Purchase Return Summary Report With GST

The Purchase Return Summary Report with GST is a document that summarizes all the return transactions related to purchases made by a business, along with the associated Goods and Services Tax (GST) details. When a company returns goods to a supplier after a purchase, this report helps in tracking and managing the impact of those returns on the business’s financial records, particularly in relation to GST.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Purchase Return Summary Report With GST.

Pre-Requisite Activities

- From Date

- To Date

- Vendor.

Business Rules

- The business rules for the Purchase Return Summary Report with GST ensure that the process of returning goods is well-documented, compliant with tax laws, and accurately reflected in the financial system.

- These rules guide how return transactions should be processed, how GST should be reversed, and how inventory and tax records are adjusted.

- They ensure transparency, accountability, and compliance with GST regulations, making the report a key tool for financial and tax management.

User Interface

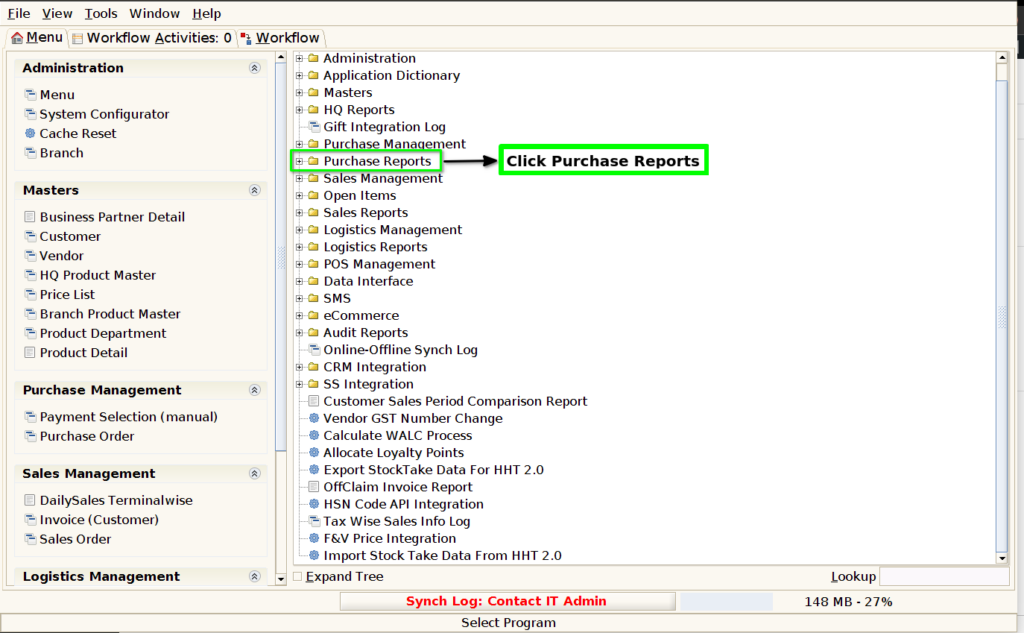

STEP1: Click Purchase Reports Folder.

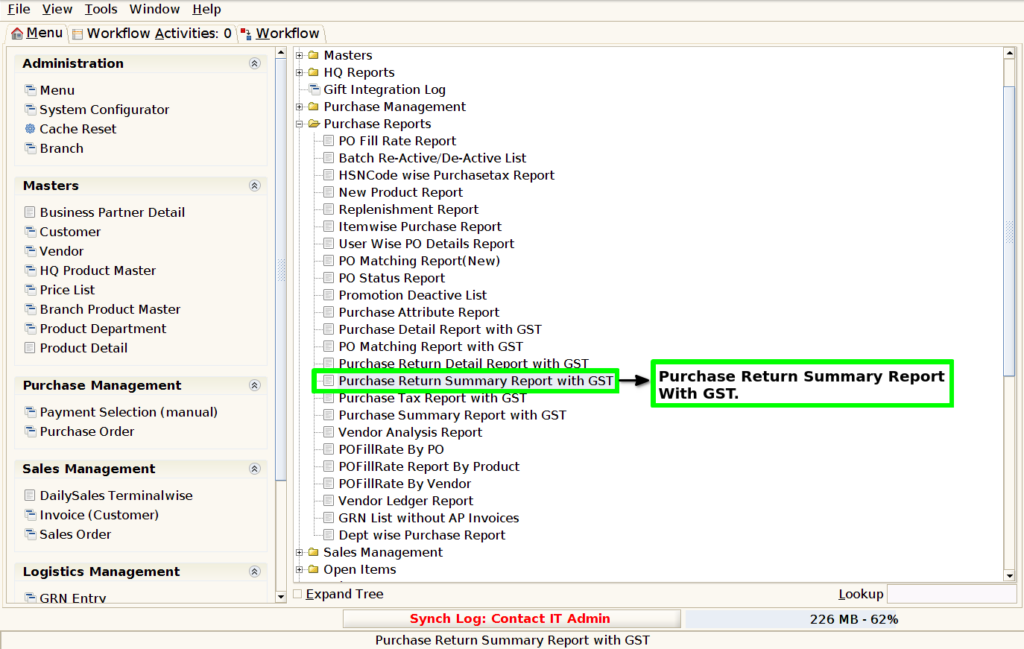

STEP2: Click Purchase Return Summary Report with GST.

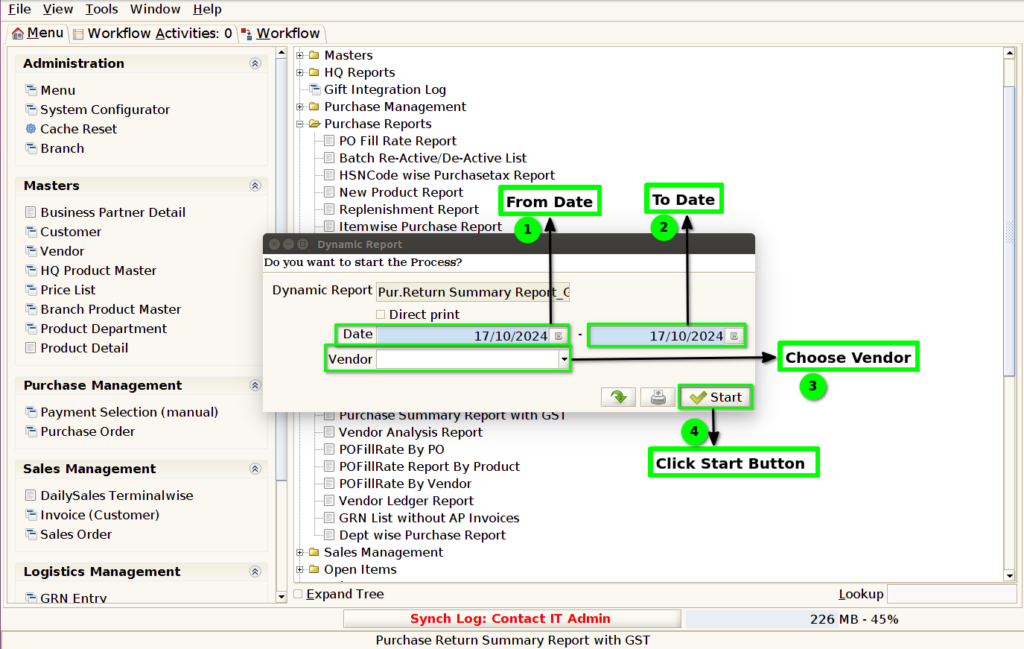

STEP3: Choose Parameter From Date, To Date and Vendor Name.

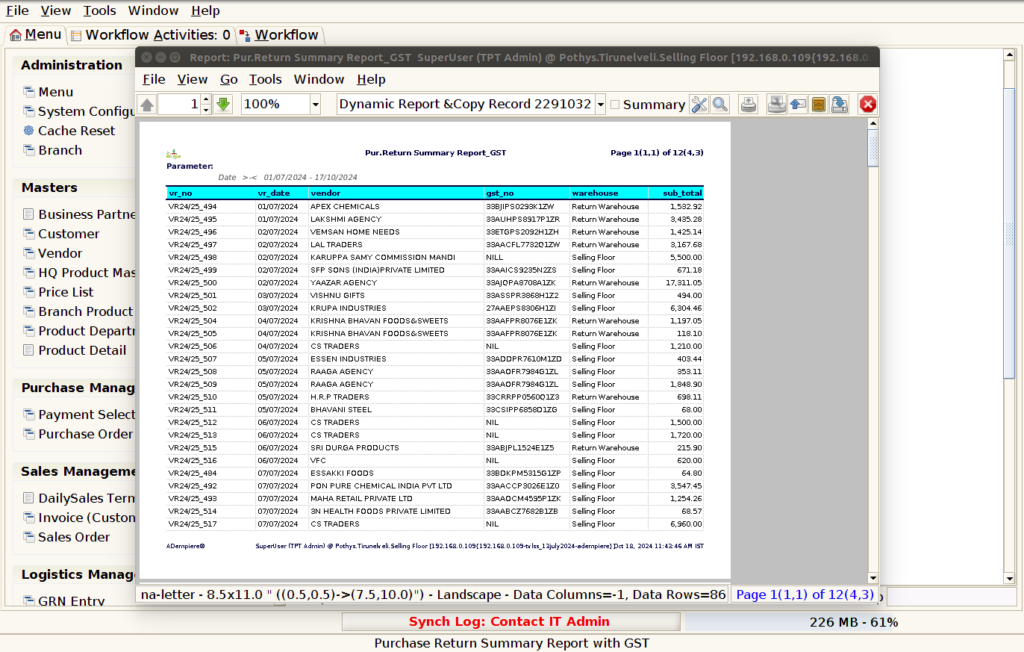

STEP4: Show Columns Details.

1.Vendor Return Document Number : The Vendor Return Document Number in the Purchase Return Summary Report with GST is included to ensure that each purchase transaction is properly documented and linked to a unique GST invoice.

2.Vendor Return Date : The Vendor Return Date in the Purchase Return Summary Report with GST is included for several important reasons, primarily related to tracking, compliance, financial management, and reporting.

3.Vendor Name : The Vendor Name in the Purchase Return Summary Report with GST is included for several key reasons related to vendor management, tracking, compliance, and financial reporting.

4. Vendor GST Number : The Vendor GST Number (Goods and Services Tax Identification Number) is shown in the Purchase Return Summary Report with GST for several important reasons related to compliance, transparency, and accurate tax reporting.

5.Warehouse : The inclusion of Warehouse in the Purchase Return Summary Report with GST serves several important purposes, especially for businesses that have multiple locations or warehouses where goods are stored.

6.Sub-Total : The Sub Total is shown in the Purchase Return Summary Report with GST for several important reasons, primarily related to improving clarity, facilitating tax compliance, and helping businesses track their expenses effectively.

STEP5: Click Page Down Button Show Columns Details.

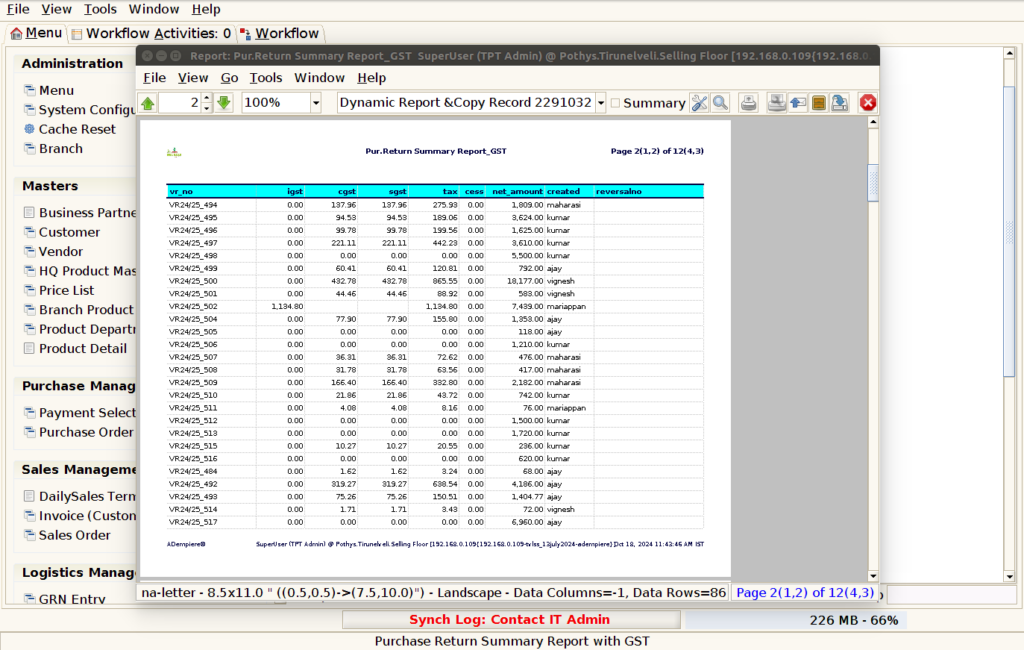

7. IGST : The inclusion of IGST (Integrated Goods and Services Tax) in the Purchase Return Summary Report with GST is essential for businesses, particularly those involved in inter-state transactions under the GST system.

8. CGST : The inclusion of CGST (Central Goods and Services Tax) in the Purchase Return Summary Report with GST is essential for businesses that are involved in intra-state transactions, where both CGST and SGST (State Goods and Services Tax) are levied on the transaction.

9. SGST : The inclusion of SGST (State Goods and Services Tax) in the Purchase Return Summary Report with GST is important for businesses involved in intra-state transactions, where both SGST and CGST (Central Goods and Services Tax) are levied on the transaction.

10.Tax : The inclusion of the Tax figure in the Purchase Return Summary Report with GST is critical for businesses to ensure proper tracking and reporting of the taxes involved in their purchases.

11. Cess : The CESS amount is shown in the Purchase Return Summary Report with GST because it is a mandatory part of the GST system for certain goods and services. Including CESS in the report ensures compliance with GST laws, supports Input Tax Credit (ITC) claims, and helps businesses understand their total tax burden.

12.Net Cost Amount : The Net Cost Amount in the Purchase Return Summary Report with GST reflects the actual cost of the purchase after all adjustments have been made, such as discounts, taxes, additional charges, and deductions.

13.Created : The “Created” field in the Purchase Return Summary Report with GST refers to the date and time when a particular purchase transaction or record was created in the system.

14.Reversal Number : The “Reversal Number” in the Purchase Return Summary Report with GST is shown to indicate a purchase reversal or purchase return transaction. This refers to a situation where a business has reversed or canceled a previous purchase, typically due to reasons such as incorrect goods, damaged products, or disputes with the supplier.

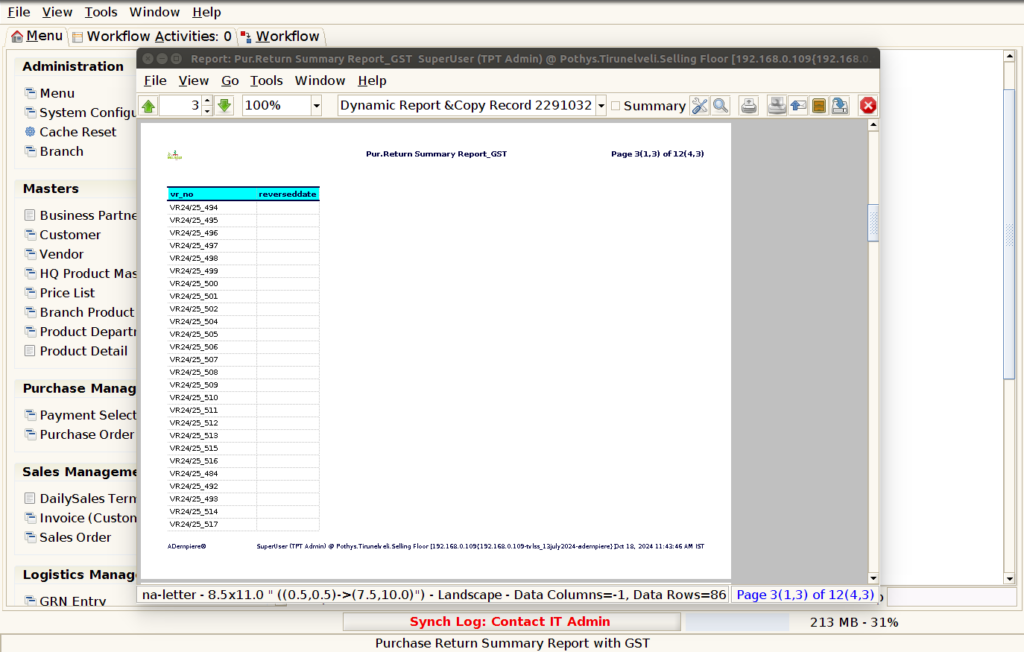

STEP6: Click Page Down Button Show Columns Details.

15.Reversal Date : The “Reversal Date” in the Purchase Return Summary Report with GST refers to the date when a purchase transaction (or part of it) was reversed, returned, or canceled. This date is critical for accurately adjusting financial records, GST filings, and ensuring that returns or cancellations are properly reflected in business transactions.