Purchase Tax Report With GST

A Purchase Tax Report with GST is a financial document that provides a detailed breakdown of the Goods and Services Tax (GST) applied to purchases made by a business. This report typically includes information on the input tax credit (ITC) that a business can claim for the tax paid on purchases.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Purchase Tax Report With GST.

Pre-Requisite Activities

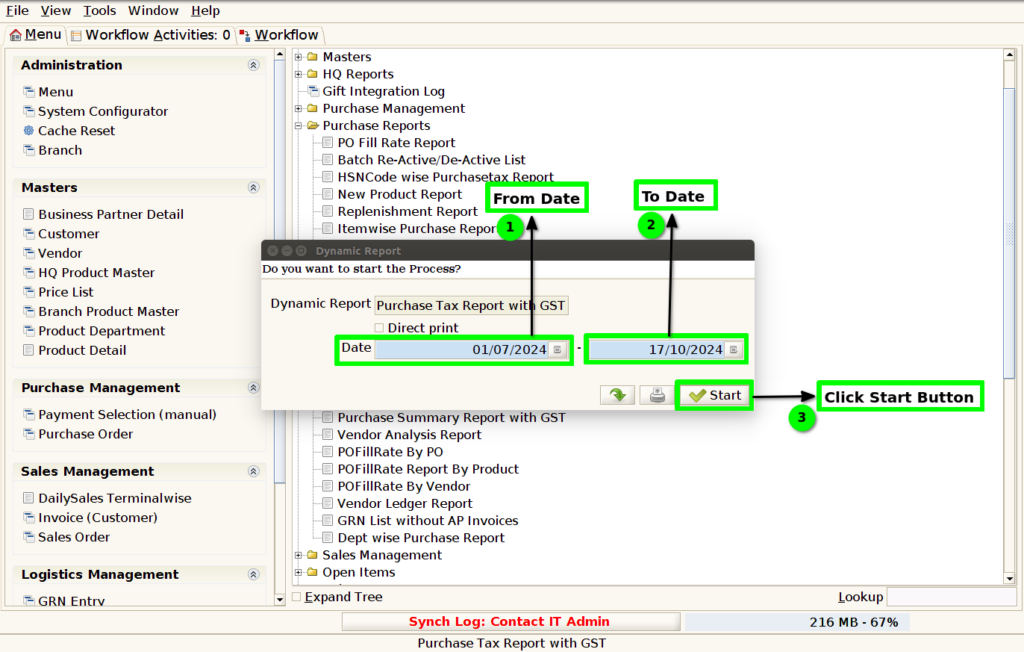

- From Date

- To Date

Business Rules

- The Business Rules for the Purchase Tax Report with GST are essential to ensure that businesses comply with GST regulations, accurately claim input tax credit, and maintain transparency in their financial reporting.

- These rules help businesses track and report GST paid on purchases, reconcile it with sales tax data, and ensure that the correct amount of GST is reported and claimed.

- Failing to adhere to these rules can result in penalties, tax audits, and financial discrepancies.

User Interface

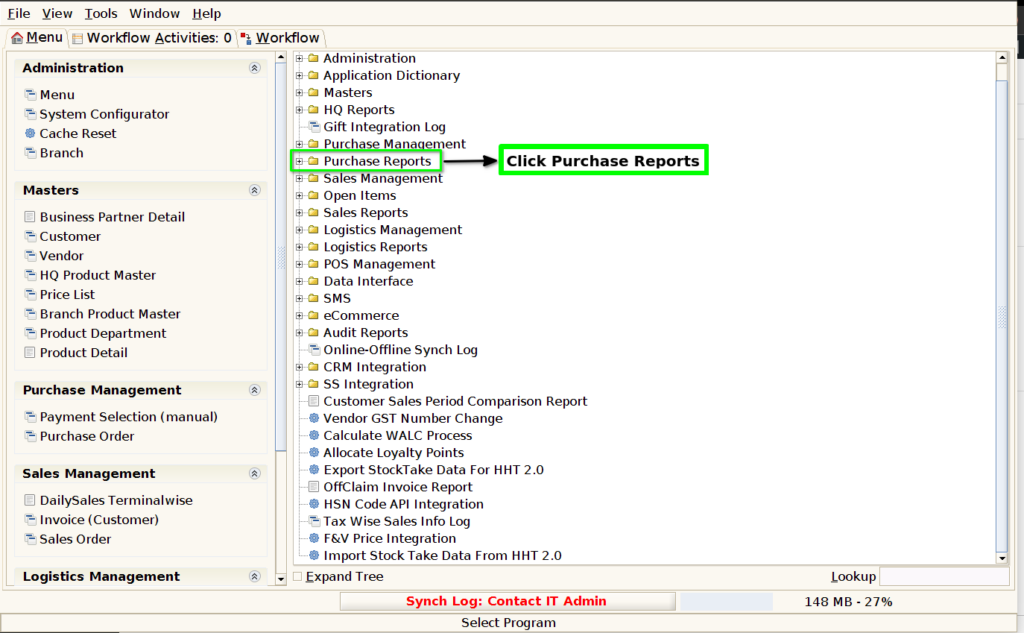

STEP1: Click Purchase Reports Folder.

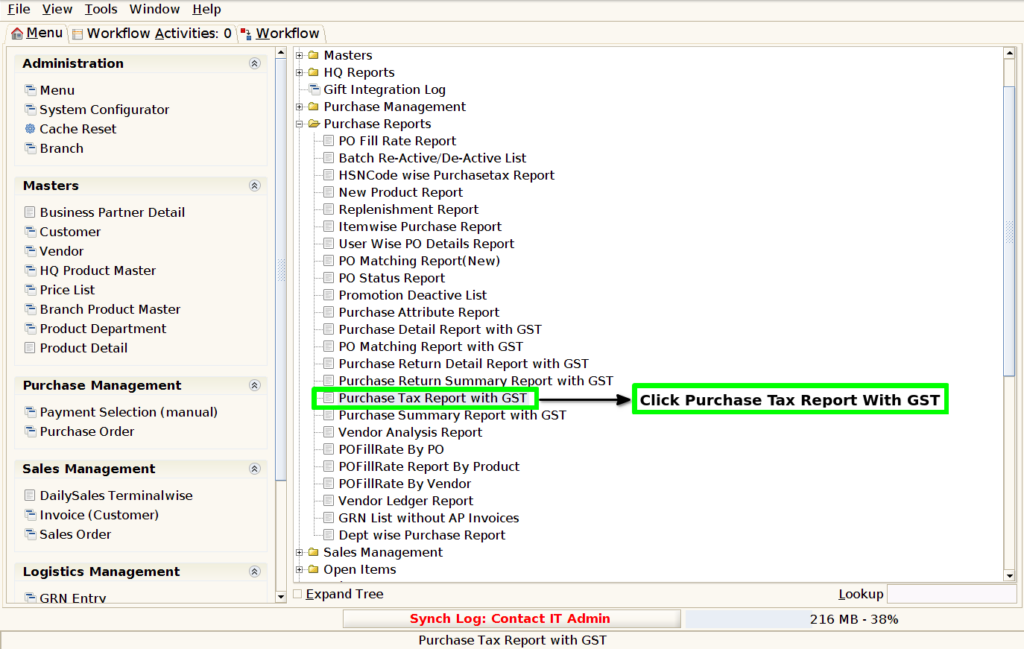

STEP2: Click Purchase Tax Report With GST.

STEP3: Choose Parameter From Date, To Date .

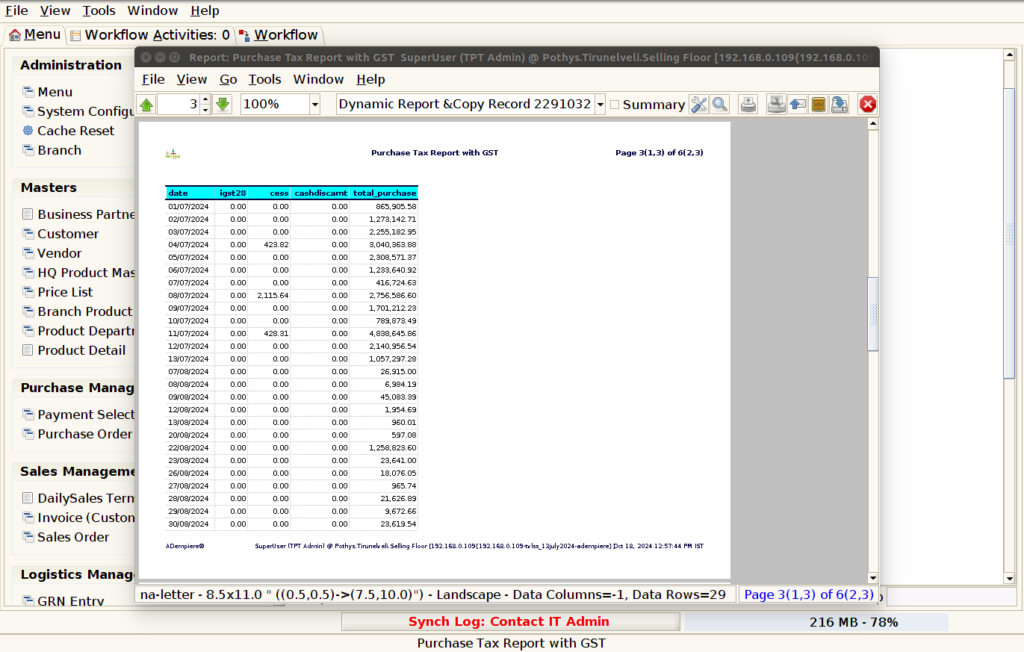

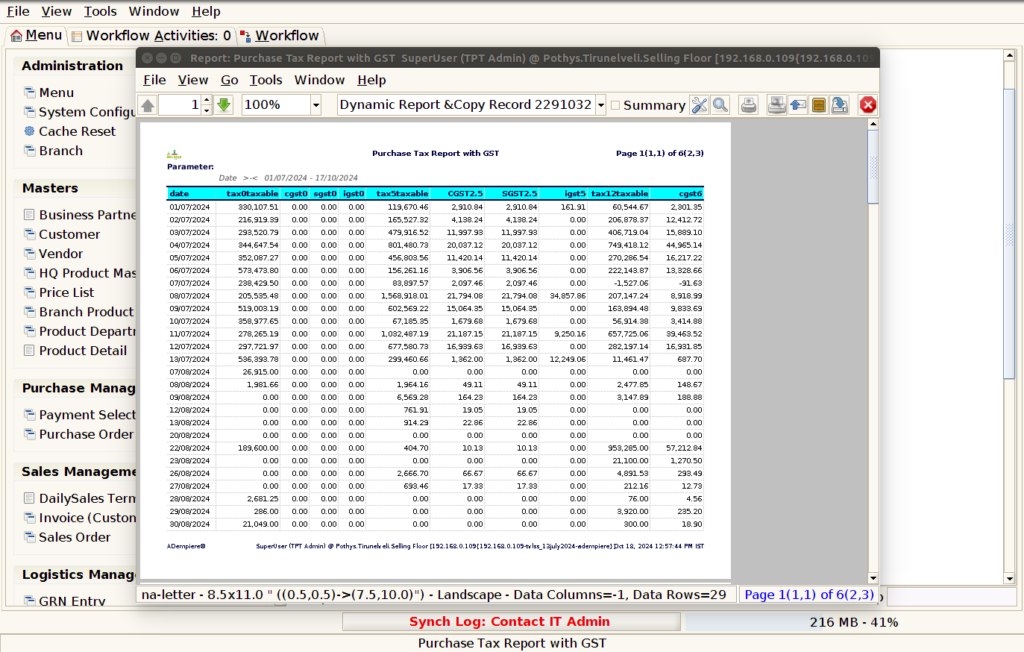

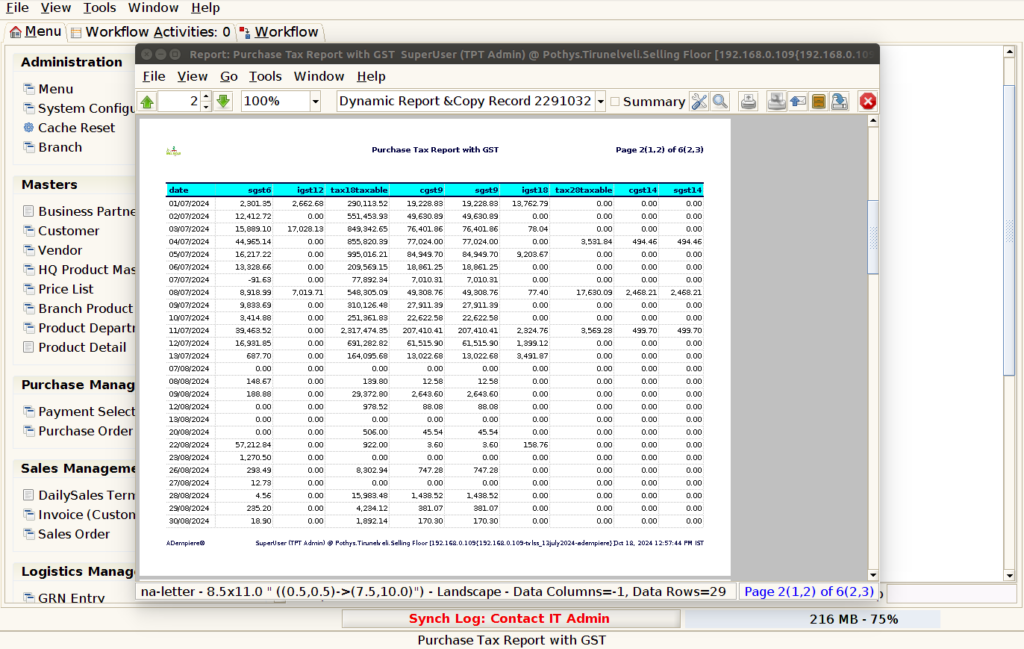

STEP4: Show Columns Details.

1.Date : The date in the Purchase Tax Report with GST is crucial for several reasons related to compliance, accuracy, and proper tracking of GST-related transactions.

2.Tax (0,5,12,18,28)% Taxable : The “Taxable” amount in the Purchase Tax Report with GST is shown to reflect the value of goods or services on which GST (Goods and Services Tax) is applicable. This amount plays a key role in calculating the GST liability (output tax) and input tax credit (ITC) for the business.

3.CGST (0,2.5,6,9,14)% : The CGST (Central Goods and Services Tax) amount in the Purchase Tax Report with GST is shown because it represents the tax portion that has been levied by the Central Government on the goods or services purchased by the business.

4.SGST (0,2.5,6,9,14)% : The SGST (State Goods and Services Tax) amount in the Purchase Tax Report with GST is shown because it represents the portion of the GST that is levied by the State Government on goods or services purchased by the business.

5.IGST (0,5,12,18,28)% : The IGST (Integrated Goods and Services Tax) amount in the Purchase Tax Report with GST is shown because it represents the portion of the GST that is levied by the Central Government on interstate transactions

6. Cess Amount : The CESS amount is shown in the Purchase Tax Report with GST because it represents an additional tax levy applied to certain goods and services under the Goods and Services Tax (GST) system in India. This tax is over and above the regular CGST, SGST, or IGST and is aimed at addressing specific purposes such as compensation to states for revenue loss and other special funds.

7.Cash Discount Amount : The cash discount amount is shown in the Purchase Tax Report with GST because it is relevant for determining the final purchase price and the GST liability of a transaction. Cash discounts are typically offered by sellers to encourage early payments or to incentivize customers to settle invoices quickly.

8.Total Purchase Value : The total purchase value is shown in the Purchase Tax Report with GST because it represents the complete amount a business has spent on purchasing goods and services, including taxes, discounts, and additional charges.