TO CREATE A HSN CODE WISE SALES TAX REPORT WITH GST-SS

An HSN Code Wise Sales Tax Report with GST is a detailed report used by businesses to track their sales transactions based on the HSN (Harmonized System of Nomenclature) codes and their associated Goods and Services Tax (GST) rates. This report is commonly used for GST compliance, accounting, and tax filing purposes in countries like India, where GST is implemented.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- HSN Code Wise Sales Tax Report With GST

Pre-Requisite Activities

- Date Range

Business Rules

- HSN Code Mapping- Every product or service sold must be linked to a valid HSN (Harmonized System of Nomenclature) code.

- Tax Rate and GST Calculation -The GST rate applicable to each HSN code should be taken into account. Goods and services are classified under different GST slabs (e.g., 0%, 5%, 12%, 18%, 28%).

- The tax calculation must differentiate between CGST (Central GST), SGST (State GST), and IGST (Integrated GST) based on whether the transaction is intra-state or inter-state.

- Sales Data Grouping by HSN Code – The report must summarize sales data based on HSN codes.

- Group the data by HSN code. Include the total sales value, GST amount (both CGST, SGST, and IGST), and taxable value for each HSN.

User Interface

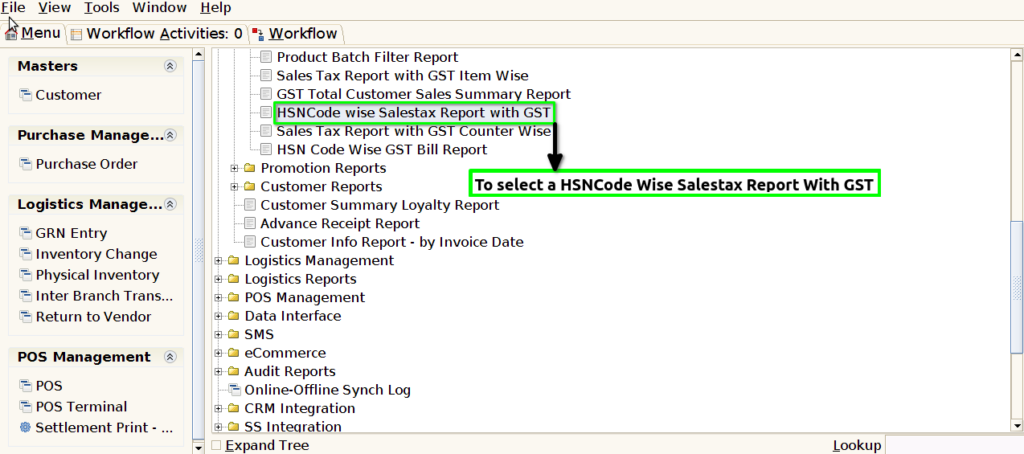

STEP 1: To select a HSN Code Wise Sales Tax Report With GST.

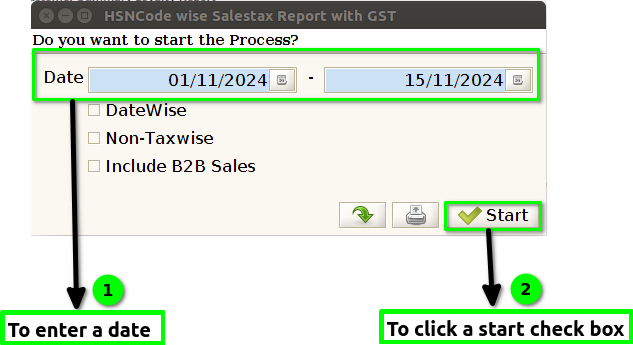

STEP 2: To enter a Date in this field is mandatory.Then to click a Start Check Box to run the process.

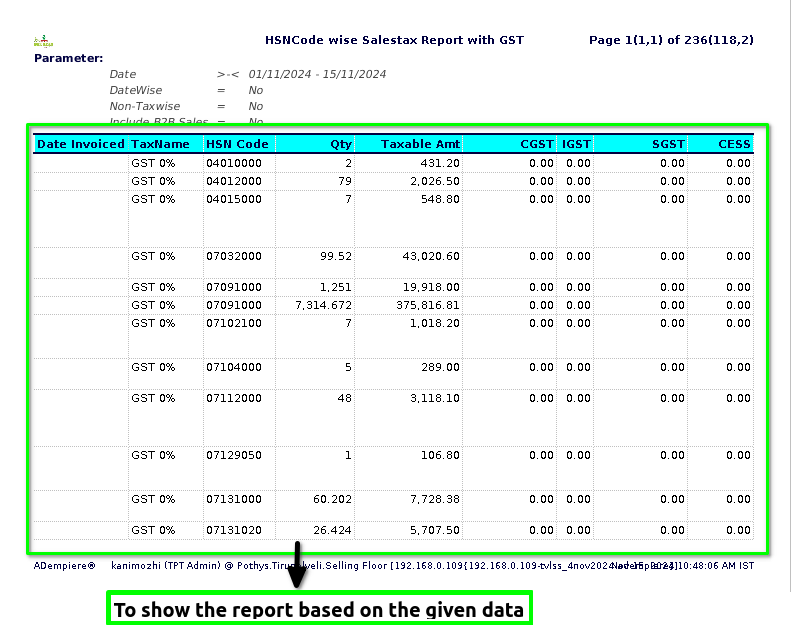

STEP 3: Once to complete the process to show the report based on the given data.STEP 2:

STEP 4: Date invoiced– refers to the specific date on which an invoice is issued or generated. It is the official date recorded on the invoice document when a business or individual charges for goods or services provided.

Tax name-generally refers to the official name used for tax purposes, typically associated with an individual, business, or organization.

HSN Code-(Harmonized System of Nomenclature Code) is a system of classification used for goods in international trade. It is an internationally standardized numerical method of classifying traded products and is used by customs authorities around the world to assess duties and taxes on imports and exports.

Quantity-refers to an amount or number of something, typically measurable or countable. It can be used in various contexts, and its meaning depends on the situation.

Taxable amount-is the portion of income, sales, or the value of goods and services that is subject to taxation. It represents the amount on which taxes are calculated. The taxable amount is determined by applying various tax rules, exemptions, deductions, or adjustments.

CGST– (Central Goods and Services Tax)-It is the tax levied by the central government on intra-state (within the same state) transactions of goods and services.

SGST -(State Goods and Services Tax)-It is the tax levied by the state government on intra-state transactions of goods and services.

IGST (Integrated Goods and Services Tax)-It is the tax levied by the central government on inter-state (between different states) transactions of goods and services.

Cess-is a type of tax or levy that is imposed for a specific purpose, typically to fund a particular government initiative or service. It is an additional tax over and above the normal taxes (like income tax, sales tax, etc.) and is usually applied to a specific sector or activity.

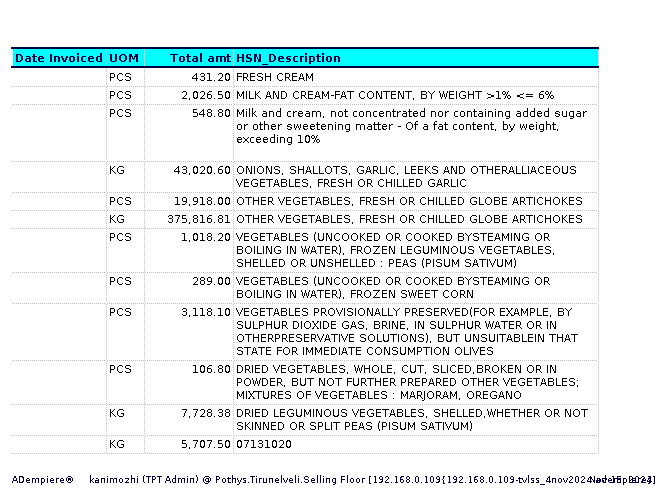

UOM-stands for Unit of Measurement. It refers to the standard unit used to quantify or measure a particular item, product, or service. UOM is used in various fields, such as commerce, science, and engineering, to specify how quantities are expressed.

Total amount– generally refers to the entire sum or quantity of something. It’s the complete or final number when you add up all individual parts, quantities, or components.

HSN (Harmonized System of Nomenclature) description -refers to the standardized code and description used to classify goods in international trade. The HSN system, maintained by the World Customs Organization (WCO), categorizes products in a hierarchical manner for customs and taxation purposes.

Training Videos

FAQ

SOP