TO CREATE A VENDOR WISE PURCHASE REPORT

A vendor-wise purchase report is a document that summarizes purchases made from different vendors over a specific period.Vendor Name: The name of each vendor from whom purchases were made. Purchase Amount: Total money spent on purchases from each vendor.Quantity Purchased: The total quantity of items bought from each vendor.Item Details: Specific items purchased, including descriptions and unit prices.Purchase Dates: The dates when purchases were made.Payment Status: Information on whether payments have been made, are pending, or are overdue.

User Access

Who Can Access

- Pothys admin

- Head cashier

- Sales Manager

- manager

What User Can Do

- View Reports

- Vendor Wise Purchase Report.

Pre-Requisite Activities

- Date

- Vendor

- Dynamic Report

Business Rules

- Data Accuracy – Ensure all purchase data is entered correctly into the system. – Conduct regular audits to verify data accuracy.

- Reporting Period – Define standard reporting periods (monthly, quarterly, annually). – Allow for custom date ranges for ad-hoc reports.

- Vendor Categorization – Classify vendors by type (e.g., suppliers, service providers). – Use predefined categories to streamline reporting (e.g., local, national).

- Threshold Values – Set thresholds for minimum purchase amounts to be included in the report. – Exclude low-value purchases that do not meet a specified criterion.

- Itemization – Include item details for each purchase, including descriptions and quantities. – Ensure items are categorized consistently across vendors.

- Payment Status Tracking – Track payment status for all purchases (paid, pending, overdue). – Highlight overdue payments in the report for follow-up actions.

- User Access – Define user roles and permissions for who can view or generate reports. – Ensure sensitive vendor information is restricted to authorized personnel.

- Format and Presentation – Standardize the format for report generation (e.g., tables, graphs). – Include summary statistics (total purchases, average spending per vendor).

- Automated Alerts – Set up automated alerts for significant changes in purchasing patterns. – Notify relevant stakeholders for timely decision-making.

- Compliance and Documentation – Ensure all reports comply with internal and external auditing requirements. – Maintain documentation for report generation processes for transparency.

User Interface

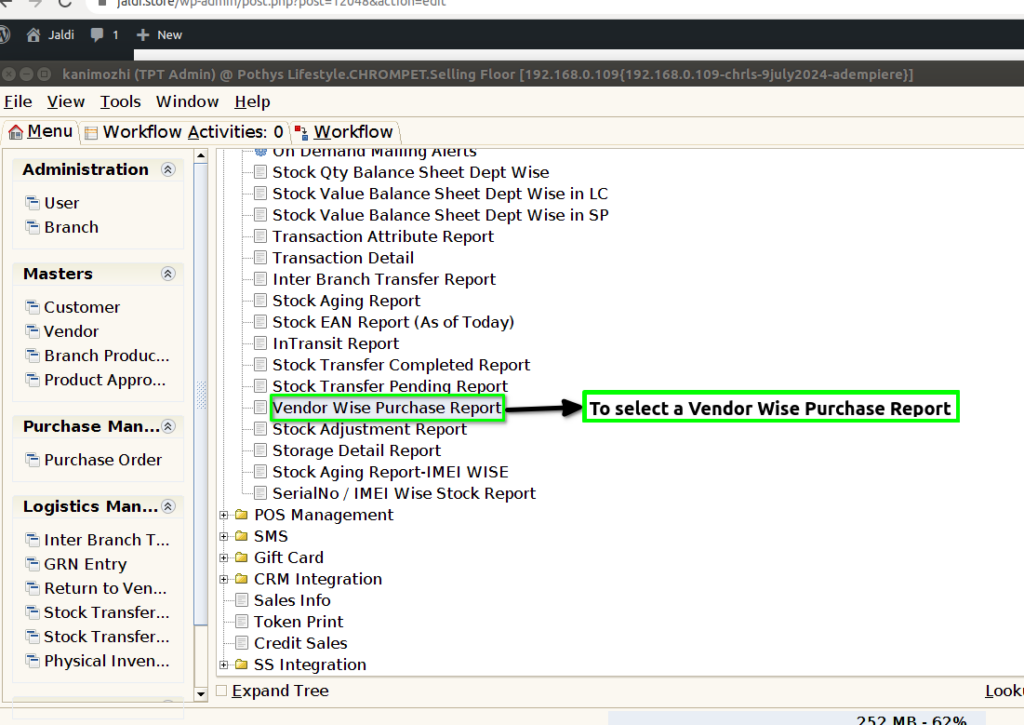

STEP1: To select a Vendor Wise Purchase Report.

STEP2: To enter a Dynamic Report default update.And then to enter a Date.Date field is Mandatory.To enter a Vendor and to click a start check box.To run the process.

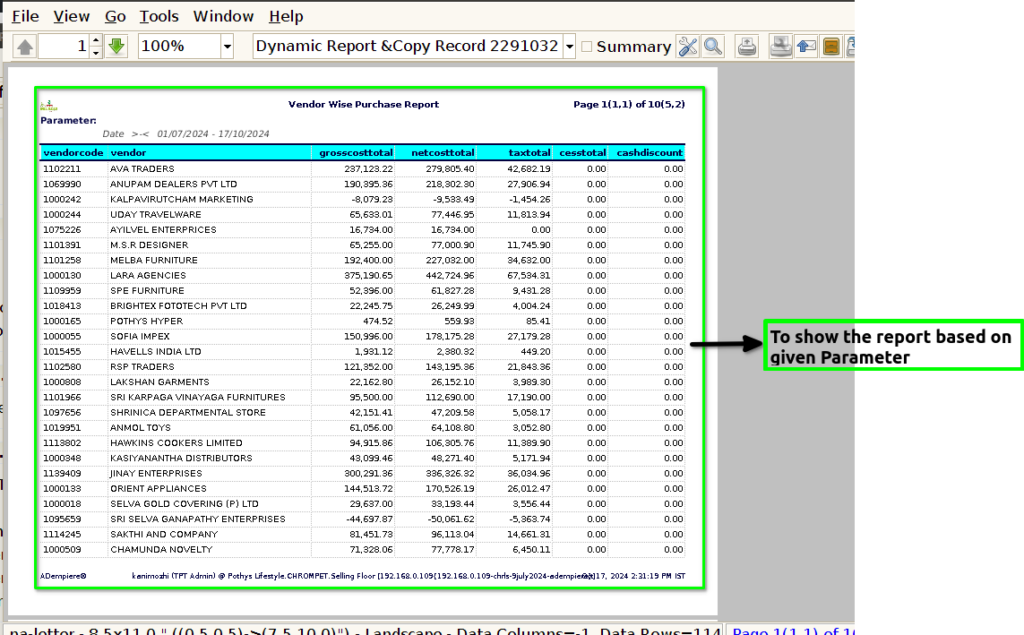

STEP3: Once to complete the process to show the report based on the giving parameter

STEP4: Vendor: A vendor is a person or business that sells goods or services to another entity, typically referred to as a buyer or customer.

Vendor code:A vendor code is a unique identifier assigned to a specific vendor or supplier within a company’s procurement or inventory management system.

Gross cost Total & Net cost Total: Gross Cost Total refers to the overall total of all costs associated with acquiring a product or service before any deductions.Net Cost Total on the other hand, is the total cost after subtracting any deductions or discounts from the gross cost.

Tax Total: Tax total refers to the cumulative amount of taxes applied to a transaction or a series of transactions. This total includes all applicable taxes that must be paid in addition to the base price of goods or services.

Cess Total: Cess total refers to the cumulative amount of cess, which is a type of tax levied by governments for specific purposes, added on top of other taxes.

Cash discount: A cash discount is a reduction in the price of a product or service offered to customers as an incentive to pay in cash or to pay their bills promptly.

Landed cost total: Landed cost total is simply the cumulative sum of all these expenses, giving a comprehensive view of the actual cost incurred to acquire and deliver the product.

Added amt:Added amount refers to an additional sum that is included in a total, often representing extra costs, fees, or charges applied to an initial amount.

Grand total: The grand total refers to the final sum of all amounts in a transaction or calculation, encompassing all individual components, such as Subtotal,Taxes,Fees,Discounts.

Training Videos

FAQ

SOP