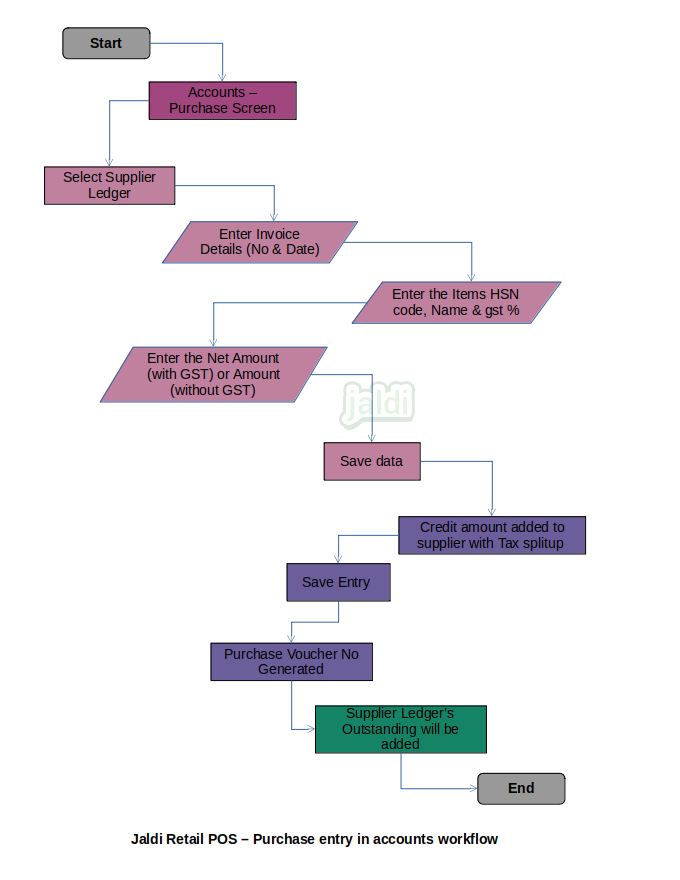

Purchase entry in Retail POS Accounts

Purchase entry in accounts is for to update the non inventory item’s purchase. Ex:- purchasing AC, furniture and systems to shop.

Business rules

- Supplier name and supplier details will be created in ledger master with GST details.

- There should be the purchase entry screen under transaction module for user to create purchase entry in accounts.

- In that purchase entry screen, enter voucher date and select suppler ledger and once supplier selected system will show popup screen to enter invoice details.

- In popup screen, enter invoice number and invoice date and then enter item name, HSN or SAC code and enter gst tax % for each items.

- Also user should enter net amount (with gst) or amount (without gst) for each items. if amount is entered then system will auto calculate net amount or if net amount is entered then system will auto calculate amount.

- After that user should click save. Then credit amount will be added to supplier with tax split up.

- After that user will save the purchase entry by pressing the function key called “save”.

- Completed purchase entry should be reflect in GSTR reports for gst filing.

- After saving the purchase entry, the supplier outstanding will be increased.

- Entered details of purchased Item will not be saved for future use.

- User can view, edit and delete the competed purchase entry by using the respective function keys called view, edit and delete.

Purchase entry in Retail POS Accounts workflow