TO CREATE A CUSTOMER AGING REPORT

Customer Aging Report (also called an Accounts Receivable Aging Report) is a financial document used by businesses to track outstanding customer invoices and assess the time they have been overdue. It organizes customer balances by age categories, typically broken down into intervals such as 0-30 days, 31-60 days, 61-90 days, and 90+ days.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Customer Aging Report

Pre-Requisite Activities

- Customer

Business Rules

- A Customer Aging Report – is a critical financial tool for tracking outstanding receivables and assessing the credit risk posed by customers.

- Aging Buckets (Time Intervals) – Standard Buckets-Typically, the aging report breaks down outstanding invoices into categories, such as: -0-30 days Current or recent invoices,31-60 days: Invoices that are slightly overdue,61-90 days.Invoices that are becoming significantly overdue.91-120 days: Invoices that are highly overdue.Over 120 days-Long overdue, potentially at risk for non-payment.

- Due Dates – Invoice Date: Aging is usually based on the invoice date (not the payment date).

- Outstanding Amounts – Total Amount Due-The report should display the total outstanding balance, not just the unpaid amount on individual invoices.

- Credit Memos and Adjustments- Any credit memos or adjustments made to customer accounts should be subtracted from the aging amount.

- Customer Classification – Current vs. Past Due- If possible, segment customers based on their credit risk, frequency of late payments, or account type (e.g., key accounts, new customers).

- Receivables Status – Payments Received.

- Write-offs : If an amount is written off as uncollectible, it should be excluded from the aging report.

- Account Balances-Multiple Invoices per Customer-If a customer has multiple invoices, the aging report should sum the amounts of all outstanding invoices for that customer.

- Currency and Exchange Rates – Multiple Currencies.

User Interface

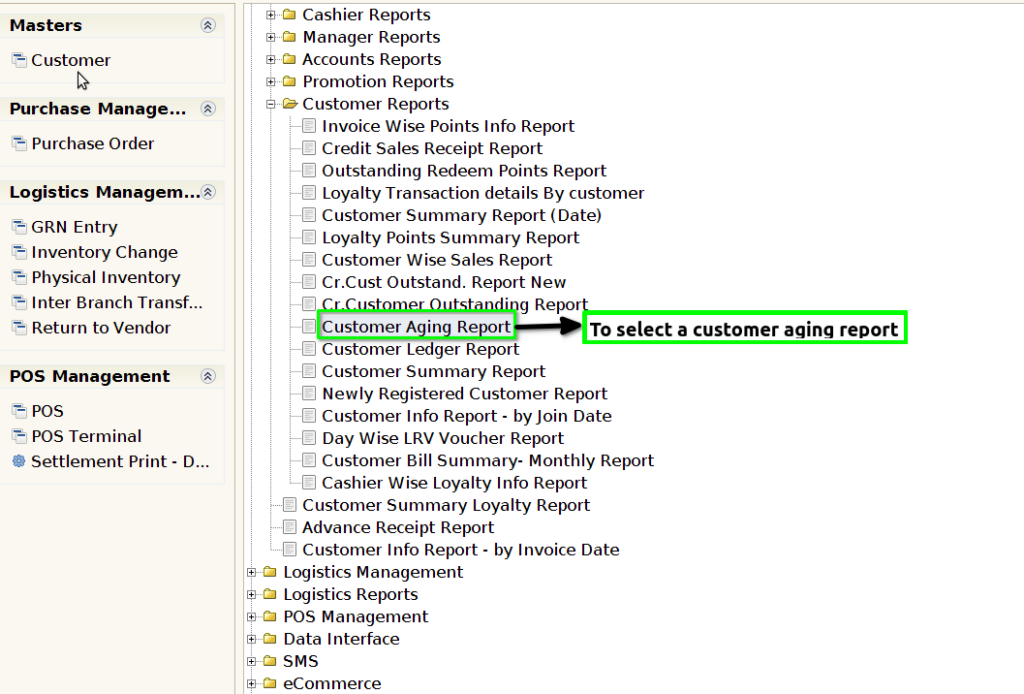

STEP 1: To select a Customer Aging Report.

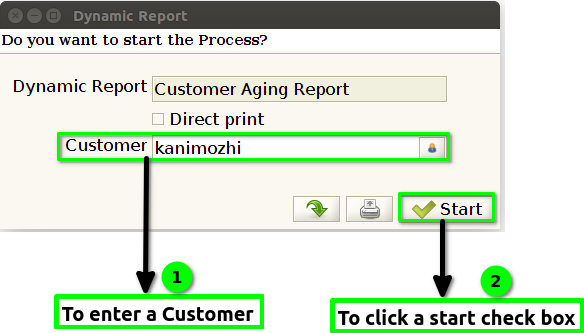

STEP 2:To enter a Customer and to click the start check box to run the process.

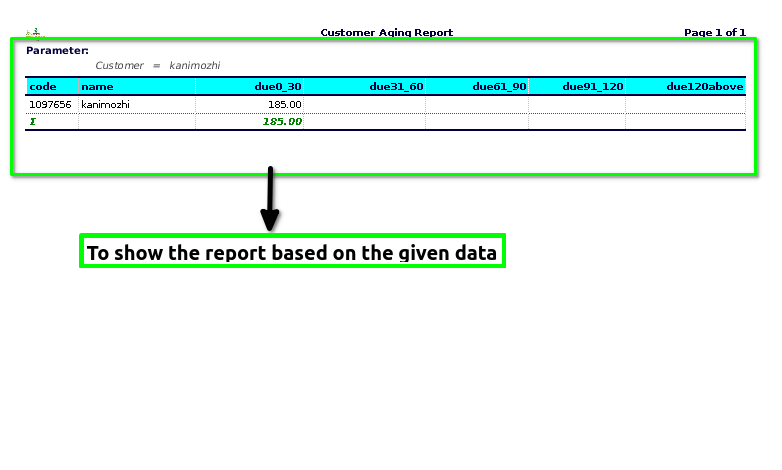

STEP 3:Once to complete the process to show the report based on the given data.

STEP 4: Product code – is a unique identifier assigned to a product to distinguish it from other products.

Product name – is the specific name given to a product to identify and differentiate it from other products.

Due 0-30 -is a financial report that categorizes accounts receivable based on the age of outstanding invoices.

Due 31-60 – refers to a category within an accounts receivable aging report that shows the outstanding invoices from customers that are between 31 to 60 days overdue.

Due 61-90 – refers to the category in an accounts receivable aging report that tracks customer invoices that are 61 to 90 days overdue.

Due 91-120 – is a financial report used to track accounts receivable that have been outstanding for 91 to 120 days, this report helps businesses prioritize follow-up efforts and manage financial risk by highlighting those customers whose payments are significantly overdue (91-120 days).

Due 120 Above -refers to a section of an accounts receivable aging report that highlights invoices or accounts that are past due by 120 days or more.

Training Videos

FAQ

SOP