TO CREATE A SALES VAT REPORT-ITEM WISE-LS

Sales VAT Report – Item Wise is a detailed financial report that breaks down the sales transactions and calculates the Value Added Tax (VAT) applicable to each item sold. It provides insights into how much VAT is charged on a per-item basis, and it’s often used by businesses to ensure accurate tax reporting and compliance.

User Access

Who Can Access

- Pothys admin

- Back Office

- Purchase Manager

- Manager

What User Can Do

- View Reports

- Sales VAT Report-Item wise

Pre-Requisite Activities

- Date Range

- Department

- Product

- Commodity code

Business Rules

- Item Classification for VAT -Item VAT Rate-Each item must have an associated VAT rate, which may vary based on product categories (e.g., standard rate, reduced rate, exempt, or zero-rated).

- VAT Exempt / Zero-rated Items- Items that are VAT-exempt or zero-rated (e.g., some food items, healthcare products) must be classified properly to ensure that VAT is not incorrectly calculated for these items.

- Bundled Items-In case of bundled sales (e.g., a package of items sold together), VAT should be calculated on the entire value of the bundle, while also itemizing the individual VAT portion for each product included in the bundle.

- Transaction Date and VAT Rate Applicability – Date of Sale.

- VAT Rate Periodicity-The system should account for changes in VAT rates over time (e.g., changes due to government regulations or tax reforms) and ensure the report reflects the correct rate for each item based on the date of the transaction.

- VAT Calculation Method-Sales Price vs.

- Tax Inclusive/Exclusive Sales-Ensure clarity on whether the sales price.

- VAT on Discounts and Returns – Discounts.

- VAT Reporting Format -Itemized Reporting.

User Interface

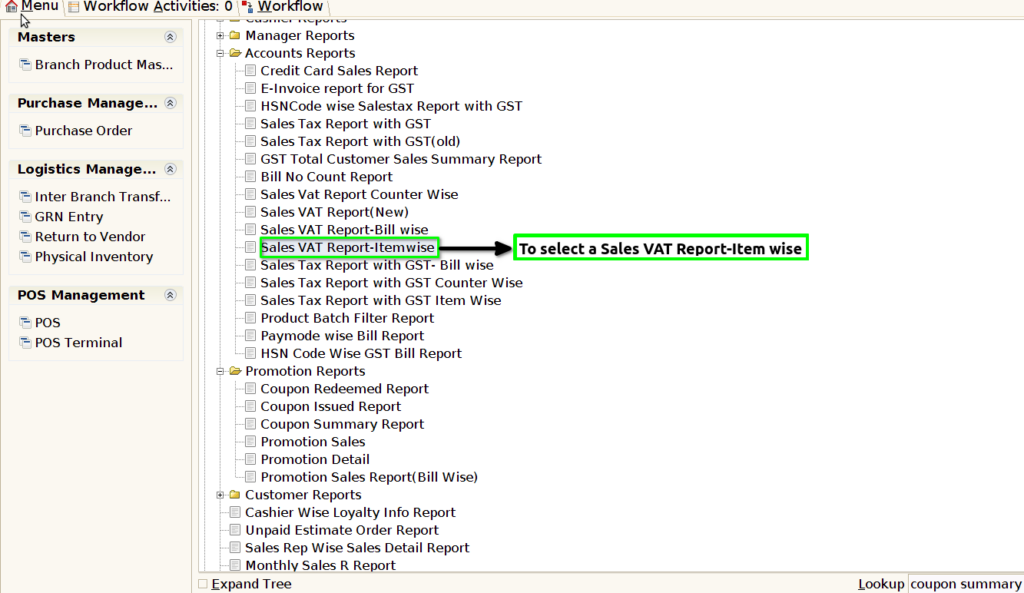

STEP 1: To select a Sales VAT Report-Item wise.

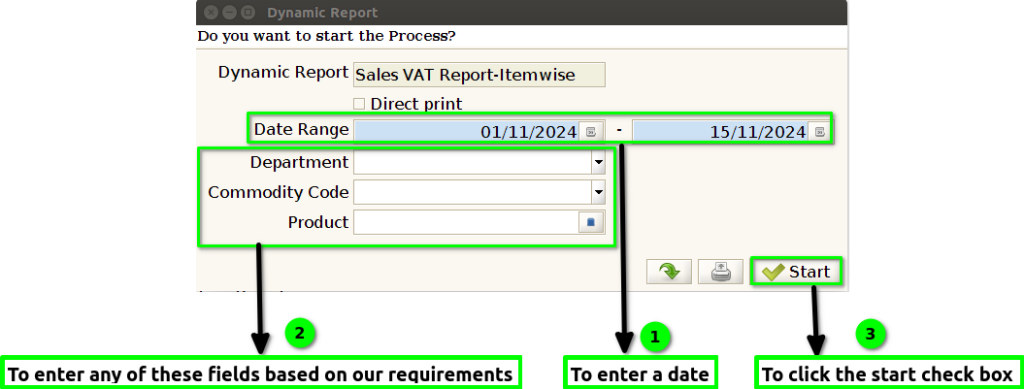

STEP 2: To enter a date range in this field is mandatory.And to enter any of these fields based on our requirements.Then to click a start check box to run the process.

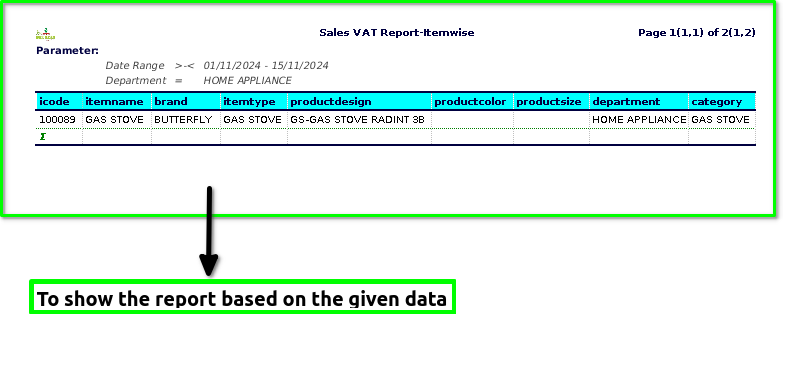

STEP 3: Once to complete the process to show the report based on the given data.

STEP 4: Item code -(also known as a product code, SKU, or stock-keeping unit) is a unique identifier assigned to a specific product or item, usually for the purpose of inventory management, sales tracking, and categorization.

Item name-is the descriptive title or label given to a specific product or item to identify it. It is typically used to provide a clear understanding of what the item is, making it easier for customers, employees, and businesses to recognize and differentiate products.

Brand– A brand is created through design, packaging, and advertising elements that distinguish the product from its competitors.

Item type-can have different meanings depending on the context in which it is used.

Product Color – This refers to the hue or shade of the product. Color is an important feature as it can influence consumer preference, appeal, and perception.

Product Design– This refers to the aesthetics, style, and overall appearance of the product, as well as its functionality. Design encompasses aspects such as shape, texture, form, and the materials used in the product’s construction.

Product Size– This refers to the physical dimensions or measurements of the product, such as length, width, height, or volume. Size is crucial for determining how the product fits into its intended environment or user context.

Category -is a way for a business to group similar items together for customers to find them, whether in a store or on a website.

Department -for each product and that department controls all activities related to the product including development, production, marketing, sales, and distribution.

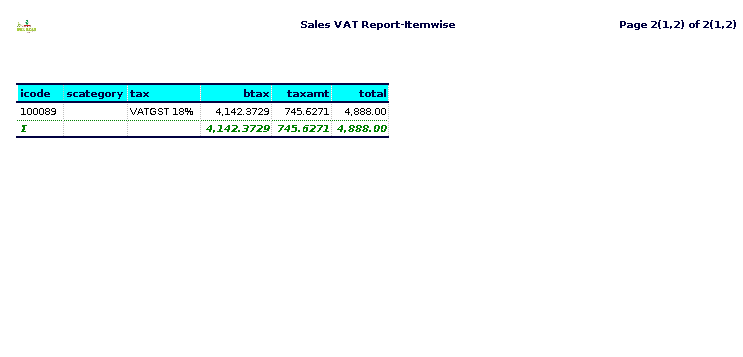

Tax– axes on products comprise value added tax, taxes and duties on imports and exports and other taxes on products.

Subcategories– help businesses, retailers, and consumers navigate large product selections and make it easier to find what they are looking for.Example:Product Category: Electronics – Subcategory: Smartphones.

Business Tax-B Tax– could be shorthand for general business taxation, such as corporate tax, sales tax, or other taxes that businesses are required to pay.

Tax amount-refers to the total sum of money that a person, business, or entity is required to pay to a government in the form of taxes. It is typically calculated based on specific tax rates applied to a taxable income, value, or transaction.

Total– generally refers to the complete sum or aggregate of a set of numbers, amounts, or items. It represents the final value obtained after adding up all the individual parts or components in a given context.

Training Videos

FAQ

SOP