TO CREATE A SALES TAX REPORT WITH GST ITEM WISE

A Sales Tax Report with GST item-wise is a detailed financial document that outlines the sales transactions of a business, broken down by each item or product, along with the Goods and Services Tax (GST) applicable to each item. This report helps businesses comply with tax regulations and provides a clear view of tax collected on each sale.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Sales Tax report With GST Item wise

Pre-Requisite Activities

- Date Range

- Product

- Department

Business Rules

- GST Tax Rate Determination by Item – Each item in the sales transaction must have a GST rate associated with it based on its classification under the GST Act (e.g., 5%, 12%, 18%, 28% for domestic sales).

- The GST rate for each item should be calculated and documented at the time of the sale, using the applicable rate for the specific goods/services.

- GST rates for products/services subject to reverse charge mechanisms (RCM) should be identified separately.

- Inclusion of SGST, CGST, or IGST-ate sales(same state transactions), both SGST and CGST should be calculated and reported separately. For inter-state sales (sales between different states), only IGST applies, and should be calculated and reported for each item.

User Interface

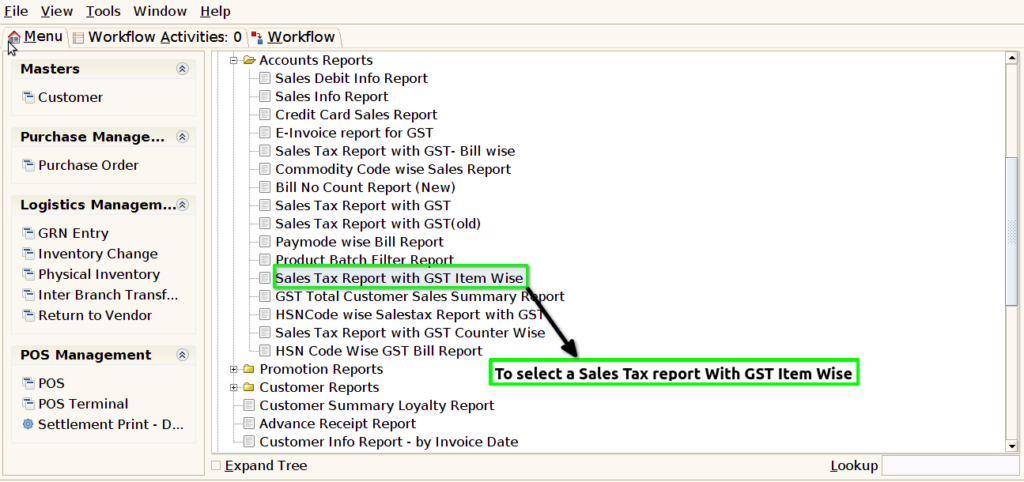

STEP 1: To select a Sales tax report with GST item wise.

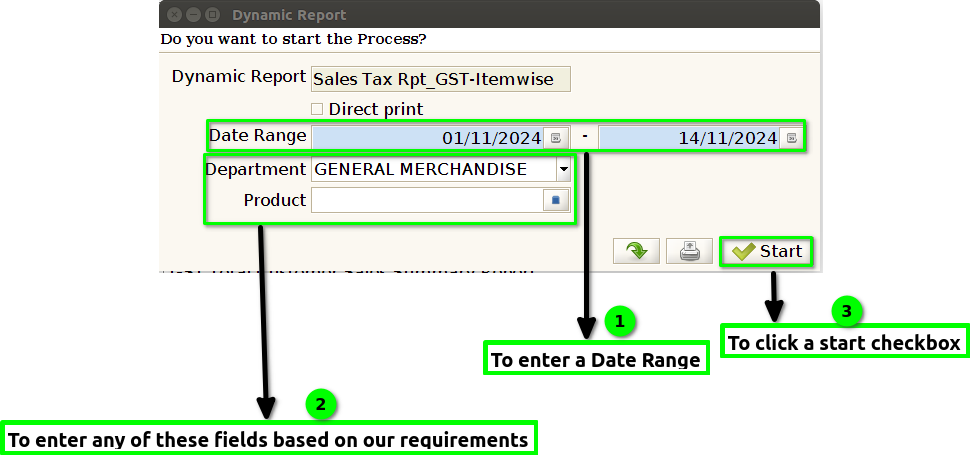

STEP 2:To enter a date in this field is mandatory and to enter any of these field is optional or based on our requirements.Then to click the start check box to run the process.

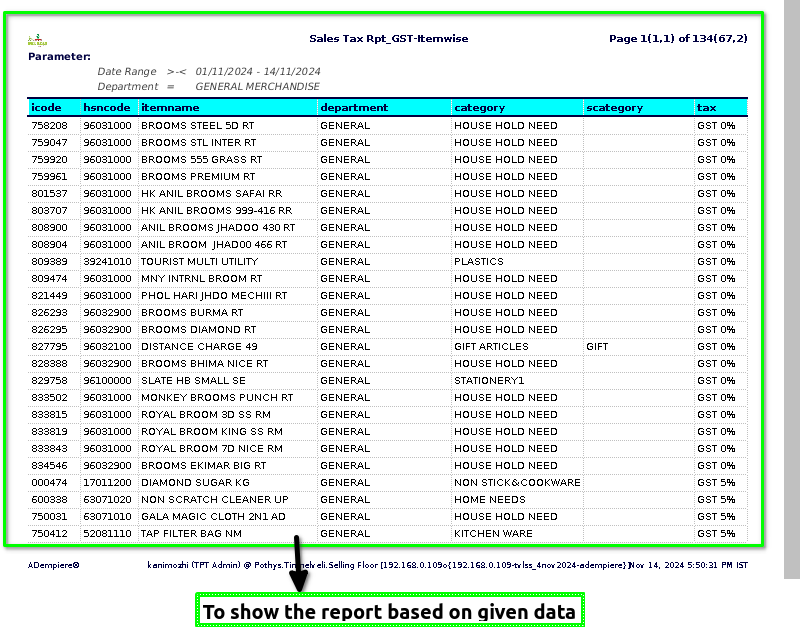

STEP 3: Once to complete the process to show the report based on the given data.

STEP 4: Item code is a unique identifier or alphanumeric code used to classify and track individual products or items in a system. It helps businesses, retailers, and warehouses organize inventory, streamline ordering, and manage stock more efficiently.

HSN code-stands for Harmonized System of Nomenclature code. It is an internationally standardized system of names and numbers used to classify traded products.

Item name– typically refers to the name or label given to a specific object, product, or thing in various contexts.

Department (sometimes referred to as Product Management Department or Product Team) is a division within an organization responsible for overseeing the development, management, and lifecycle of a product or group of products. This department works across multiple stages, from initial concept and design through to delivery, marketing, and ongoing improvements.

Category-is a broad group of products that share similar characteristics, functions, or are aimed at fulfilling a specific need.Examples of Product Categories: – Electronics: All products related to electronic devices, like phones, laptops, cameras, and televisions.

Subcategory– is a more specific grouping within a larger product category. Subcategories break down a product category into smaller, more detailed groups based on more specific characteristics. Examples of Product Subcategories: – Electronics: – Smartphones – Laptops – Headphones.

Tax-is a mandatory financial charge or levy imposed by a government on individuals, businesses, and other entities to fund public services and government expenditures. Taxes are collected by government agencies at the federal, state, and local levels and are used to finance a wide range of services, including infrastructure, education, healthcare, defense, social services, and more.

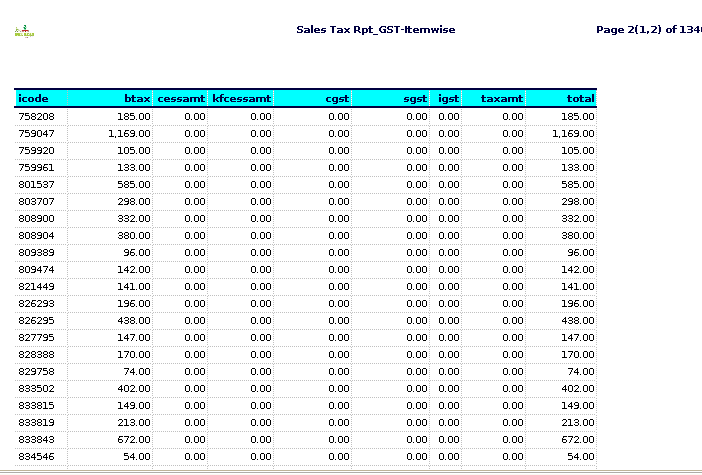

BTAX generally refers to “business tax” or “business taxation,” but the term can have different meanings depending on the context.Business Taxation (BTAX) – This is a broad term used to refer to the taxation policies, procedures, and regulations that businesses must follow. It could include corporate income taxes, sales taxes, payroll taxes, excise taxes, and other forms of taxation applicable to businesses.

Cess amount-refers to the actual amount of money that a taxpayer must pay as a cess. This is a specific surcharge or levy imposed by the government, in addition to regular taxes, for funding a particular cause or service

CGST-stands for Central Goods and Services Tax. It is a component of the Goods and Services Tax (GST) system implemented in India to streamline and unify the taxation system across the country.

SGST– stands for State Goods and Services Tax. It is one of the components of the Goods and Services Tax (GST) system in India.

IGST– stands for Integrated Goods and Services Tax. It is a tax levied on the supply of goods and services between different states in India, designed to ensure a seamless flow of credit and avoid the cascading effect of taxes.

Total-refers to the sum or overall amount obtained by adding together individual components or values. It is commonly used to indicate the complete quantity or aggregate of something after considering all parts or elements.

Taxamt– typically refers to the tax amount, which is the monetary value of tax that needs to be paid or collected on a transaction, product, or service. It is the amount of tax calculated based on the applicable tax rate and the taxable value of the goods or services.

Training Videos

FAQ

SOP