TO CREATE A CREDIT CUSTOMER OUTSTANDING REPORT NEW-SS

A Credit Customer Outstanding Report (often referred to as Credit Customer Outstand Report New in some systems) is a financial report that details the outstanding credit balances owed by customers to a business. This report provides an overview of all unpaid invoices, the amount owed by each customer, and may include the aging of those receivables (i.e., how long the debt has been outstanding).

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Credit Customer Outstanding Report New.

Pre-Requisite Activities

- Customer

- Sales rep

Business Rules

- Customer Eligibility for Credit – The report should only include customers who have been approved for credit terms.

- The report should exclude customers who are not currently carrying an outstanding balance or have paid in full within the period.

- Outstanding Amount Calculation – The report will list the outstanding amounts due from customers based on invoices, excluding payments made.

- It may include all unpaid invoices as of the report date, with aging details (e.g., 0-30 days, 31-60 days, 61-90 days, etc.).

- Invoices should be considered outstanding until the payment is fully received or any necessary adjustments (e.g., discounts, allowances) are made. – The report should track overdue amounts, and any payments received after the report is generated should be reflected in the next report.

User Interface

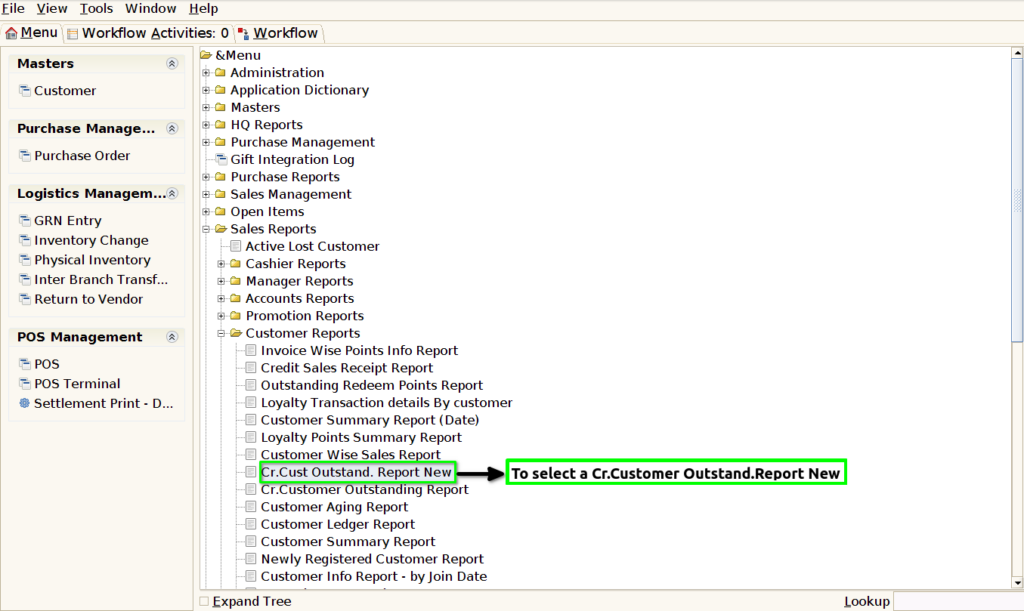

STEP 1: To select a Credit Customer Outstanding Report New.

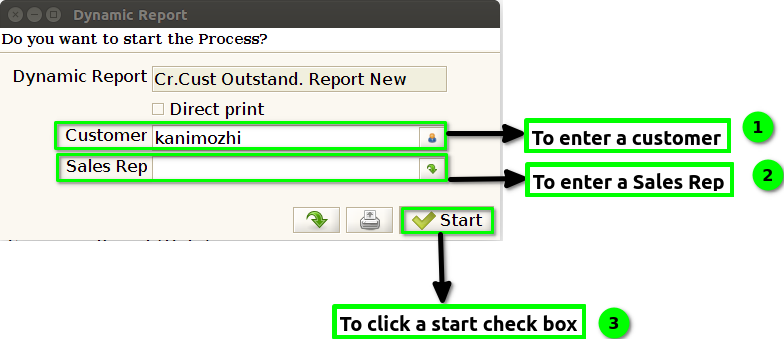

STEP 2: To enter a Customer and to enter a Sales rep.Then to click a start check box to run the process.

STEP 3:Once to complete the process to show the report based on the given data.

STEP 4: Bill number – refers to a unique identifier assigned to a proposed law (or “bill”) introduced in a legislative body, such as a parliament or congress. It helps to track the bill’s progress through the legislative process and distinguishes it from other bills.

Bill date – is typically recorded in the official legislative records, and it helps to track the bill’s progress through the various stages of the legislative process, such as committee hearings, floor debates, and votes.

Sales representative (sales rep) – is a professional who is responsible for selling products or services to customers, clients, or businesses. Their primary role is to drive revenue by identifying potential buyers, presenting products or services, and closing sales.

Pay details – typically refer to information about the payments made by customers against their outstanding balances or credit.

Code – is a unique identifier used by manufacturers, retailers, or other businesses to distinguish a specific product from others. It helps track inventory, sales, and orders more efficiently.

Customer name – refers to the full name of an individual or organization that is purchasing or using a product or service. It is used to identify the person or entity involved in a transaction, account, or relationship with a business or service provider.

Bill amount – represents the amount the customer owes as of the reporting date. It could be further categorized into aging periods (e.g., 0–30 days, 31–60 days, etc.), indicating how long the amount has been overdue.

Discount amount – is the amount of money subtracted from the original price of a product or service in order to reduce its selling price. It represents the difference between the original price and the sale price.

Received amount – refers to the total amount of money that a buyer actually pays or the seller actually receives after any discounts, taxes, or additional charges are applied.

Balance amount – typically refers to the remaining amount of money or value due on an account, loan, or invoice after payments, charges, or other adjustments have been made.

Training Videos

FAQ

SOP