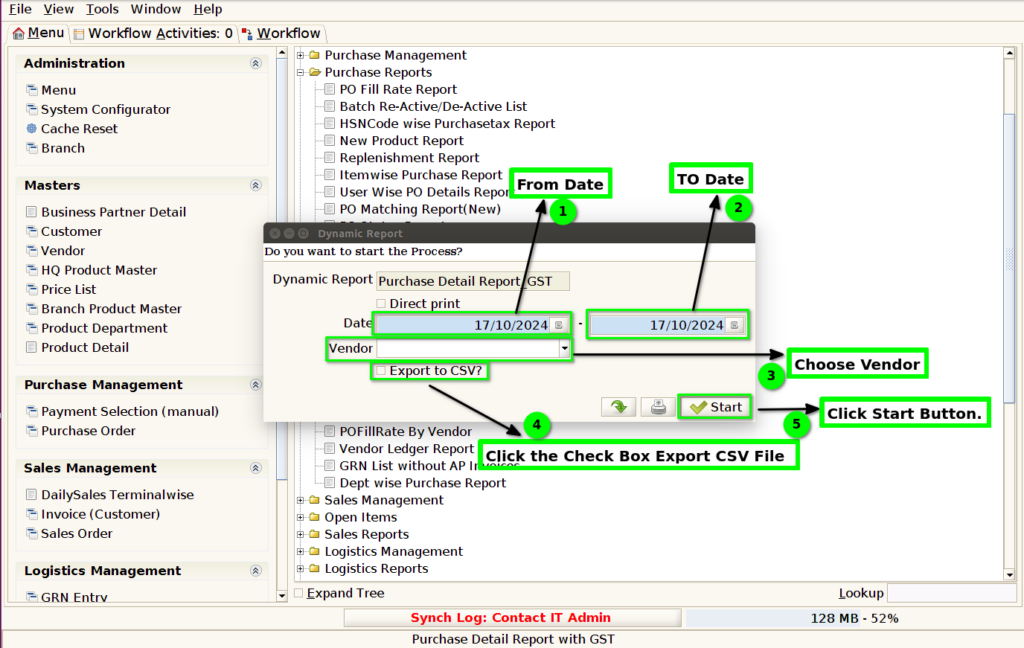

STEP3: Choose Parameter From Date, To Date and Vendor Name.

STEP4: Show Columns Details.

1.GRN Document Number : The GST Document Number in the Purchase Details Report with GST is included to ensure that each purchase transaction is properly documented and linked to a unique GST invoice.

2.Purchase Order Number : The Purchase Order Number in the Purchase Details Report with GST is included for several important reasons related to tracking, verifying, and managing the purchase transactions made by a business.

3.Bill Number : The Bill Number in the Purchase Summary Details with GST is a crucial identifier for each purchase transaction. It helps in managing, tracking, and validating purchases made by the business.

4. GRN Date : The GRN (Goods Receipt Note) Date in the Purchase Details Report with GST is included for several reasons related to inventory management, financial reconciliation, GST compliance, and tracking of goods and services.

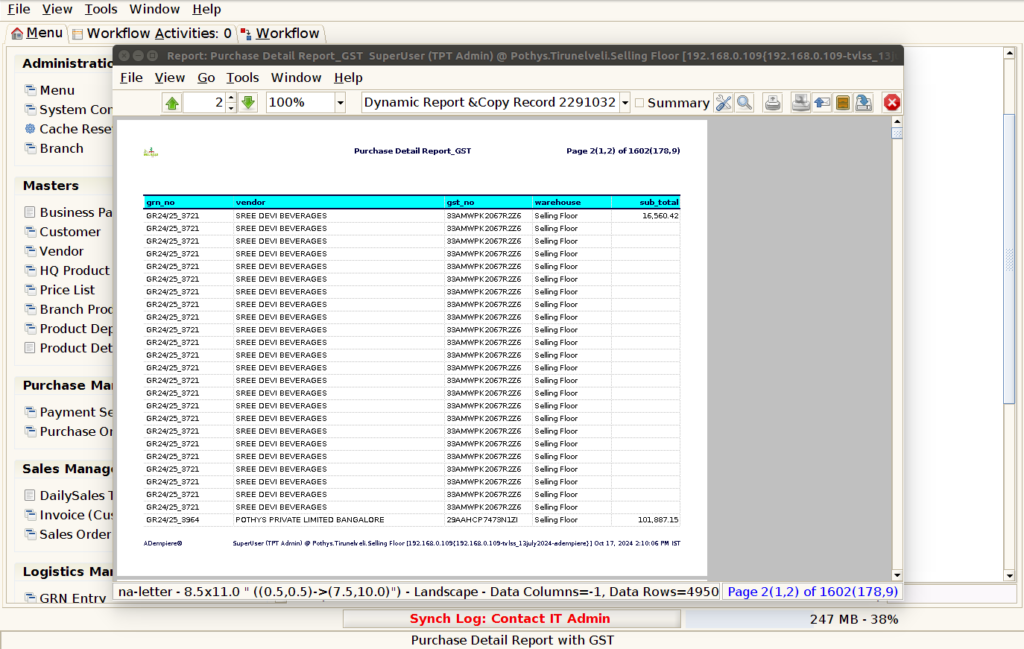

STEP5: Click Page Down Button Show Columns Details.

5.Vendor Name : The Vendor Name in the Purchase Details Report with GST is included for several key reasons related to vendor management, tracking, compliance, and financial reporting.

6.GST Number : The GST Number (Goods and Services Tax Identification Number) is shown in the Purchase Details Report with GST for several important reasons related to compliance, transparency, and accurate tax reporting.

7.Warehouse : The inclusion of Warehouse in the Purchase Details Report with GST serves several important purposes, especially for businesses that have multiple locations or warehouses where goods are stored.

8.Sub-Total : The Sub Total is shown in the Purchase Details Report with GST for several important reasons, primarily related to improving clarity, facilitating tax compliance, and helping businesses track their expenses effectively.

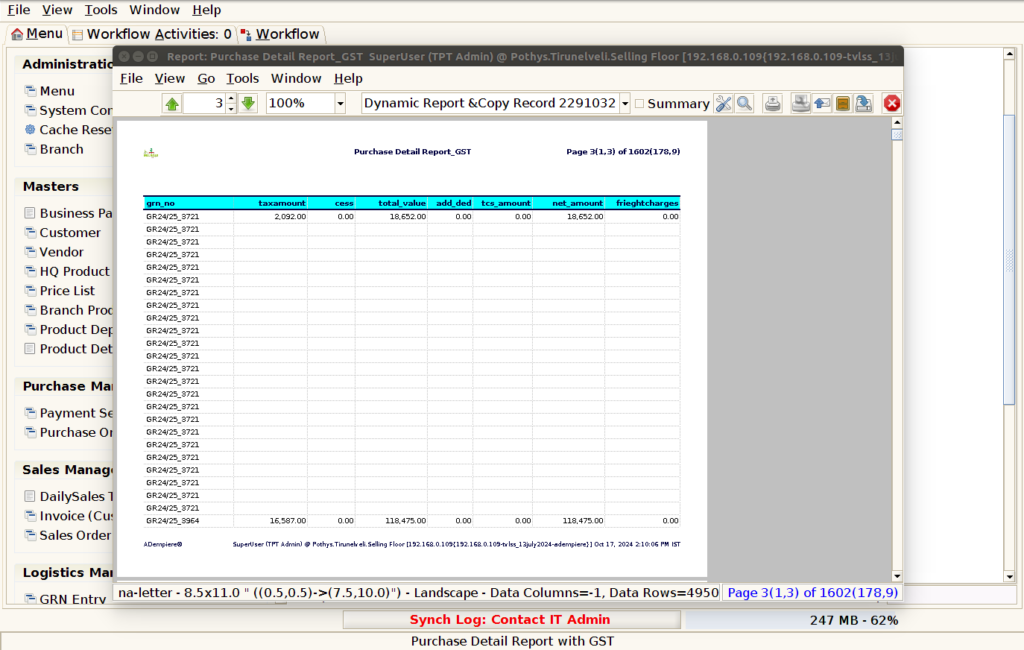

STEP6: Click Page Down Button Show Columns Details.

9.Tax Amount: The inclusion of the Tax Amount in the Purchase Details Report with GST is critical for businesses to ensure proper tracking and reporting of the taxes involved in their purchases.

10. Cess Amount: The CESS Amount is shown in the Purchase Details Report with GST because it is a mandatory part of the GST system for certain goods and services. Including CESS in the report ensures compliance with GST laws, supports Input Tax Credit (ITC) claims, and helps businesses understand their total tax burden.

11.Total Value : The Total Value in the Purchase Details Report with GST is essential for businesses to fully understand the complete cost of their purchases, including both the base price and the taxes involved.

12.Addition / Deduction Value : The Addition/Deduction Value in the Purchase Details Report with GST reflects any additional charges or deductions applied to the total purchase value.

13. TCS Amount : The TCS (Tax Collected at Source) amount in the Purchase Details Report with GST represents the tax that a seller collects from the buyer at the time of sale, as per the provisions of the Income Tax Act in India.

14.Net Cost Amount : The Net Cost Amount in the Purchase Details Report with GST reflects the actual cost of the purchase after all adjustments have been made, such as discounts, taxes, additional charges, and deductions.

15. Freight Charges : The Freight Charge is an additional cost incurred by the business to bring the purchased goods to its location. This charge is part of the total cost of acquisition, which includes the price of the goods, GST, discounts, and any other charges like freight.

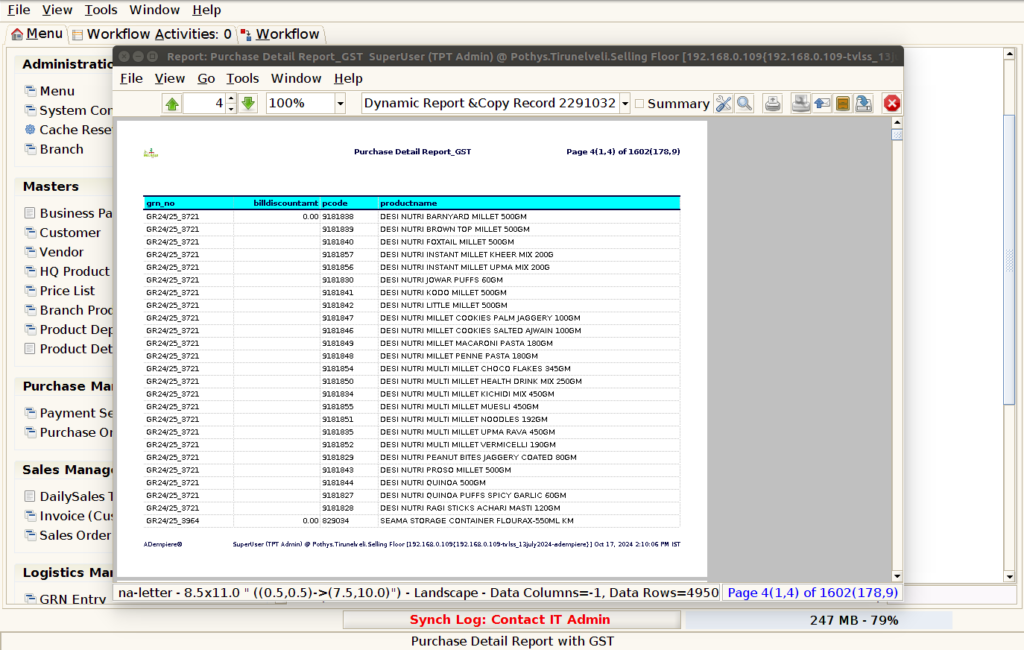

STEP7: Click Page Down Button Show Columns Details.

16.Bill Discount Amount : The Bill Discount Amount in the Purchase Details Report with GST is shown to reflect any discounts provided by the supplier on the bill or invoice amount for goods or services purchased.

17.Product Code : The Product Code is shown in the Purchase Details Report with GST for several important reasons related to tracking, inventory management, and accurate financial reporting. 18.Product Name : The Product Name is shown in the Purchase Details Report with GST for several important reasons related to the clarity, accuracy, and traceability of purchase return transactions.

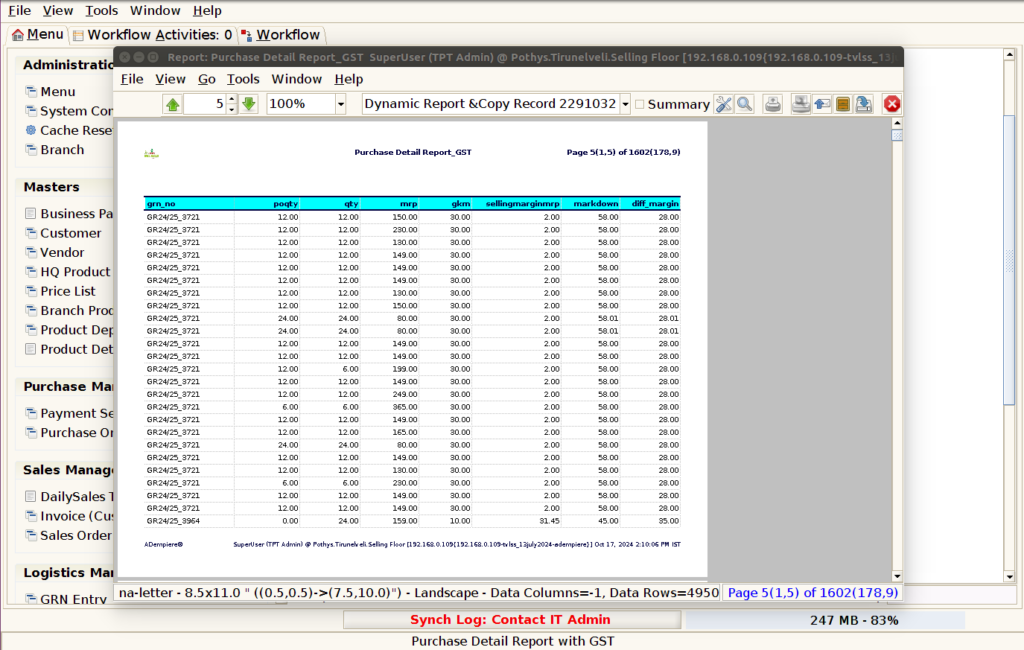

STEP8: Click Page Down Button Show Columns Details.

19.Purchase Order Quantity : By displaying the purchase order quantity alongside the goods received, businesses can verify if the quantity invoiced by the supplier matches what was ordered and delivered.

20.MRP Amount : Showing the MRP (Maximum Retail Price) in the Purchase Details Report with GST is significant for various operational, financial, and compliance-related reasons.

21.GKM Amount : Showing GKM (Gate Keeping Margin) amount in the Purchase Details Report with GST serves several practical and financial purposes, especially when it comes to understanding the actual cost of goods and making informed business decisions.

22.Selling Margin MRP : Including the Selling Margin MRP (Maximum Retail Price) in the Purchase Details Report with GST is valuable for several reasons, particularly related to pricing strategies, profitability analysis, and ensuring proper tax reporting.

23.Mark Down : Including Mark Down in the Purchase Details Report with GST is useful for businesses to track the reduction in the selling price of goods, typically after a product’s initial pricing or after promotions.

24.Diff Margin : Including the diff margin (differential margin) in the Purchase Details Report with GST provides valuable insights into how various costs, including those affected by GST, impact the profitability of the business.

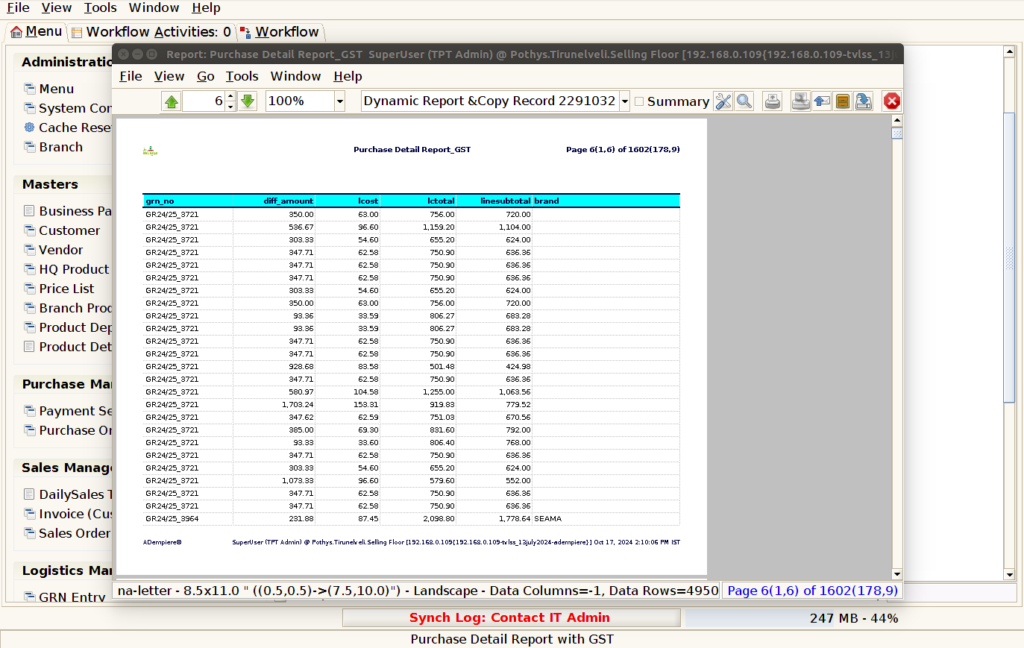

STEP9: Click Page Down Button Show Columns Details.

25.Diff Amount : Including diff amount (differential amount) in the Purchase Details Report with GST is important for tracking discrepancies or differences between expected and actual amounts, especially in terms of costs, prices, and GST-related adjustments.

26.Land Cost : The landed cost is the total cost of a product once it has arrived at its final destination, including not only the purchase price but also additional costs associated with bringing the product to the business.

27.Land Cost Total : Showing the landed cost total in the Purchase Details Report with GST is essential for businesses to get a complete picture of the overall cost of purchasing goods, factoring in not just the price of the items themselves, but all associated expenses.

28.Line Sub Total : The line sub-total in a Purchase Details Report with GST is the total cost for each individual item or product line in the report, including the base purchase price, GST, and any additional charges (like freight or handling) associated with that particular item.

29.Brand Name : Including the brand of products in the Purchase Details Report with GST provides valuable information for businesses, enabling better inventory management, supplier relationships, pricing strategies, and product tracking.

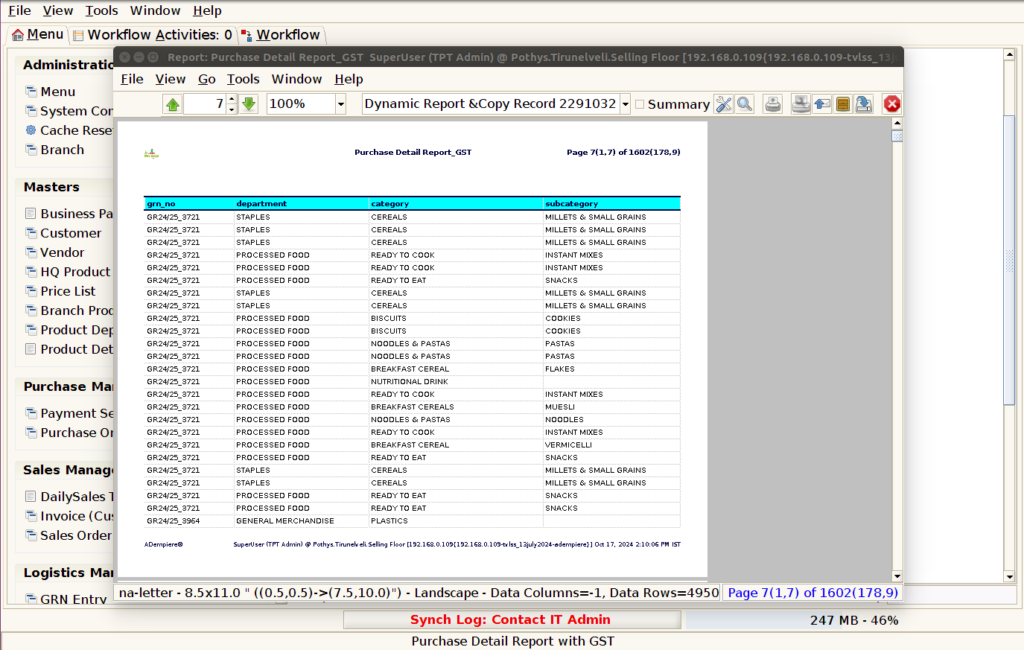

STEP10: Click Page Down Button Show Columns Details.

26.Department Name : The Department Name is shown in the Purchase Details Report with GST for several important reasons, primarily related to organizational structure, reporting accuracy, and ensuring proper tax and financial reconciliation.

27.Category : Including the Category in the Purchase Details Report with GST serves several important purposes, especially related to product classification, tax compliance, inventory management, and reporting.

28.Sub-Category : Including the Sub-category in the Purchase Details Report with GST enables businesses to track returns with greater detail and accuracy, ensuring better inventory management, financial reconciliation, GST compliance, and vendor communication.

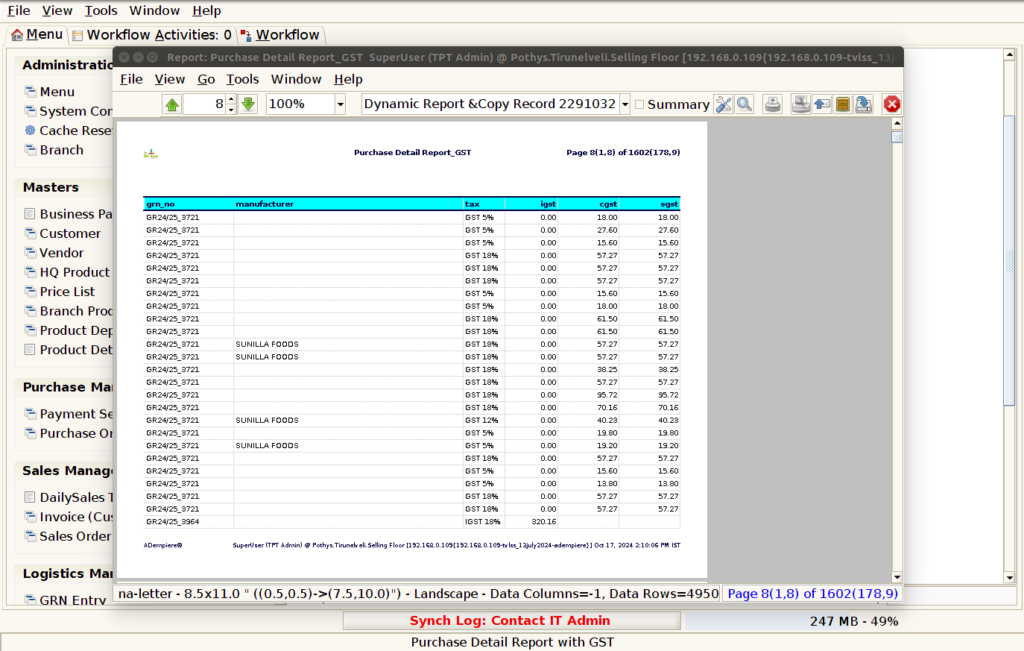

STEP11: Click Page Down Button Show Columns Details.

29.Manufacturer Name : Including the manufacturer name in the Purchase Details Report with GST is beneficial for businesses as it helps with product traceability, supplier management, cost analysis, and financial reporting.

30.Tax : Including tax details in the Purchase Details Report with GST is essential for businesses to ensure tax compliance, track GST payments, and manage cost analysis effectively.

31. IGST : The inclusion of IGST (Integrated Goods and Services Tax) in the Purchase Details Report with GST is essential for businesses, particularly those involved in inter-state transactions under the GST system.

32. CGST : The inclusion of CGST (Central Goods and Services Tax) in the Purchase Details Report with GST is essential for businesses that are involved in intra-state transactions, where both CGST and SGST (State Goods and Services Tax) are levied on the transaction.

33. SGST : The inclusion of SGST (State Goods and Services Tax) in the Purchase Details Report with GST is important for businesses involved in intra-state transactions, where both SGST and CGST (Central Goods and Services Tax) are levied on the transaction.

STEP12: Click Page Down Button Show Columns Details.

34.Line Tax Total : The inclusion of the Line Tax Total in the Purchase Details Report with GST is critical for businesses to ensure proper tracking and reporting of the taxes involved in their purchases.

35.Cess Total : The CESS Total amount is shown in the Purchase Details Report with GST because it is a mandatory part of the GST system for certain goods and services. Including CESS in the report ensures compliance with GST laws, supports Input Tax Credit (ITC) claims, and helps businesses understand their total tax burden.

36.Created Customer name : The “Created Customer name” field in the Purchase Details Report with GST refers to the date and time when a particular purchase transaction or record was created in the system.

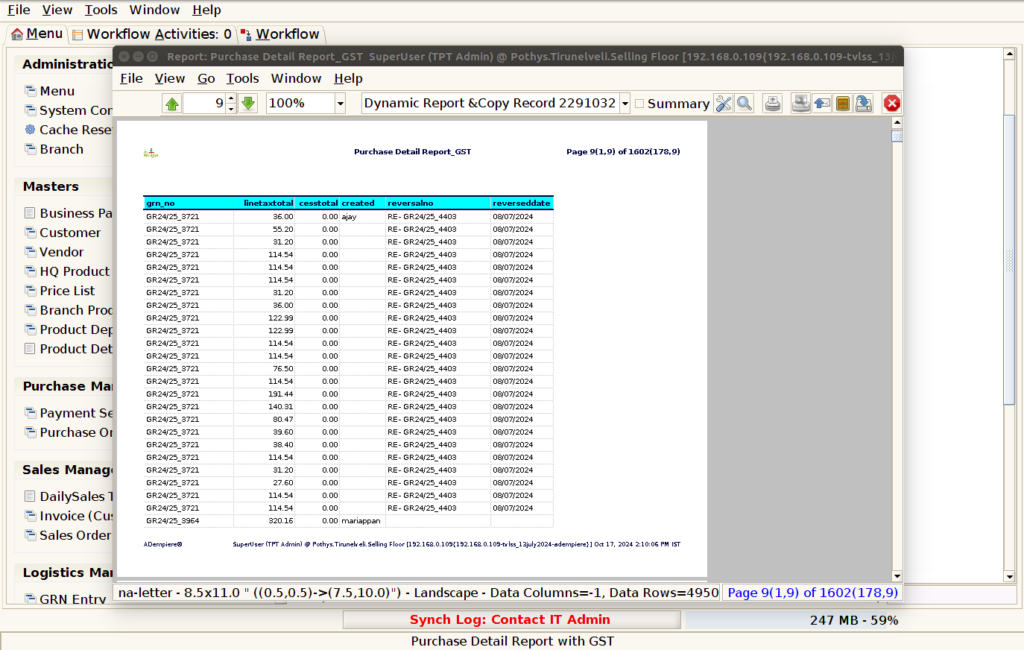

36.Reversal Number : The “Reversal Number” in the Purchase Details Report with GST is shown to indicate a purchase reversal or purchase return transaction. This refers to a situation where a business has reversed or canceled a previous purchase, typically due to reasons such as incorrect goods, damaged products, or disputes with the supplier.

37.Reversal Date : The “Reversal Date” in the Purchase Details Report with GST refers to the date when a purchase transaction (or part of it) was reversed, returned, or canceled. This date is critical for accurately adjusting financial records, GST filings, and ensuring that returns or cancellations are properly reflected in business transactions.